Statement of Changes in Beneficial Ownership (4)

23 September 2020 - 7:34AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Pullara Samuel J III |

2. Issuer Name and Ticker or Trading Symbol

Snowflake Inc.

[

SNOW

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

755 PAGE MILL ROAD, SUITE A-200 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/18/2020 |

|

(Street)

PALO ALTO, CA 94304-1005

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 7822231.0000 | | (2) | (2) | Class A Common Stock | 7822231.0000 | $0.0000 | 7866483.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 7464467.0000 | | (2) | (2) | Class A Common Stock | 7464467.0000 | $0.0000 | 15330950.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 4163543.0000 | | (2) | (2) | Class A Common Stock | 4163543.0000 | $0.0000 | 19494493.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 2726595.0000 | | (2) | (2) | Class A Common Stock | 2726595.0000 | $0.0000 | 22221088.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 2170228.0000 | | (2) | (2) | Class A Common Stock | 2170228.0000 | $0.0000 | 24391316.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 2121351.0000 | | (2) | (2) | Class A Common Stock | 2121351.0000 | $0.0000 | 26512667.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 727185.0000 | | (2) | (2) | Class A Common Stock | 727185.0000 | $0.0000 | 27239852.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 69370.0000 | | (2) | (2) | Class A Common Stock | 69370.0000 | $0.0000 | 27309222.0000 | I | By Ltd Partnership (SHV) (3) |

| Series A Preferred Stock | (4) | 9/18/2020 | | C | | | 7822231.0000 | (4) | (4) | Class B Common Stock | 7822231.0000 | $0.0000 | 0.0000 | I | By Ltd Partnership (SHV) (3) |

| Series B Preferred Stock | (4) | 9/18/2020 | | C | | | 4163543.0000 | (4) | (4) | Class B Common Stock | 4163543.0000 | $0.0000 | 0.0000 | I | By Ltd Partnership (SHV) (3) |

| Series C Preferred Stock | (4) | 9/18/2020 | | C | | | 7464467.0000 | (4) | (4) | Class B Common Stock | 7464467.0000 | $0.0000 | 0.0000 | I | By Ltd Partnership (SHV) (3) |

| Series D Preferred Stock | (4) | 9/18/2020 | | C | | | 2170228.0000 | (4) | (4) | Class B Common Stock | 2170228.0000 | $0.0000 | 0.0000 | I | By Ltd Partnership (SHV) (3) |

| Series E Preferred Stock | (4) | 9/18/2020 | | C | | | 69370.0000 | (4) | (4) | Class B Common Stock | 69370.0000 | $0.0000 | 0.0000 | I | By Ltd Partnership (SHV) (3) |

| Series F Preferred Stock | (4) | 9/18/2020 | | C | | | 2726595.0000 | (4) | (4) | Class B Common Stock | 2726595.0000 | $0.0000 | 0.0000 | I | By Ltd Partnership (SHV) (3) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 361676.0000 | | (2) | (2) | Class A Common Stock | 361676.0000 | $0.0000 | 362290.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 180614.0000 | | (2) | (2) | Class A Common Stock | 180614.0000 | $0.0000 | 542904.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 116250.0000 | | (2) | (2) | Class A Common Stock | 116250.0000 | $0.0000 | 659154.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 104002.0000 | | (2) | (2) | Class A Common Stock | 104002.0000 | $0.0000 | 763156.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 83962.0000 | | (2) | (2) | Class A Common Stock | 83962.0000 | $0.0000 | 847118.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 46648.0000 | | (2) | (2) | Class A Common Stock | 46648.0000 | $0.0000 | 893766.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 30030.0000 | | (2) | (2) | Class A Common Stock | 30030.0000 | $0.0000 | 923796.0000 | I | By Trust (5) |

| Class B Common Stock | (1) | 9/18/2020 | | C | | 2854.0000 | | (2) | (2) | Class A Common Stock | 2854.0000 | $0.0000 | 926650.0000 | I | By Trust (5) |

