U.S. RECELL® System product sales of A$5.81M

for fiscal third quarter

AVITA Medical Limited (ASX: AVH, NASDAQ: RCEL), a regenerative

medicine company with a technology platform positioned to address

unmet medical needs in therapeutic skin restoration, reported

financial results for the fiscal third quarter ended 31 March 2020

(Q3) today in its Appendix 4C - Quarterly Cash Flow Report filed

with the Australian Securities Exchange (ASX).

U.S. Commercial Sales of RECELL® System for Quarter Ended 31

March 2020

Product sales and other revenues for the third quarter and nine

months ended 31 March 2020 were as follows (unaudited):

Three Months Ended

Nine Months Ended

(Thousand Australian $’s)

31

March

31

March

2020

2019

2020

2019

U.S. product sales

A$5,809

A$2,206

A$15,083

A$3,308

International product sales

148

189

558

900

Total product sales

5,957

2,395

15,641

4,208

Other income (including BARDA)

2,108

2,427

5,954

7,540

Total revenue

A$8,065

A$4,822

A$21,595

A$11,748

“Our strong fiscal third quarter results demonstrate continued

growing adoption trends within both our existing and new RECELL

System customers,” said Dr. Mike Perry, AVITA Medical’s Chief

Executive Officer. “In the current COVID-19 environment, we are

deploying various strategies, including supply redundancies and

digital training, to drive usage and continue serving burn surgeons

and their patients. While severe burn treatments are not elective

procedures, there has been a pause in enrollment in some of our

clinical trials due to COVID-19; however, we are advancing our

pipeline and are currently developing the protocol and FDA

Investigational Device Application for the RECELL vitiligo pivotal

study. In addition, we are continuing to make progress toward

redomiciling the Company to the United States to better align the

Company’s corporate structure with our U.S. business

operations.”

Corporate Update

Our commercial efforts in Q3 progressed well with quarterly

growth exceeding 20% across both procedural volume and U.S. RECELL

System revenue. Q3 represents our strongest quarter since launching

in the United States in January last year reflecting strong

customer uptake, even with the COVID-19 pandemic beginning toward

the end of the quarter. In the quarter ended 31 March 2020, we also

added nine new customers and certified an additional 21 surgeons,

bringing our total to 69 customers and 205 certified burn surgeons,

together with progressing our ongoing clinical investigations with

first patient enrollment in our soft tissue and pediatric partial

thickness studies. All of these factors collectively demonstrate

ongoing high interest in the RECELL System, together with

consistent usage and acceptance across our growing customer

base.

We have seen consistent growth since the launch of the RECELL

System and we have, so far, been somewhat insulated from the

COVID-19 challenges to-date given the treatment of burns patients

is generally not elective nor deferrable. While we didn’t see any

impact to the rate of burn incidence or RECELL System utilization

during the quarter, it continues to be difficult to predict the

breadth of potential impacts over the coming months due to the

current COVID-19 macroenvironment. These considerations operate in

addition to the overarching burn environment which is inherently

“lumpy” and difficult to forecast.

Set out below is additional information which builds on our two

earlier news releases on our progress and COVID-19

implications:

- Our field force, as with all our employees, continue to operate

largely on a work-from-home basis with severely limited travel.

These measures have been implemented in accordance with relevant

government requirements and, more importantly, to protect the

safety and welfare of our employees. We continue to monitor the

environment but, at this juncture, do not expect a relaxation or

reduction of the restrictions until June at the earliest, and

potentially longer.

- The Company is well-positioned from a supply and distribution

perspective and does not envisage any disruption or delays to the

availability of the RECELL System. In addition, the Company has

established two offsite storage points which house RECELL System

inventory in case of disruption at the Company’s manufacturing

facility in Ventura, California.

- With nationwide COVID-19 restrictions, our field force has very

limited face-to-face access with our existing and potential new

customers and our current commercialization efforts continue to be

largely driven in a remote format. These activities may be

summarized as follows:

- Extensive digital and telephonic outreach in a variety of

forms.

- Webinars, teach-ins, digital proctoring, remote “in-service”

interactions, remote wet labs are some examples.

- Live digital and audio case support continues as required.

- Live case support by our field force in a very limited number

of hospitals.

- Identification of certain unique cases that demonstrate the

clear benefits of the RECELL System, such as the “faces”

presentation which may be accessed at

https://www.avitamedical.com/about-recell-us.

- We also continue to conduct remote teach-ins and regional

Advisory Board forums, to enable shared RECELL System experience

and to broaden physician awareness around the unique benefits of

the RECELL System (including one this past weekend).

