NAB Launches A$3.5 Billion Capital Raising, Slashes Interim Divided

27 April 2020 - 9:29AM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank Ltd. has launched a 3.5 billion

Australian dollar (US$2.23 billion) capital raising, while also

slashing its interim dividend by 64% as it responds to upheaval

caused by the coronavirus pandemic.

NAB, one of Australia's largest lenders, said it would raise A$3

billion from a placement of shares to institutional investors and

seek to raise a further A$500 million from a Share Purchase Plan.

New shares would be issued at A$14.15 each, representing a 10%

discount to Friday's closing price.

On Monday, NAB also reported a 51% drop in cash earnings for the

six months through March to A$1.44 billion. The result was dragged

down by A$1.04 billion in one-off charges, including higher credit

impairment charges and mark-to-market losses on its liquids

portfolio within Markets and Treasury.

The bank said it would cut its interim dividend by 65% to 30

cents per share. It also increased collective provisions by A$828

million to A$2.14 billion.

"We entered this challenging period in a robust position, with

capital, funding and liquidity significantly strengthened over

recent years," said Chief Executive Ross McEwan. "However, given

the uncertain outlook, we have taken proactive steps to further

strengthen our balance sheet."

The bank said the capital raising would increase its proforma

CET1 ratio to 11.2%, while the decision to reduce its interim

dividend is equivalent to another A$1.6 billion or 37 basis points

of CET1.

NAB's chairman and directors will forego 20% of their base fees

for the second half of fiscal 2020, while Mr. McEwan will forego

20% of his fixed remuneration for the second half.

Write to Alice Uribe at alice.uribe@hotmail.com

(END) Dow Jones Newswires

April 26, 2020 19:14 ET (23:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

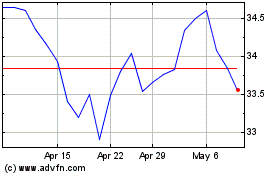

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Apr 2023 to Apr 2024