Coronavirus Epidemic Threatens Rio Tinto's Supply Chain -- Update

26 February 2020 - 8:00PM

Dow Jones News

By David Winning

Rio TintoPLC warned the coronavirus epidemic is threatening its

supply chain as it reported a 41% decline in annual net profit, but

said it would pay a record final dividend.

The world's second-biggest miner by market value on Wednesday

said its products were continuing to reach customers, but it was

seeking ways to adjust to the impact of the virus--which originated

in China and is known as Covid-19--on demand for commodities

globally.

"We are closely monitoring the impact of the Covid-19 virus and

are prepared for some short-term impacts, such as supply-chain

issues," Chief Executive Jean-Sébastien Jacques said.

Rio Tinto is a major supplier of iron ore to China. The country

buys about 60% of the world's iron ore traded by sea and uses the

commodity to make steel for infrastructure such as bridges and in

the construction of apartments. With fears of contagion keeping

workers at home, Chinese production, including steel, has taken a

hit. Morgan Stanley has estimated that more than 40 blast furnaces

have been taken offline temporarily with the potential loss of 80

million metric tons of annualized iron-ore demand.

The virus has spread to other countries, with infections sharply

rising in South Korea, Italy and Iran, and fueled a global stocks

selloff. The Australia-listed shares of Rio Tinto--which has become

more reliant on Chinese demand for its iron ore in recent years

after it sold coal mines and copper pits--closed at a three-month

low ahead of Wednesday's earnings results.

Rio Tinto reported a net profit of $8.01 billion for 2019, down

from a profit of $13.64 billion a year earlier. The result was

dragged down by $1.7 billion in impairment charges, primarily

against the Oyu Tolgoi underground project in Mongolia and the

Yarwun alumina refinery in Australia. This compared with a $4.0

billion gain on asset sales in 2018, Rio Tinto said.

However, annual profit before one-off items was up 18% at $10.37

billion, beating consensus expectations for an underlying profit of

$10.13 billion based on data compiled by FactSet. That reflected a

37% on-year rise in the price of iron ore dug up at its operations

in Australia's Pilbara region, which more than offset a 3% drop in

annual production of the commodity.

The company declared a final dividend of $2.31 a share, taking

the company's full-year dividend to $3.82 a share. In addition, it

paid a special dividend worth $0.61 a share in September. For 2018,

the miner paid ordinary dividends totaling $3.07 a share.

Investors are weighing the impact of the coronavirus and

operational setbacks against increased dividends, which have become

more of a focus for global miners in recent years after several

deals clinched at the top of the last mining cycle were much less

profitable than hoped. BHP Group Ltd. this month lifted its

dividend after high iron-ore prices drove its half-year net profit

up 29% to $4.87 billion.

Rio Tinto this month lowered a forecast for iron-ore shipments

from the Pilbara region due to damage caused by a tropical cyclone,

which analysts estimated could drive a 2% cut to earnings if it

isn't offset by higher prices. Rio Tinto now expects to ship

between 324 million and 334 million tons of iron ore this year. In

2019, the miner moved 327.4 million tons.

Rio Tinto also expects to produce between 530,000 tons and

570,000 tons of copper this year, and 3.1 million tons to 3.3

million tons of aluminum. Forecasts for those commodities, made in

mid-January, were framed by expectations that the global economy

would be generally stable.

Rio Tinto said its net debt totaled $3.7 billion at the end of

December, swinging from a small net cash position in 2018. It also

forecast capital expenditure this year of $7.0 billion.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

February 26, 2020 03:45 ET (08:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

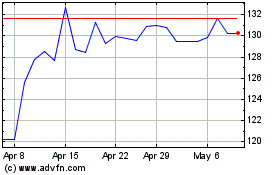

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

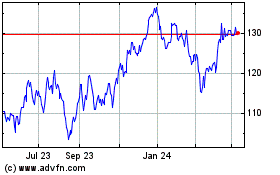

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024