- We reached further corporate milestones during the quarter by

initiating two (2) pivotal studies with treatment of the first

patient in our soft tissue reconstruction study, and in our

pediatric partial-thickness (scald) study.

- We were disappointed with the understandable cancellation of

the 52nd annual American Burn Association (ABA) Meeting in March;

however, data abstracts from the meeting are summarized at

https://www.avitamedical.com/uploads/pdf/ABA-Data-Press-Release-04022020.pdf.

3Q Review & 2020

Perspective

As we look back at Q3, this quarter represents one of our best

performances since launch and included revenue and procedural

volume growth exceeding 20%. Q3 also marked the first quarter for

the RECELL System to be utilized in more than 400 procedures

marking continued strong endorsement of the unique benefits that

the RECELL System offers.

A summary of our quarterly commercial highlights is set out

below:

(United States $'s)

Quarter Ended 31-Mar-19

30-Jun-19 30-Sep-19 31-Dec-19 31-Mar-20

US RECELL Sales

$

1,577,341

$

2,036,270

$

3,183,030

$

3,178,160

$

3,861,530

Cumulative. U.S. RECELL Sales

$

1,577,341

$

3,613,611

$

6,796,641

$

9,974,801

$

13,836,331

New Accounts

9

21

13

8

9

Cumulative Accounts

18

39

52

60

69

Physicians Trained

32

39

21

27

21

Cumulative Physicians

97

136

157

184

205

As we look back at a very successful quarter and think about the

path ahead, it is clear that our customers are now operating under

challenging conditions, and this is creating a broad spectrum of

commercial behavior which varies greatly and is driven by

heterogeneic considerations such as:

- Localized COVID-19 conditions (i.e. whether the hospital is

located within or near to a COVID-19 “hotspot”).

- The breadth of the infrastructure within a relevant hospital,

and its inherent ability to cope with COVID-19 patient admission

surges with, or without, impacting the treatment of burn patients

in that hospital.

- The availability of proximate hospital facilities with burn

treatment capabilities that enable burn patients to be

re-distributed to preserve COVID-19 response capabilities.

- Institutional specific policies that limit the number of ICU

beds available to treat burn patients.

Given the above, we are experiencing a wide degree of commercial

variability across the United States, which is representative of

the inconsistent and regionalized nature of COVID-19 outbreaks. In

regions where we see highly restrictive operating conditions or

constrained burn treatment resources, our ability to be effective

in those locations is impacted by the number of our customers in

those regions and, more importantly, the associated degree of

RECELL System experience (i.e. our outcomes are impacted by

regional COVID-19 considerations and whether the affected hospital

is, for example, a “super user”).

Independent of the above and despite burn procedures being non

elective, our experience tends to indicate that the incidence of

burns will not be immune from the lower levels of economic activity

(e.g. manufacturing, retail, etc.) and reduced travel and road

activity that are presently occurring in the United States due to

the COVID-19 pandemic. Similar to the experience with the declining

number of car accidents and heart attacks, our best guess is that

the number of burns patients could decline during the COVID-19

overhang and that decline could potentially occur in the range of 0

to 20%.

Despite these unprecedented operating conditions, our commercial

team continues to be highly active with our customers as

circumstances permit. However, the lack of face-to-face time with

our customers and the fact that hospital resourcing is generally

focused around COVID-19 means that new account accrual and the

opportunity for our field force to assist newer accounts to develop

broader burns treatment experience (i.e. migrating from bigger to

smaller burns, and using the RECELL System without autografting) is

presently impaired.

Other Developments and

Updates

As broadly reported across the United States, the COVID-19

pandemic has required hospitals and clinical research institutions

to prioritize their resources, efforts and facilities to expand,

and reserve, capacity for the treatment of COVID-19 patients. The

direct implication of this is that clinical investigational studies

are not generally being actively pursued and, in consequence,

enrollment in our existing clinical studies (i.e. our soft tissue

reconstruction pivotal, pediatric partial-thickness pivotal study

and our vitiligo feasibility study) is largely paused pending

further developments with COVID-19. We are hopeful that the present

re-prioritization of resources away from clinical studies will

lessen in the short term to allow a restart of our studies. We will

provide updates here as appropriate.

Vitiligo

Over the last few months, we have been exploring the possibility

of advancing a pivotal study that would evaluate the safety and

effectiveness of the RECELL System in the treatment of stable

vitiligo patients. These efforts have incorporated a range of

discussions with industry experts and key opinion leaders for the

purpose of determining essential elements of a potential clinical

protocol including, among other things, primary endpoints, study

population, and the treatment protocol.

