NZ Dollar Advances, U.S. Dollar Drops On Upbeat Japan, China Data

16 November 2020 - 2:07PM

RTTF2

The NZ dollar climbed and the U.S. dollar fell in the Asian

session on Monday, as strong Japan and China data suggested a

rebound in the world's second and third largest economies.

The Japanese economy grew more than expected in the third

quarter, as improved exports and consumption helped the country

emerge from the virus crisis.

China retail sales improved from last month, while industrial

output matched expectations, government data showed.

Investors also were encouraged by the news of the ASEAN trade

deal aimed to accelerate the economic recovery from the

coronavirus-induced slowdown.

Asia Pacific nations including China, Japan and South Korea on

Sunday signed the world's largest free-trade agreement.

The Regional Comprehensive Economic Partnership deal reduces

tariffs, accelerates the service sector and lays down common trade

rules within the bloc.

The kiwi strengthened to 4-day highs of 0.6890 against the

greenback, 72.02 against the yen, 1.7203 against the euro, after

falling to 0.6840, 71.56 and 1.7294, respectively in previous

deals. The kiwi is poised to find resistance around 0.70 against

the greenback, 74.00 against the yen, 1.66 against the euro.

The kiwi appreciated to 1.0588 against the aussie, following a

decline to 1.0623 at 6:15 pm ET. Next key resistance for the kiwi

is seen around the 1.03 level.

The greenback pulled back from its early highs of 104.72 against

the yen and 1.1829 against the euro, weakening to 1-week lows of

104.49 and 1.1855, respectively. If the greenback falls further,

101.00 and 1.20 are possibly seen as its next support levels

against the yen and the euro, respectively.

The greenback hit 5-day lows of 1.3234 against the pound and

0.7298 against the aussie, down from its prior highs of 1.3174 and

0.7263, respectively. The greenback is seen finding support around

1.34 against the pound and 0.75 versus the aussie.

Retreating from a high of 1.3136 seen at 5:30 pm ET, the

greenback dipped to a 4-day low of 1.3097 against the loonie. The

next possible support for the currency is seen around the 1.29

level.

The greenback edged down to 0.9114 against the franc early in

the session and was steady thereafter. The greenback is likely to

find support near the 0.90 level.

Looking ahead, Canada manufacturing sales for September and New

York Fed's empire manufacturing survey for November are scheduled

for release in the New York session.

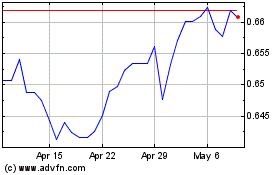

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024