Tech Stocks Lead Index Rebound -- WSJ

15 September 2020 - 5:02PM

Dow Jones News

By Alexander Osipovich and Joe Wallace

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 15, 2020).

A rebound in technology shares lifted U.S. stocks Monday,

helping major indexes recover after last week's pullback.

Deal activity at software giant Oracle and chip maker Nvidia

contributed to the bounce in tech stocks. Both companies' shares

rallied more than 4% after Oracle won the bidding for the U.S.

operations of video-sharing app TikTok and Nvidia agreed to buy

British chip-designer Arm Holdings in a potentially transformative

deal.

The tech-heavy Nasdaq Composite jumped 203.11 points, or 1.9%,

to 11056.65 after last week suffering its biggest one-week decline

since the March market crisis.

The Dow Jones Industrial Average climbed 327.69, or 1.2%, to

27993.33, while the S&P 500 advanced 42.57, or 1.3%, to

3383.54.

Monday's advance extends a spell of outsize moves in both

directions for U.S. stock indexes, much of it driven by shares of

large technology companies that have powered the market's recovery

since the spring.

Stocks like Apple and Microsoft had soared in recent months,

with investors betting tech companies were better positioned to

handle the Covid-19 pandemic than more traditional industries.

Rock-bottom interest rates also pushed investors into riskier

assets. But the tech rally abruptly lost steam this month. Even

with Monday's gains, the Nasdaq remains more than 8% below the

record highs it reached in early September.

Mike Dowdall, a portfolio manager at BMO Global Asset

Management, said he was being cautious on tech stocks because of

their lofty valuations. "Even though the economic story is really

strong, it's hard to step into that trade at the moment," he

said.

Stocks have been also buffeted this month by uncertainty about

the U.S. presidential election and worries that the economic

recovery, which appeared vigorous earlier this summer, could be

slowing.

"We're shifting into an environment of lower returns and higher

volatility and this is not inconsistent with that," said James

McCormick, global head of desk strategy at NatWest Markets. He

added: "I think the upside is going be a bit capped here until we

get through some of these events and risks."

Investor sentiment was boosted by the resumption of clinical

trials of AstraZeneca's experimental coronavirus vaccine in the

U.K. Studies were put on pause globally after a person who received

the vaccine had an unexplained illness. Trials in other countries,

including the U.S., remain on hold.

"There's a bit more positivity as regards vaccines," said Robert

Carnell, head of research for Asia-Pacific at ING Groep. "The

resumption of AstraZeneca trials will be seen in that light."

Gains were broad Monday, with all 11 of the S&P 500's

sectors advancing. The tech sector was among the biggest gainers

with a 2.1% climb.

Oracle shares rose $2.46, or 4.3%, to $59.46 after it beat

Microsoft in the race for TikTok, according to people familiar with

the matter. Nvidia shares gained $28.31, or 5.8%, to $514.89 after

it agreed to buy Arm Holdings for more than $40 billion from

SoftBank Group Corp.

Investors welcomed news that ViacomCBS agreed to sell CNET Media

Group to Red Ventures, pushing Class B shares in the entertainment

giant up 69 cents, or 2.4%, to close at $29.73.

Gilead Sciences shares rose $1.44, or 2.2%, to $66.34 after the

pharmaceutical company said it would pay $21 billion to buy biotech

Immunomedics and its prized breast-cancer drug.

Citigroup shares dropped $2.85, or 5.6%, to $48.15 after The

Wall Street Journal reported that federal regulators were preparing

to reprimand the bank for failing to improve its risk-management

systems.

Elsewhere, the Stoxx Europe 600 rose 0.1%. In Asia, China's

Shanghai Composite Index gained 0.6%.

Write to Alexander Osipovich at alexander.osipovich@dowjones.com

and Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

September 15, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

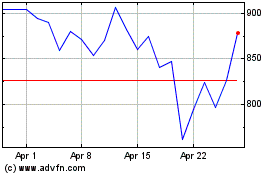

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024