The above efforts are now approaching completion and we are

presently in the process of compiling an Investigational Device

Exemption (“IDE”) application for the vitiligo pivotal study which

we plan to submit to the U.S. Food & Drug Administration

(“FDA”) before the end of June. The current proposal remains

formative but is expected to incorporate the following

elements:

- Eligible patients with stable vitiligo as confirmed by no new

lesions in the last twelve (12) months.

- The treatment arms would include skin cell suspensions with

multiple dilutions.

- Patients will act as their own control by providing two (2)

areas of depigmentation.

- Primary endpoint at twenty-four (24) weeks will likely speak to

the extent of re-pigmentation as determined by a blinded evaluator,

with a patient rated satisfaction score as a secondary

endpoint.

The Company believes the vitiligo market represents a large,

attractive market, and one for which there is no approved therapy

for patients. Vitiligo is an autoimmune deficiency which creates

enormous quality of life implications for patients and is

comparable to the stigma experienced by patients suffering from

psoriasis, acne or rosacea. Subject to receiving FDA approval for

the IDE, the Company is hopeful of being ready to initiate this

pivotal study in the second half of 2020 (subject to COVID-19

developments). If the pivotal study thereafter successfully meets

its endpoints, the Company will leverage its existing premarket

approval (“PMA”) to submit a PMA supplement to the FDA (as opposed to being

required to submit a full PMA) thereby seeking to add a new

indication for use (i.e. patients with stable vitiligo) to our

existing acute thermal burns indication.

Independent of the above efforts, the Company already has an IDE

for a vitiligo pilot study and recently entered into a research

collaboration with the University of Massachusetts. As previously

disclosed, this pilot study (n=10) will also include patients who

have vitiligo lesions that have been stable for at least one year.

This study will provide incremental learnings and data, operating

in parallel with the Company’s new efforts to bring forward a

pivotal study with the FDA as discussed above.

Pediatric Studies

In early March 2020, we announced the initiation of a pivotal

trial for the treatment of pediatric scald injuries with enrollment

of the first patient at the Arizona Burn Center at Valleywise

Medical Health Center in Phoenix, AZ. This study seeks to

demonstrate that treatment with the RECELL System of

partial-thickness burn injuries within 72-hours can safely and

effectively increase the incidence of healing at day 10 when

compared to a standard wound dressing. This study is ongoing, but

enrollment is paused given the COVID-19 pandemic.

Additionally, the Company has a second pediatric study which is

commonly referred to as the “pediatric donor study”. This is a

randomized clinical study to compare the healing of a donor site in

pediatric patients treated with the RECELL System versus

conventional care (i.e. standard dressings only). This study was

conceived more than three (3) years ago and prior to the PMA, and

the growing commercial adoption, of the RECELL System in the United

States. Given the premarket approval of the RECELL System and the

resultant strong early adoption, the Company believes that there is

little clinical utility, and little practical benefit, in

continuing this study (including no ability for this study to

expand our existing approved burn indication). For these reasons,

the Company is actively pursuing terminating this study (but

continuing with the pediatric partial thickness study mentioned

above).

Data Publication

A study titled “A pilot multi-centre prospective randomized

controlled trial of RECELL for the treatment of venous leg ulcers,”

by Paul D. Hayes, Keith G. Harding, Susan M. Johnson, Charles

McCollum, Luc Teot, Kevin Mercer, and David Russell published

online in the International Wound Journal in February and will also

publish in the June print edition of the journal.1

Intention to Redomicile to the United

States of America

On 20 April 2020, we announced our intention to redomicile from

Australia to the United States. Under the proposed redomiciliation,

AVITA Therapeutics, Inc.2 (“AVITA US”) will become our new parent

company. While the group will have a new parent company as a result

of the redomiciliation, underlying operations, business and assets

of the group will remain completely unchanged.

Since 2018, the Company has had no physical business presence,

and only one (1) employee, in Australia. In addition, our immediate

commercial focus is on unlocking the U.S. market, where we

currently source virtually all of our revenue. Against this

background, the beneficial owners of a majority of our shares are

now located outside Australia, with ~50% of shares being

beneficially owned by investors in the United States alone.

The redomiciliation proposal therefore provides the Company with

the opportunity to align our corporate structure with our business

and beneficial ownership, and has the added benefit of providing a

familiar investment offering (versus our existing American

Depositary Shares) to investors in the United States, which is the

world’s largest capital market in terms of market capitalization

and trading volume. Importantly, the proposal allows us to

substantially reduce our financial reporting and compliance burden

and save costs, while not impacting the quantity of financial

information provided to investors or disrupting trading on either

the ASX or NASDAQ.