| Series A Preferred Stock | (4) | 9/18/2020 | | C | | | 180614.0000 | (4) | (4) | Class B Common Stock | 180614.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series B Preferred Stock | (4) | 9/18/2020 | | C | | | 104002.0000 | (4) | (4) | Class B Common Stock | 104002.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series C Preferred Stock | (4) | 9/18/2020 | | C | | | 361676.0000 | (4) | (4) | Class B Common Stock | 361676.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series D Preferred Stock | (4) | 9/18/2020 | | C | | | 83962.0000 | (4) | (4) | Class B Common Stock | 83962.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series E Preferred Stock | (4) | 9/18/2020 | | C | | | 2854.0000 | (4) | (4) | Class B Common Stock | 2854.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series F Preferred Stock | (4) | 9/18/2020 | | C | | | 116250.0000 | (4) | (4) | Class B Common Stock | 116250.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series G-1 Preferred Stock | (4) | 9/18/2020 | | C | | | 30030.0000 | (4) | (4) | Class B Common Stock | 30030.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Series Seed Preferred Stock | (4) | 9/18/2020 | | C | | | 46648.0000 | (4) | (4) | Class B Common Stock | 46648.0000 | $0.0000 | 0.0000 | I | By Trust (5) |

| Explanation of Responses: |

| (1) | Each share of Class B Common Stock held by the Reporting Person will automatically convert into one share of Class A Common Stock, upon the following: (1) the sale or transfer of such share of Class B Common Stock; (2) the death of the Reporting Person; and (3) on the final conversion date, defined as the earlier of (a) the first trading day falling nine months after the date on which the outstanding shares of Class B Common Stock represents less than 10% of the then outstanding Class A and Class B Common Stock; (b) the seventh anniversary of the effectiveness of the registration statement in connection with the Issuer's IPO; or (c) the date specified by a vote of the holders of a majority of the outstanding shares of Class B Common Stock, voting as a single class. |

| (2) | Each share of Class B Common Stock is convertible at any time at the option of the Reporting Person into one share of Class A Common Stock, and has no expiration date. On any transfer of shares of Class B Common Stock, each such transferred share will automatically convert into one share of Class A Common Stock, except for certain "Permitted Transfers" described in the Issuer's amended and restated certificate of incorporation. |

| (3) | Shares held by Sutter Hill Ventures, a California Limited Partnership. The reporting person is a managing director and member of the management committee of the general partner of Sutter Hill Ventures, a California Limited Partnership. The reporting person disclaims beneficial ownership in these shares except as to the reporting person's pecuniary interest therein. |

| (4) | Each share of Series Seed Preferred Stock, Series A Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D Preferred Stock, Series E Preferred Stock, Series F Preferred Stock, and Series G-1 Preferred Stock automatically converted into one share of Class B Common Stock immediately upon the closing of the Issuer's initial public offering (IPO), and had no expiration date. |

| (5) | Shares held by a trust of which the reporting person is a trustee. The reporting person disclaims beneficial ownership in these shares except as to the reporting person's pecuniary interest therein. |

Remarks:

Due to technical limitations of the EDGAR filing system, which limits the number of lines per table, this filing is one of two separate Form 4 filings being made by the reporting person on the date hereof.,Multiple Forms Submitted |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Pullara Samuel J III

755 PAGE MILL ROAD, SUITE A-200

PALO ALTO, CA 94304-1005 |

| X |

|

|

Signatures

|

| /s/ Kanwalpreet S. Kalra, by power of attorney | | 9/22/2020 |

| **Signature of Reporting Person | Date |

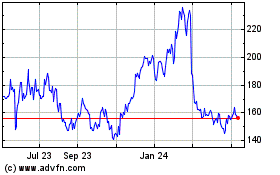

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

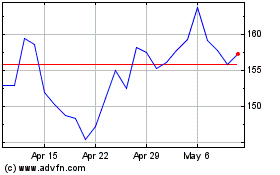

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Apr 2023 to Apr 2024