U.S. Dollar Declines On Virus, Biden's Transition Fears

17 November 2020 - 5:14PM

RTTF2

The U.S. dollar weakened against its major opponents in the

European session on Tuesday, as a return of coronavirus

restrictions in some U.S. states and the Trump administration's

refusal to coordinate with Biden's transition team weighed on the

currency.

Biden on Monday warned of dire consequences if the Trump

administration continues to resist cooperation with his transition

team on the coronavirus pandemic and block briefings on national

security, policy issues and vaccine plan.

Concerns over a smooth transition of power to President-elect

Joe Biden kept sentiment subdued.

Global Covid-19 cases topped 55 million today with more than 1.3

million deaths, according to the Johns Hopkins University.

Federal Reserve Vice Chair Richard Clarida said on Monday that

more support would be needed from fiscal and monetary authorities

to ensure a strong recovery from the coronavirus pandemic.

Investors await the release of U.S. retail sales and industrial

production later in the day to assess the health of the

economy.

The greenback slipped to 8-day lows of 1.1876 against the euro,

104.24 against the yen and 0.7340 against the aussie, from its

early highs of 1.1843, 104.60 and 0.7301, respectively. The

currency is seen challenging support around 1.20 against the euro,

100 against the yen and 0.75 against the aussie.

The greenback fell to a 6-day low of 1.3256 against the pound,

off an early high of 1.3183. The greenback may challenge support

around the 1.34 level.

The greenback reached as low as 0.9099 against the franc, down

from a high of 0.9129 set at 2:15 am ET. Next key support for the

currency is likely seen around the 0.88 region.

The greenback remained lower at 0.6910 against the kiwi, after

having dropped to a 1-1/2-year low of 0.6919 in the previous

session. Immediate support for the currency is possibly seen around

the 0.72 region.

The U.S. currency pulled back to 1.3065 against the loonie, from

a high of 1.3090 seen at 3:00 am ET. On the downside, 1.28 is

likely seen as its next support level.

Looking ahead, at 8:15 am ET, Canada housing starts for October

are due.

Canada wholesale sales for September, U.S. retail sales, import

and export prices and industrial production, all for October, NAHB

housing market index for November and business inventories for

September will be released in the New York session.

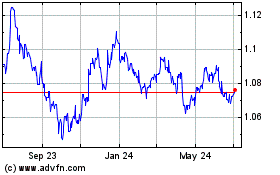

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

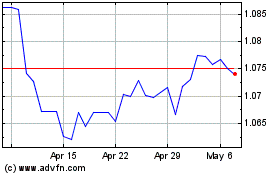

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024