The proposal, which will be implemented pursuant to a scheme of

arrangement under Australian law, is subject to approval by

shareholders (at a shareholders’ meeting currently tentatively

scheduled for 15 June 2020) and orders of the Federal Court of

Australia as well as regulatory review by various government

bodies, including the Australian Securities and Investments

Commission and the Foreign Investment Review Board. The Company is

anticipating that it will be in a position to send to shareholders

in mid-May 2020 a Scheme Booklet that will contain a detailed

explanation of the redomiciliation proposal, including the

advantages, disadvantages and risks of the proposal, together with

an Independent Expert’s report that will set out whether, in the

expert’s opinion, the proposal is in the best interests of

shareholders as a whole.

We have received a number of enquiries since the proposal was

announced on 20 April 2020 and, as such, for ease of reference we

set out below some key features of the redomiciliation proposal.

It is however important that shareholders

appreciate that the below is a brief and high level overview of

some key aspects of the proposal (if implemented), and the Board of

Directors strongly encourages shareholders to review the Scheme

Booklet in detail when they receive it and to take part in the

shareholders’ meeting. Further, shareholders should consult their

financial, legal, taxation or other independent and qualified

professional adviser if they have any questions in relation to the

proposal.

- Appendix A provides a simple illustrative example of how the

redomiciliation will affect eligible shareholdings.

- Electronic trading will continue on both the ASX and

NASDAQ; that is, shareholders will continue to be able to trade

on the ASX and NASDAQ in a similar fashion to how they have always

traded (except that trading will now be in securities of AVITA

Therapeutics, Inc. rather than AVITA Medical Limited).

- Trading is expected to continue to use the same ticker codes;

the ASX will continue to use “AVH” and NASDAQ will continue to use

“RCEL”.

- Eligible shareholders3 will have the same proportionate

value and ownership on completion of the redomiciliation as

they held before the redomiciliation (subject to adjustments for

fractional interests). In other words, underlying ownership and

proportionate value for eligible shareholders will remain unchanged

by the proposal.

- Under the proposal, eligible shareholders will swap their

existing interests in the Company for:

- Common stock in AVITA US, if shareholders currently hold

American Depositary Shares (“ADSs”) in the Company (which are

presently traded on NASDAQ).

- Holders of ADSs will receive one (1) share of common stock in

AVITA US for every 5 ADSs (which represent 100 ordinary shares)

held by them.

- As noted above, it is expected that AVITA US common stock will

trade on NASDAQ under ticker code “RCEL”.

- CHESS Depositary Interests4 (“CDIs”) in AVITA US, if

shareholders currently hold ordinary shares in the Company (which

are presently traded on the ASX).

- Ordinary shareholders will receive 5 CDIs in AVITA US for every

100 ordinary shares in the Company held by them.

- Five (5) CDI’s traded on the ASX will represent one (1) share

of common stock on NASDAQ US.

- As noted above, AVITA US CDI’s will trade on the ASX under

ticker code “AVH”.

- The proposal will have the effect of consolidating the number

of securities that the group has on issue (i.e. the same effect as

a share consolidation or a reverse split as it is more commonly

known) by reducing the number of shares the group will have

outstanding from the existing level of approximately 2.1

billion.

- The Company is presently well-capitalized and is not undertaking the redomiciliation for the

purposes of enabling a new listing of the group in a new capital

market or delisting the group from the ASX.

- If the redomiciliation proposal is approved by shareholders and

all of the relevant conditions5 that the proposal is subject to are

satisfied or waived, then shareholders will not be required to do

anything further as the above process will be facilitated

automatically by the Company and its Australian and U.S. transfer

agents (Computershare).

Third Quarter Fiscal 2020 Financial Results

(Unaudited)

(All amounts are in thousands of AUD except where noted)

A copy of the Appendix 4C - Quarterly Cash Flow Report for the

third quarter of fiscal 2020, the quarter ended 31 March 2020, is

attached. Operations for the quarter were focused primarily on the

U.S. national adoption of the RECELL System for the treatment of

acute thermal burns, and the preparation and implementation of

further clinical development of the RECELL System.

