Canada Targets Online-Streaming Services With Cultural Levy

04 November 2020 - 8:33AM

Dow Jones News

By Paul Vieira

Canada proposes to compel online streaming services to set aside

part of their revenue to fund domestic television and music

production as the government looks to force global digital players

to make a bigger contribution to the local economy.

The move, unveiled Tuesday by Canadian officials, would also

order streaming services such as Netflix Inc., Amazon.com Inc.'s

Prime Video, Walt Disney Co.'s Disney+, and Spotify Technology SA

to meet certain Canadian-content requirements, such as more

programming to serve the country's francophone and indigenous

populations.

Canada's broadcast regulator estimates, according to its most

recent financial data, that streaming services record annual

revenue of roughly 5 billion Canadian dollars, or the equivalent of

$3.77 billion. Canada is eyeing nearly C$1 billion a year to

finance the making of Canadian television shows, films and

music.

Canada's regulatory reach is the latest example of how countries

are trying to ensure a level playing field between domestic

industries and large global technology companies, which aren't

necessarily subjected to local laws when it comes to providing

their wares, such as entertainment, and paying taxes.

"This is about our cultural sovereignty. It's about investment

and jobs. It's about equity," said Steven Guilbeault, Canada

heritage minister. "We are asking these large and wealthy companies

to invest in Canadian artists, in the same way Canadian

broadcasters already have regulatory obligations."

Mr. Guilbeault said Canada's Liberal government intends to

pursue additional tax-related issues focused on bigger companies in

the technology sector, such as Facebook Inc. and Alphabet Inc.'s

Google. The discussion of digital taxes, as proposed by European

countries like France, has triggered trans-Atlantic friction and

the threat of tariffs from Washington on European goods and

services for unfair targeting of U.S. technology companies.

The changes are outlined in legislation to be introduced to the

Canadian legislature for approval. The Liberal government runs a

minority government, so it would require the support of another

party to put through changes. Some of the crucial regulatory

details will be established by Canada's broadcast regulator, the

Canadian Radio-television and Telecommunications Commission, after

legislation is passed.

Officials said the changes are meant to address a regulatory

imbalance, as streaming services from abroad are making inroads in

the Canadian economy at the expense of the domestic cultural

industry. Under the proposed revamp, online-streaming services

would be defined as broadcasters under Canadian law, and thereby

subject to the same rules as legacy domestic broadcasters.

Under Canada's regulatory framework, the broadcasting industry

must contribute a chunk of its revenue to fund the Canadian

production of TV shows, movies and music. In 2018, or the most

recent annual figures available, Canada's broadcasters contributed

roughly 20% of revenue to finance Canadian programming. Based on

their projections of revenue from streaming services, officials

expect Netflix and the others to contribute at least C$1 billion

toward financing Canadian programming, starting in 2023.

A spokeswoman for Netflix said the company was reviewing

Canada's proposed changes, and stood ready to work in partnership

with Canada's cultural sector. In 2017, the Los Gatos, Calif.-based

company signed a deal with the Canadian government, in which it

pledged to spend a minimum C$500 million over a five-year period on

original Canadian productions. The deal came at a time when global

policy makers worried about the streaming service's rapid

growth.

Representatives from Walt Disney, Amazon and Spotify didn't

respond to a request for comment.

The changes would apply to both foreign and Canadian streaming

services, such as Crave, which is operated by Montreal-based BCE

Inc.'s Bell Media unit. (Crave holds licensing rights in Canada to

HBO programming.)

Michael Geist, a law professor at University of Ottawa with a

focus on the internet and technology, said the changes represent

significant regulatory hurdles for streaming providers. He said

completing the rules could be a yearslong process, and warned that

could lead some streaming services to pare back on planned spending

in Canada or avoid the market altogether.

Write to Paul Vieira at paul.vieira@wsj.com

(END) Dow Jones Newswires

November 03, 2020 16:18 ET (21:18 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

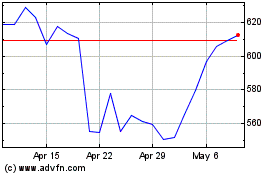

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

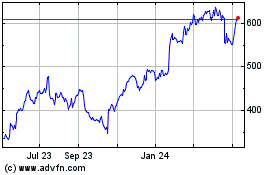

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024