BHP Annual Profit Falls, Seeks Exit of Thermal Coal Assets

18 August 2020 - 8:54AM

Dow Jones News

By David Winning

SYDNEY--BHP Group Ltd. reported a 4% drop in annual net profit,

and said it wanted to stop mining thermal coal and would seek

buyers for some older oil and gas assets.

BHP, the world's largest listed miner by market value, reported

a net profit of US$7.96 billion for the 12 months through June,

down from US$8.31 billion a year earlier. The result was dragged

down by U$1.1 billion in one-off charges, including costs tied to

its pandemic response.

The company said its annual underlying profit fell by 1% to

US$9.06 billion, missing the US$9.33 billion median forecast of

eleven analysts compiled by FactSet.

Directors declared a final dividend of 55 U.S. cents a share.

That brought the full-year ordinary dividends to US$1.20 a share,

down 10% on 12 months earlier.

Chief Executive Mike Henry said most major economies will likely

suffer deep recessions this year, with the exception of China.

"Recovery will vary considerably by country," he said. "Our

diversified portfolio and high-quality assets position us to

continue to generate returns in the face of near-term

uncertainty."

Net debt rose to US$12.04 billion at the end of June to be at

the bottom end of the company's stated US$12 billion-US$17 billion

target range.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

August 17, 2020 18:39 ET (22:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

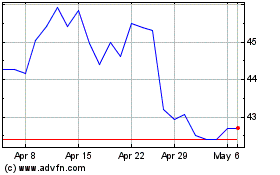

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

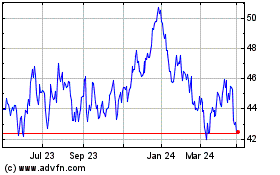

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024