During the quarter ended 31 March 2020, total cash receipts were

A$5,743, a decrease of A$1,946 or 25% compared to the prior quarter

ended 31 December 2019. Cash receipts from customers for the

quarter ended 31 March 2020 were A$5,254, an increase of A$334 or

7% compared to the prior quarter due to increased sales. Cash

received from BARDA during the current quarter totalled A$489 a

decrease of A$2,280 or 82% compared to the prior quarter. The

decrease was the result of a one-time rate adjustment that was

received during the prior quarter ended 31 December 2019. Through

31 March 2020, cumulative payments of A$31.2 million have been

received under the BARDA contract.

Overall payments for operating expenses increased in line with

expectations during the third quarter of fiscal 2020. During the

quarter ended 31 March 2020, payments related to sales and

marketing, staffing, administrative and corporate costs totalled

A$14,287, a A$3,709 or 35% increase compared to the quarter ended

31 December 2019 due to increased initiatives and staffing costs.

During the quarter ended 31 March 2020, payments related to product

manufacturing and operating costs totalled A$1,678, a A$296 or 15%

decrease compared to the quarter ended 31 December 2019. During the

quarter ended 31 March 2020, payments for research and development

costs totalled A$1,918, a A$585 or 44% increase compared to the

quarter ended 31 December 2019 driven by the increased initiatives.

As a result of the ongoing commercialization of the RECELL System

in the U.S. along with other planned initiatives set forth by the

Company, payments for operating expenses are expected to increase

during 2020. These expense payments are expected to be partially

offset by receipts from customers and receipts under the BARDA

contract.

Total net cash used in operating activities during the quarter

ended 31 March 2020 was A$11,866, a A$5,531 or 87% increase

compared to the quarter ended 31 December 2019 driven primarily by

increased legal and professional costs associated with the planned

redomiciliation, together with annual employee incentives. Cash and

cash equivalents held at 31 March 2020 was A$129,935 compared to

A$124,658 in the prior quarter, an increase of A$5,277 or 4%. The

increase was attributable to the effect of movement in exchange

rate on cash held, partially offset by operating expenses.

Authorized for release by the Chief Executive Officer of AVITA

Medical Limited.

###

Non-IFRS Financial Measures and Other Items

We use the following measures of financial performance which are

not presented in accordance with IFRS:

- "U.S. RECELL Sales", which is the amount of revenue,

denominated in United States dollars, we generate from our

commercial efforts in relation to the sale of RECELL Systems within

the United States. Management believes that this measurement is

useful for comparing period to period sales performance, and

product acceptance, of the Company’s lead product, the RECELL

System, within the United States burn market.

ABOUT AVITA MEDICAL LIMITED

AVITA Medical is a regenerative medicine company with a

technology platform positioned to address unmet medical needs in

burns, chronic wounds, and aesthetics indications. AVITA Medical’s

patented and proprietary collection and application technology

provides innovative treatment solutions derived from the

regenerative properties of a patient’s own skin. The medical

devices work by preparing a RES® REGENERATIVE EPIDERMAL SUSPENSION,

an autologous suspension comprised of the patient’s skin cells

necessary to regenerate natural healthy epidermis. This autologous

suspension is then sprayed onto the areas of the patient requiring

treatment.

AVITA Medical’s first U.S. product, the RECELL® System, was

approved by the U.S. Food and Drug Administration (FDA) in

September 2018. The RECELL System is indicated for use in the

treatment of acute thermal burns in patients 18 years and older.

The RECELL System is used to prepare Spray-On Skin™ Cells using a

small amount of a patient’s own skin, providing a new way to treat

severe burns, while significantly reducing the amount of donor skin

required. The RECELL System is designed to be used at the point of

care alone or in combination with autografts depending on the depth

of the burn injury. Compelling data from randomized, controlled

clinical trials conducted at major U.S. burn centers and real-world

use in more than 8,000 patients globally, reinforce that the RECELL

System is a significant advancement over the current standard of

care for burn patients and offers benefits in clinical outcomes and

cost savings. Healthcare professionals should read the INSTRUCTIONS

FOR USE - RECELL® Autologous Cell Harvesting Device

(https://recellsystem.com/) for a full description of indications

for use and important safety information including

contraindications, warnings and precautions.

In international markets, our products are marketed under the

RECELL System brand to promote skin healing in a wide range of

applications including burns, chronic wounds and aesthetics. The

RECELL System is TGA-registered in Australia and received CE-mark

approval in Europe.

To learn more, visit www.avitamedical.com.

- Hayes, PD, Harding, KG, Johnson, SM, et al. A pilot

multi‐centre prospective randomised controlled trial of RECELL for

the treatment of venous leg ulcers. Int Wound J. 2020; 17: 742–

752. https://doi.org/10.1111/iwj.13293

- AVITA Therapeutics, Inc. is a newly incorporated Delaware

company that we control (and which has been solely established for

the purposes of redomiciliation).

