Euro Higher Amid Risk Appetite

05 August 2020 - 4:55PM

RTTF2

The euro strengthened against its major opponents in the

European session on Wednesday amid risk appetite, as hopes for more

economic stimulus from global policymakers and signs of a gradual

recovery in the Chinese economy helped investors shrug off worries

about rising coronavirus infections in many countries.

Final data from IHS Markit showed that the euro area private

sector expanded at the fastest pace since mid-2018 as easing of

Covid-19 lockdown restrictions boosted demand and expectations.

The IHS Markit final composite output index rose to 54.9 in July

from 48.5 in June. The flash reading was 54.8. Both the

manufacturing and service sectors reported marked rates of growth

in July, with manufacturing registering the slightly stronger pace

of expansion.

The services Purchasing Managers' Index advanced to 54.7 in July

from 48.3 in June, but this was below the flash score of 55.1.

Data from Eurostat showed that Eurozone retail sales grew at a

moderate pace in June after rebounding sharply in May. Retail sales

increased 5.7 percent on a monthly basis, following a 20.3 percent

increase in May. Economists had forecast a 5.9 percent increase for

June.

The euro appreciated to 125.41 against the yen, its highest

level since April 22. The euro is seen finding resistance around

the 127.00 level.

The euro climbed to a 5-day high of 1.1862 against the

greenback, from a low of 1.1793 hit at 6:30 pm ET. The euro may

test resistance around the 1.20 region, if it gains again.

After falling to 0.9012 at 3:30 am ET, the euro firmed to a

5-day high of 0.9046 against the pound. Next immediate resistance

for the euro is seen around the 0.92 level.

The euro recovered to 1.7816 against the kiwi and 1.5721 against

the loonie, from its early 2-day low of 1.7754 and a 1-week low of

1.5684, respectively. The next possible resistance for the euro is

seen around 1.80 against the kiwi and 1.59 against the loonie.

The euro edged higher to 1.0793 against the franc, from a low of

1.0762 seen at 4:30 am ET. On the upside, 1.10 is likely seen as

its next resistance level.

In contrast, the euro held steady against the aussie, after

having fallen to a 6-day low of 1.6415 at 4:00 am ET. The pair had

ended Tuesday's trading at 1.6479.

Looking ahead, at 8:15 am ET, ADP private payrolls data for July

is set for release.

U.S. and Canadian trade data for June and and ISM

non-manufacturing composite index for July will be released in the

New York session.

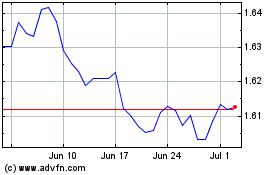

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024