FedEx Revenue Jumps on Holiday Surge -- Update

18 December 2020 - 10:55AM

Dow Jones News

By Paul Ziobro

FedEx Corp. isn't missing Amazon.com Inc. this holiday

season.

Shipping volumes at FedEx's Ground unit surged 29% in the latest

quarter, as consumers continued to buy everyday goods online, while

retailers urged them to do their holiday shopping earlier than

normal against the backdrop of the coronavirus pandemic.

The combination of factors boosted revenue and profits at the

delivery company for the three months ended Nov. 30, which included

Black Friday. FedEx has raised prices and handled a surge in

e-commerce packages this year, even after it publicly split ways in

2019 with Amazon, the biggest online retailer.

FedEx has found more than enough packages to fill its network

after parting ways with Amazon, helped by the overall growth of

e-commerce during the pandemic and courting of new customers.

Online sales rose 33% in the first nine months of 2020, FedEx said,

compared with just a 1% gain in overall retail sales, excluding

categories such as gas and food services.

FedEx's large Express unit posted a 10% jump in volume from a

year ago. It continues to benefit from tight capacity in the

air-cargo market, as a severe decline in passenger flights that

carried freight in their bellies has cut into supply. Air-cargo

companies such as FedEx have been flying fuller jets and charging

higher rates as a result.

The delivery company is in the midst of the busiest period for

shipping parcels ahead of the holidays, with around 100 million

packages dispatched daily across the industry, according to

ShipMatrix, a software provider that analyzes shipping data.

Industry data so far show that FedEx and United Parcel Service

Inc. have held up against the onslaught well, with on-time delivery

performance improving from last year.

However, part of it has come from stricter limits than usual on

how many items shippers can tender to the carriers daily. Both

companies have temporarily stopped accepting shipments from some

retailers, resulting in a backlog at some warehouses.

"All available capacity across the entire industry has been

severely constrained," FedEx chief marketing officer Brie Carere

said on Thursday's earnings call.

The carriers are also pushing rates up higher and adding new

fees to offset the cost of handling so many packages during the

pandemic. On Wednesday, FedEx said it would extend some peak-season

surcharges that were supposed to expire on Jan. 17 until further

notice because it expects costs and demand to remain elevated.

FedEx said the higher revenue was partially offset by higher

costs, including safety equipment to protect workers from Covid-19.

For its Ground network, that included hiring more workers than

usual before the holidays and opening several new facilities,

including one the weekend before Thanksgiving, to handle holiday

shipping volume.

"Peak preparation expenses were much higher and occurred much

earlier than in the past," Henry Maier, chief executive officer of

FedEx Ground, said.

For its fiscal second quarter ended Nov. 30, FedEx posted a

profit of $1.23 billion, or $4.55 a share, compared with $560

million, or $2.13, a year earlier. Revenue came in at $20.3

billion.

Analysts polled by FactSet on average expected FedEx to post

earnings of $4.01 a share on $19.4 billion in revenue.

FedEx continues to withhold its financial forecast for the

current fiscal year. Chief Financial Officer Michael Lenz said the

company expects earnings to grow in the second-half because of

"anticipated heightened demand for our services."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

December 17, 2020 18:40 ET (23:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

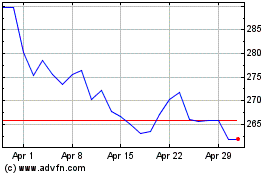

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

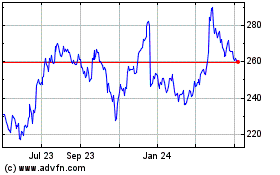

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024