- Shareholders in countries outside of Australia, the United

States, Hong Kong, New Zealand, the United, Kingdom, France,

Norway, Switzerland, the United Arab Emirates and Singapore,

together with shareholders with less than 100 shares, will not be

eligible to participate and will have the common stock or CDI

entitlement to which they would otherwise have been entitled

“cashed out” on their behalf and the net cash proceeds remitted to

them.

- Foreign companies are only permitted to trade on the ASX via

CDIs. An example of another company trading CDIs on the ASX is

Resmed, Inc., which uses ticker code “RMD” (while its primary

listing is on the NYSE, also under ticker code “RMD”).

- The conditions precedent and requisite approvals will be set

out in detail in the Scheme Booklet which is currently expected to

be made available to shareholders in mid-May 2020.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This letter includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “intend,” “could,” “may,”

“will,” “believe,” “estimate,” “look forward,” “forecast,” “goal,”

“target,” “project,” “continue,” “outlook,” “guidance,” “future,”

other words of similar meaning and the use of future dates.

Forward-looking statements in this letter include, but are not

limited to, statements concerning, among other things, our ongoing

clinical trials and product development activities, regulatory

approval of our products, the potential for future growth in our

business, and our ability to achieve our key strategic, operational

and financial goal. Forward-looking statements by their nature

address matters that are, to different degrees, uncertain. Each

forward- looking statement contained in this letter is subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statement.

Applicable risks and uncertainties include, among others, the

timing of regulatory approvals of our products; physician

acceptance, endorsement, and use of our products; failure to

achieve the anticipated benefits from approval of our products; the

effect of regulatory actions; product liability claims; risks

associated with international operations and expansion; risks

associated with commercial, supply chain or other business

interruptions or downturns associated with national, state or

international health emergencies (e.g. pandemics), and other

business effects, including the effects of industry, economic or

political conditions outside of the company’s control. Investors

should not place considerable reliance on the forward-looking

statements contained in this letter. Investors are encouraged to

read our publicly available filings for a discussion of these and

other risks and uncertainties. The forward-looking statements in

this letter speak only as of the date of this release, and we

undertake no obligation to update or revise any of these

statements.

Appendix A Illustrative Example

- Ordinary shares of AVITA Medical Limited trade on the ASX under

the ticker code “AVH” and on NASDAQ under the ticker code “RCEL”

(via American Depositary Shares (“ADSs”)). Currently, 1 ADS on

NASDAQ is equivalent to 20 ordinary shares on the ASX.

- Depending on factors set out in Scheme Booklet, eligible

shareholders (see footnote 3 above) will receive AVITA US common

stock or AVITA US CDIs. It is currently anticipated that AVITA US

CDI’s will trade on the ASX under the ticker code “AVH”, and AVITA

US common stock will trade on NASDAQ under the ticker code

“RCEL”.

- Proportionate value and ownership for eligible shareholders

will be unchanged following redomiciliation (subject to adjustments

for fractional interests).

How trading works

before redomiciliation …

Ordinary Shares Held

on ASX These are equivalent ...

one(1) ADS on NASDAQ is the same as twenty (20) ordinary shares on

the ASX American Depositary Shares (ADSs) Held on

NASDAQ

Ordinary Shares

100,000

(A)

<------- -------> ADSs

5,000

(A)

(Equivalent ADS on NASDAQ

(1:20))

5,000

(A) ÷ 20

(Equivalent Ordinary Shares on the ASX (20:1))

100,000

(A) x 20

Illustrative ASX Price (AVH) in A$

A$0.46

(B)

Illustrative NASDAQ Price (RCEL) in US$

U$5.80

(B)

Illustrative A$ Value

A$46,000

(A) x (B) = (C)

Illustrative US$ Value

US$28,980

(A) x (B) = (C)

Foreign

Exchange Rate (AUD / USD)

0.63

(FX)

Foreign Exchange Rate (USD / AUD)

1.59

(FX)

Equivalent US$ Value

US$28,980

(C) x (FX)

Equivalent A$ Value

A$46,000

(C) x (FX)

Percentage Ownership

0.0046897%

Percentage Ownership

0.0046897%

Total ordinary shares outstanding:

2,132,311,745 In both cases, shareholders can

"transmute" (i.e. transfer) between the ASX and NASDAQ at will, and

vice versa. How trading will

work after redomiciliation

… Ordinary

Shares Held on the ASX → AVITA US CDIs Held on the ASX

After redomiciliation ... one(1) share of common stock on NASDAQ

is the same as five (5) CDIs on the ASX ADSs Held on NASDAQ

→ AVITA US Common Stock Held on NASDAQ

Ordinary Shares Held

Before Redomiciliation

100,000

(C)

