Snowflake Shares Up After 3Q Results

04 December 2020 - 4:55AM

Dow Jones News

By Michael Dabaie

Snowflake Inc. shares were up 14% to $334.16 around midday.

The provider of cloud data warehousing software Wednesday after

the market close reported third-quarter total revenue was $159.6

million, up from $73 million a year earlier. FactSet consensus was

for $147.7 million.

Product revenue was $148.5 million, which the company said was

up 115% year-over-year. FactSet consensus was for $136.6

million.

Loss was $168.9 million, wider than a year earlier loss of $88.1

million.

Loss per share was $1.01, versus a loss of $1.92 in the year-ago

period. Weighted-average shares were about 166 million, from about

46 million a year earlier.

Snowflake had its initial public offering in September and had

an IPO pricing at $120.

"We are pleased with our performance this first quarter as a

public company," said Chief Executive Frank Slootman. "The period

was marked by continued strong revenue growth coupled with

improving unit economics, cash flow, and operating

efficiencies."

Snowflake guided for fourth-quarter product revenue of $162

million to $167 million and fiscal-year product revenue of $538

million to $543 million.

J.P. Morgan said in a note that Snowflake posted a healthy third

quarter with product revenue exceeding its forecast. "The

combination of growth and scale remains elite as it is remarkable

to see this revenue stream approach a $600M annual run-rate with

triple-digit growth," J.P. Morgan said in its note.

J.P. Morgan boosted its price target to $250 from $247 and rates

the stock at Neutral.

"Snowflake could grow into and beyond the current valuation in

future years, but it is difficult to see material outperformance

within the horizon of our price target," J.P. Morgan said in its

note.

Mizuho Securities USA said that fourth-quarter guidance was

"roughly in line, but we believe it will likely prove

conservative."

"We maintain that SNOW is enabling customers to transform from

large data stores to data-driven organizations, and that companies

will increasingly standardize on SNOW. Although SNOW already trades

at a substantial premium, we believe the shares can go higher as

the company continues to grow at elevated rate" over the next

twelve months and beyond. Mizuho reiterated its Buy rating and

boosted its price target to $310 from $300.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

December 03, 2020 12:40 ET (17:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

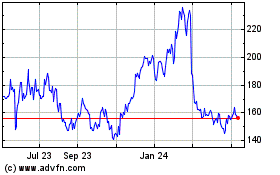

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

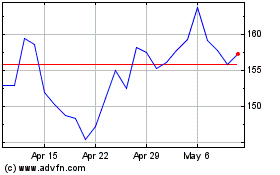

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Apr 2023 to Apr 2024