Dollar Appreciates As Virus, Stimulus Concerns Weigh

15 October 2020 - 6:23PM

RTTF2

The U.S. dollar strengthened against its major rivals in the

European session on Thursday, as uncertainty over a U.S. stimulus

package and a rapid rise in coronavirus cases across Europe lifted

the appeal of the safe-haven assets.

Treasury Secretary Stephen Mnuchin cautioned that the stimulus

package is unlikely to pass before the election, as the two sides

remained far apart on certain issues.

Mnuchin blamed Democrats for the deadlock, adding that it is

"part of the reality."

Risk sentiment was undermined by rising cases of coronavirus in

some regions of Europe and return of restrictions to contain the

outbreak.

France has introduced curfews and other European nations are

closing schools and cancelling operations due to COVID-19.

The two-day European Union summit will kick off later in the

day, with Brexit talks on the agenda.

EU leaders will re-examine the post-Brexit talks as the deadline

for a pact on the European Union's relations with Britain

nears.

Economic reports on weekly jobless claims, regional

manufacturing activity and import and export prices are due later

in the day.

The greenback appreciated to 1.2930 against the pound from

Wednesday's closing value of 1.3012. The greenback is poised to

find resistance around the 1.28 area.

The greenback reached as high as 1.1703 against the euro, which

was its strongest level since October 2. The greenback is seen

finding resistance around the 1.16 level.

After falling to 0.9127 at 1:45 am ET, the U.S. currency edged

up to 0.9156 against the Swiss franc. Next key resistance for the

greenback is seen around the 0.94 region.

The greenback was higher against the yen, at 105.34. Further

rally may lead the greenback to a resistance around the 108.00

level.

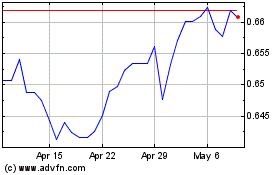

Reversing from its early lows of 1.3138 against the loonie,

0.7170 against the aussie and 0.6663 against the kiwi, the dollar

spiked up to a 1-week high of 1.3207, more than 2-week high of

0.7067 and a 6-day high of 0.6592, respectively. On the upside,

1.37, 0.68 and 0.63 are possibly seen as its next resistance levels

against the loonie, the aussie and the kiwi, respectively.

Looking ahead, the U.S. weekly jobless claims for the week ended

October 10, New York Fed's empire manufacturing survey for October

and import and export prices for September will be featured in the

New York session.

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024