ADSs Held Before Redomiciliation

5,000

(C)

CDIs Held After Redomiciliation

5,000

(C) ÷ 20 (=D)

<------- -------> Common Stock Held After

Redomiciliation

1,000

(C) ÷ 5 (=D)

(Equivalent Common Stock on NASDAQ

(1:5))

1,000

(D) ÷ 5

(Equivalent CDIs on the ASX (5:1))

5,000

(D) x 5

Illustrative CDI ASX price (AVH)

A$9.20

(E)

Illustrative NASDAQ Price (RCEL)

U$28.98

(E)

Illustrative A$ Value

A$46,000

(D) x (E) = (F)

Illustrative US$ Value

US$28,980

(D) x (E) = (F)

Foreign

Exchange Rate (AUD / USD)

0.63

(FX)

Foreign Exchange Rate (USD / AUD)

1.59

(FX)

Equivalent US$ Value

US$28,980

(F) x (FX)

Equivalent A$ Value

A$46,000

(F) x (FX)

Percentage Ownership

0.0046897%

[Unchanged]

Percentage Ownership

0.0046897%

[Unchanged]

Total common stock

outstanding: est. 21,323,117 The above is provided as

an illustrative example of the trading relationship between the ASX

and NASDAQ. Shareholders should not rely on this

illustration and should consult professional advisers.

Actual performance, including trading prices and patterns on the

ASX or NASDAQ, may not occur as portrayed above.

Appendix

4C

Quarterly cash

flow report for entities subject to Listing Rule 4.7B

Name of entity

Avita Medical Limited

ABN

Quarter ended (“current

quarter”)

28 058 466 523

31 March 2020

Consolidated statement of cash

flows

Current quarter $A’000

Year to date (9 months)

$A’000

1.

Cash flows from operating

activities

5,254

489

14,253

4,416

1.1

1.1a

Receipts from customers

Receipts from government contract

(BARDA)

1.2

Payments for

(1,918

)

(4,551

)

(a) research and development

(b) product manufacturing and operating

costs

(1,678

)

(4,996

)

(c) advertising and marketing

(3,740

)

(7,973

)

(d) leased assets

(267

)

(798

)

(e) staff costs

(8,062

)

(19,661

)

(f) administration and corporate costs

(2,485

)

(6,766

)

1.3

Dividends received (see note 3)

-

-

1.4

Interest received

541

838

1.5

Interest and other costs of finance

paid

-

-

1.6

Income taxes paid

-

-

1.7

Government grants and tax incentives

-

-

1.8

Other (provide details if material)

-

-

1.9

Net cash from / (used in) operating

activities

(11,866

)

(25,238

)

2.

Cash flows from investing

activities

-

-

2.1

Payments to acquire:

(a) entities

(b) businesses

-

-

(c) property, plant and equipment

(379

)

(646

)

(d) investments

-

-

(e) intellectual property

(77

)

(300

)

(f) other non-current assets

-

-

2.2

Proceeds from disposal of:

-

-

(a) entities

(b) businesses

-

-

(c) property, plant and equipment

-

-

(d) investments

-

-

(e) intellectual property

-

-

(f) other non-current assets

-

-

2.3

Cash flows from loans to other

entities

-

-

2.4

Dividends received (see note 3)

-

-

2.5

Other (provide details if material)

-

-

2.6

Net cash from / (used in) investing

activities

(456

)

(946

)

3.

Cash flows from financing

activities

-

120,000

3.1

Proceeds from issues of equity securities

(excluding convertible debt securities)

3.2

Proceeds from issue of convertible debt

securities

-

-

3.3

Proceeds from exercise of options

108

471

3.4

Transaction costs related to issues of

equity securities or convertible debt securities

-

(7,572

)

3.5

Proceeds from borrowings

-

-

3.6

Repayment of borrowings

-

-

3.7

Transaction costs related to loans and

borrowings

-

-

3.8

Dividends paid

-

-

3.9

Other (provide details if material)

489

-

3.10

Net cash from / (used in) financing

activities

597

112,899

4.

Net increase / (decrease) in cash and

cash equivalents for the period

124,658

28,983

4.1

Cash and cash equivalents at beginning of

period

4.2

Net cash from / (used in) operating

activities (item 1.9 above)

(11,866

)

(25,238

)

4.3

Net cash from / (used in) investing

activities (item 2.6 above)

(456

)

(946

)

4.4

Net cash from / (used in) financing

activities (item 3.10 above)

597

112,899

4.5

Effect of movement in exchange rates on

cash held

17,002

14,237

4.6

Cash and cash equivalents at end of

period

129,935

129,935

5.

