Teva Pharmaceutical's U.S. Unit Indicted on Price-Fixing Charges -- Update

26 August 2020 - 8:57AM

Dow Jones News

By Brent Kendall and Jared S. Hopkins

WASHINGTON -- The U.S. business of Teva Pharmaceutical

Industries Ltd. has been indicted on charges the drugmaker fixed

prices on generic drugs, according to a person familiar with the

matter.

The Justice Department is expected to announce the charges

imminently, the person said.

The indictment is the highest-profile action in a long-running

investigation of the generic-drug industry that has resulted in

more than 10 cases against companies and executives.

Most companies so far have agreed to settle charges by paying

criminal penalties, admitting wrongdoing and agreeing to cooperate,

in exchange for deferred prosecution agreements in which the

government would drop the cases eventually, so long as the

defendant companies fulfilled their obligations under the

settlements.

Among those that reached such deals were Novartis AG's Sandoz

subsidiary, which in March agreed to pay a $195 million criminal

penalty, and Taro Pharmaceuticals Inc., which agreed last month to

pay $205.7 million.

Teva had met with top DOJ brass to try to persuade them not to

bring a case, and it was resistant to a settlement that would have

included a deferred prosecution agreement and a requirement that

the company admit wrongdoing, the person familiar with the matter

said.

A Teva spokeswoman declined to comment.

Teva, which had nearly $17 billion in sales last year, is among

the largest pharmaceutical companies globally. The company has been

challenged in recent years by the collapse of generic drug prices

and a heavy debt load, seeing shares fall more than 80% since 2015.

New management initiated a restructuring.

In addition to financial penalties, a felony conviction of Teva

could lead to its exclusion from federal health-care programs.

The charges are the latest headache for Teva, which also is

facing price-fixing lawsuits from state attorneys general and

private plaintiffs.

The company's U.S. unit also was hit with a separate civil

lawsuit from the Justice Department earlier this month alleging it

engaged in a scheme to game the Medicare system and prop up high

prices for its multiple sclerosis drug Copaxone. Teva denied the

allegations.

Write to Brent Kendall at brent.kendall@wsj.com and Jared S.

Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

August 25, 2020 18:42 ET (22:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

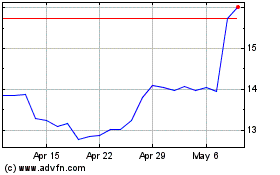

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

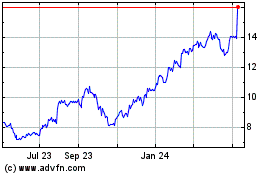

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

From Apr 2023 to Apr 2024