UCASU - Airbnb-based Innovative Strategy Kicked off by UCASU to Target $60 Billion Market

02 October 2020 - 4:19AM

InvestorsHub NewsWire

October 1, 2020 -- InvestorsHub NewsWire -- UC Asset LP

(OTCQX:

UCASU) kicked off an innovative property investment strategy

during the firm’s annual shareholder meeting on Wednesday,

September 30, 2020. This new investment strategy targets the $60

billion business trip accommodation market.

Atlanta Skyline

The new investment strategy, named SHOC (pronounced as "shock"

and standing for Shared Home Office Cluster), aims to acquire a

cluster of distressed residential properties in communities nearby

airports, renovate them into cost-efficient home offices, and

market them as shared accommodation on platforms such as Airbnb, to

serve business travelers who prefer renting a shared home-office

than staying at a conventional hotel.

"The US hotel market was close to $200 billion before COVID-19

pandemic, and about thirty percent of that, or, $60 billion,

focuses on business travelers," explains Greg Bankston, managing

general partner of UC Asset. "But as more businesspeople shift

their daily operation from conventional office spaces to home

offices, we believe they will prefer the familiarity of a

home-office environment on the road as well. Conventional hotels

will lose these customers to share accommodations that can provide

a home office environment."

"The COVID-19 pandemic has accelerated the transition from

conventional office space to home offices, and should accelerate

the transition from conventional hotel to shared home-office

accommodation," Bankston projects. "UC Asset is a real estate

investor and redeveloper. We excel in residential property

renovation and have mastered the art of turning distressed

residential properties into comfortable, safe and cost-efficient

accommodations. With proper management, we are confident that our

new product, SHOC (Shared Home Office Cluster), will attract a new

generation of business travelers on shared accommodation platforms

such as Airbnb."

"Our business is based in Atlanta, Georgia, and Atlanta is

arguable the best place to start our new strategy," says Larry Wu,

founder of UC Asset. "The city of Atlanta has launched multiple

mega initiatives to address its issue of inequality, which is the

worst among major US cities. And a critical mission of Atlanta city

is to increase business activities in distressed communities."

"Most of Atlanta’s distressed communities surround

Hartfield-Jackson Atlanta International Airport. The bright point

is, it is the busiest airport in the world, served 110 million

passengers in the year of 2019. If we acquire properties and build

our SHOC (Shared Home Office Clusters) in those distressed

communities surrounding the Atlanta Airport, it is not only great

for our business, but will also bring income to local communities

to help reduce inequality," Wu shares.

UC Asset has done projects in those communities before, and they

are among the most successful investments of the company. According

to the company, one project closed last year yielded a 48%

annualized return over a period of 11 months. "With the new SHOC

strategy, we probably can close more projects like this," says

Bankston.

Seperately, UC Asset recently announced entering into a letter of

intent agreement to sell a 72 acer

property in Farmersville, Texas to Puraiton, Inc. (USOTC:

PURA).

About UC Asset LP

UC Asset LP is a limited partnership formed for the purpose of

investing in real estate for development and redevelopment,

concentrating in metropolitan areas of Atlanta, GA and Dallas, TX.

For more information about UC Asset, please visit: www.ucasset.com

Disclaimer:

This News Release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause our

actual results, performance or achievements, or industry results,

to differ materially from any these statements. You are cautioned

not to place undue reliance on any those forward-looking

statements. Except as otherwise required by the federal securities

laws, we undertake no obligation to publicly update or revise any

forward-looking statements after the date of this news release.

None of such forward-looking statements should be regarded as a

representation by us or any other person that the objectives and

plans set forth in this News Release will be achieved or be

executed.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201001005934/en/

Contacts

For More Information Contact:

Christal Jordan | Investor Relations Director, UC Asset LP

cjordan@ucasset.com | 678-499-0297

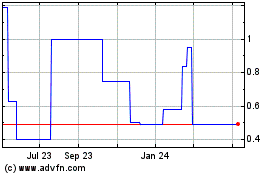

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Mar 2024 to Apr 2024

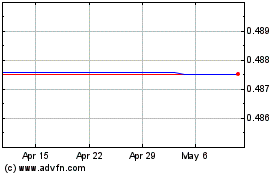

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Apr 2023 to Apr 2024