Enel to Sell Up to 50% of Open Fiber to Macquarie Infrastructure

18 December 2020 - 5:08AM

Dow Jones News

By Cecilia Butini

Enel SpA said Thursday that it has resolved to sell a minimum

40% stake and up to 50% of Open Fiber SpA to Macquarie

Infrastructure & Real Assets, part of Macquarie Group Ltd.

The sale of Enel's 50% stake would mean a sale of its entire

stake in Open Fiber, it said.

The Rome-based energy company said the consideration for the

sale of 50% of Open Fiber equals 2.65 billion euros ($3.23 billion)

and includes the transfer to Macquarie Infrastructure of the

totality of Enel's portion of a shareholders' loan granted to Open

Fiber. That would have an estimated consideration of about EUR270

million as of June 30, 2021.

Should the sale be for 40% of Open Fiber, the consideration for

the sale would be EUR2.12 billion, the company said. Enel's portion

of the shareholders' loan granted to Open Fiber and transferred to

Macquarie Infrastructure would be equal to 80% and would have an

estimated value of around EUR220 million as of June 30, 2021.

The transaction is expected to be finalized by June 30,

2021.

Write to Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

December 17, 2020 12:53 ET (17:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

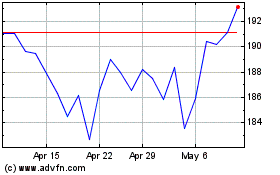

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

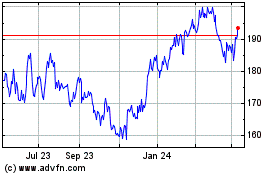

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024