Reconciliation of cash and cash

equivalents at the end of the

quarter (as shown in the consolidated statement of cash flows) to

the related items in the accounts

Current quarter $A’000

Previous quarter

$A’000

5.1

Bank balances

129,935

124,658

5.2

Call deposits

-

-

5.3

Bank overdrafts

-

-

5.4

Other (provide details)

-

-

5.5

Cash and cash equivalents at end of

quarter (should equal item 4.6 above)

129,935

124,658

6.

Payments to related parties of the

entity and their associates – N/A

Current quarter $A'000

6.1

Aggregate amount of payments to related

parties and their associates included in item 1

913

6.2

Aggregate amount of payments to related

parties and their associates included in item 2

-

6.1 Executive Director remuneration

(825k), Directors fees (77k), and Clinical Advisory Board Fees

(11k)

7.

Financing facilities – N/A

Note: the term “facility’

includes all forms of financing arrangements available to the

entity.

Add

notes as necessary for an understanding of the sources of finance

available to the entity.

Total facility amount at

quarter end $A’000

Amount drawn at quarter end

$A’000

7.1

Loan facilities

-

-

7.2

Credit standby arrangements

-

-

7.3

Other (please specify)

-

-

7.4

Total financing facilities

-

-

7.5

Unused financing facilities

available at quarter end

-

7.6

Include in the box below a description of

each facility above, including the lender, interest rate, maturity

date and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed to be

entered into after quarter end, include a note providing details of

those facilities as well.

N/A

8.

Estimated cash available for future

operating activities

$A’000

8.1

Net cash from / (used in) operating

activities (Item 1.9)

(11,866

)

8.2

Cash and cash equivalents at quarter end

(Item 4.6)

129,935

8.3

Unused finance facilities available at

quarter end (Item 7.5)

-

8.4

Total available funding (Item 8.2 + Item

8.3)

129,935

8.5

Estimated quarters of funding available

(Item 8.4 divided by Item 8.1)

11

8.6

If Item 8.5 is less than 2 quarters,

please provide answers to the following questions:

1. Does the entity expect that it

will continue to have the current level of net operating cash flows

for the time being and, if not, why not?

Answer: N/A

2. Has the entity taken any

steps, or does it propose to take any steps, to raise further cash

to fund its operations and, if so, what are those steps and how

likely does it believe that they will be successful?

Answer: N/A

3. Does the entity expect to be

able to continue its operations and to meet its business objectives

and, if so, on what basis?

Answer: N/A

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters

disclosed.

Date: 4/29/2020

Authorised by: David McIntyre

(Name of body or officer authorising release – see note 4)

Notes

- This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity’s

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

- If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standard applies to this report.

- Dividends received may be classified either as cash flows from

operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

- If this report has been authorised for release to the market by

your board of directors, you can insert here: “By the board”. If it

has been authorised for release to the market by a committee of

your board of directors, you can insert here: “By the [name of

board committee – eg Audit and Risk Committee]”. If it has been

authorised for release to the market by a disclosure committee, you

can insert here: “By the Disclosure Committee”.

- If this report has been authorised for release to the market by

your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council’s Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200428006111/en/

U.S. Media Sam Brown, Inc. Christy Curran Phone +1 615

414 8668 christycurran@sambrown.com

O.U.S Media Monsoon Communications Rudi Michelson

Phone +61 (0)3 9620 3333 Mobile +61 (0)411 402 737

rudim@monsoon.com.au

Investors: Westwicke Partners Caroline Corner

Phone +1 415 202 5678 caroline.corner@westwicke.com

AVITA Medical Ltd David McIntyre Chief Financial Officer

Phone +1 661 367 9178 dmcintyre@avitamedical.com

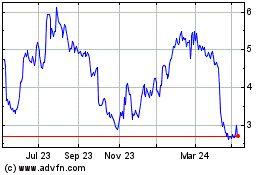

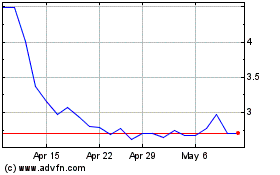

AVITA Medical (ASX:AVH)

Historical Stock Chart

From Mar 2024 to Apr 2024

AVITA Medical (ASX:AVH)

Historical Stock Chart

From Apr 2023 to Apr 2024