Australian, NZ Dollars Higher After China Data

09 September 2020 - 5:41PM

RTTF2

The Australian and NZ dollars appreciated against their major

counterparts in the European session on Wednesday, as China's

consumer price index matched forecasts in August.

Data from the National Bureau of Statistics showed that the CPI

rose 0.4 percent month-on-month in August versus 0.6 percent gain

in July. The rate came in line with expectations.

On an annual basis, the CPI grew 2.4 percent in August, compared

to a 2.7 percent increase in July.

Producer prices decreased at a pace of 2 percent on a yearly

basis in August, as expected, following a 2.4 percent drop in the

previous month.

European stocks rose despite fears about AstraZeneca's halt in

its vaccine trials.

The company said it is investigating whether a patient's

reported side effect is related to the vaccine, known as

AZD1222.

Survey data from Westpac showed that Australia's consumer

sentiment strengthened in September even though the economy plunged

into its first recession since 1992.

The Westpac-Melbourne Institute Index of Consumer Sentiment

climbed 18 percent to 93.8 in September from 79.5 in August.

The aussie advanced to 0.7242 against the greenback, 76.86

versus the yen and 1.6239 against the euro, off its early a 2-week

low of 0.7192, fresh 2-week low of 76.11 and near a 2-week low of

1.6354, respectively. The next possible resistance for the aussie

is seen around 0.75 against the greenback, 78.00 versus the yen and

1.58 against the euro. The aussie touched a 6-day high of 0.9576

versus the loonie, up from a low of 0.9531 hit at 5:45 pm ET. The

aussie is seen finding resistance around the 0.98 level.

The kiwi gained to 70.47 versus the yen, 0.6642 versus the

greenback and 1.7704 against the euro, after falling to a 2-week

low of 69.87 and near 2-week lows of 0.6601 and 1.7816,

respectively in prior deals. The kiwi is likely to find resistance

around 72.00 versus the yen, 0.68 versus the greenback and 1.74

against the euro.

The kiwi recovered to 1.0890 against the aussie, from a low of

1.0914 set at 5:15 am ET. If the kiwi continues its rise, 1.06 is

possibly seen as its next resistance level.

Looking ahead, Canada housing starts data for August is set for

release at 8:15 am ET.

At 10:00 am ET, the Bank of Canada announces decision on

interest rates. Economists forecast the benchmark rate to remain at

0.25 percent.

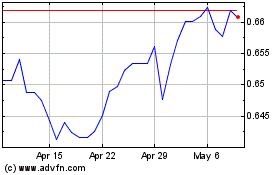

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024