Booking Holdings Seeks to Raise $750 Million Through Senior Convertible Notes

08 April 2020 - 11:02PM

Dow Jones News

By Dave Sebastian

Booking Holdings Inc. said it is seeking to raise $750 million

through an offering of senior convertible notes to fund its

operations.

The convertible notes will mature on May 1, 2025, Booking said.

The company said it would use the proceeds to repay debt.

In cutting costs amid the coronavirus pandemic, Booking's Chief

Executive Glenn Fogel and the company's three brand CEOs will forgo

their salaries.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

April 08, 2020 08:47 ET (12:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

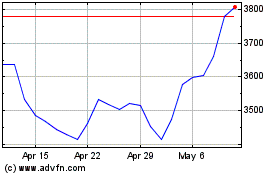

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

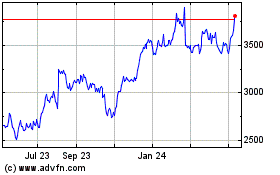

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024