By Tim Higgins

Tesla Inc.'s effort to bring out its Model 3 brought the

electric car company near collapse in 2018. Now Chief Executive

Elon Musk has divulged a new twist: He says he contacted his Apple

Inc. counterpart, Tim Cook, to save his company.

"During the darkest days of the Model 3 program, I reached out

to Tim Cook to discuss the possibility of Apple acquiring Tesla

(for 1/10 of our current value)," Mr. Musk said in a tweet Tuesday.

But the Apple CEO, he said, "refused to take the meeting."

Mr. Musk revealed the latest detail as he worked to question

whether Apple is serious about bringing out an electric car of its

own amid a new report the company is pushing for 2024

production

On Twitter, Mr. Musk called the report "strange, if true."

Tesla has built a brand for itself as a Silicon Valley auto

maker offering high-tech cars with promises of fully self-driving

technology on the near horizon. The specter of a driverless,

electric car made by tech giant Apple could prove the kind of

fierce competition that traditional auto makers, such as General

Motors Co. and Volkswagen AG, have yet to muster.

In 2014, Apple began working on its own car project, dubbed

Project Titan, details of which emerged in early 2015. The project

has gone in fits and starts.

Apple has been making plans to begin production of an electric

car as soon as 2024, a person familiar with the effort said.

Reuters earlier reported the new timeline.

The Apple project is being headed up by Doug Field, a longtime

Apple executive who left the company for about five years to work

at Tesla, where he oversaw the development of the Model 3. He left

in 2018 and returned to Apple, where he began work on the car

project.

Apple declined to comment.

Mr. Musk on Tuesday didn't specify exactly when he approached

Mr. Cook.

Launched in 2017, the Model 3 proved harder to build than Mr.

Musk expected. Costly delays mounted before Tesla eventually worked

through production and delivery snags in 2018, when it posted

profitable quarters in the second half of that year. It continued

to struggle the early part of the following year, however.

In August 2018, Mr. Musk shocked investors with the idea of

taking the electric-car maker private in what would have been the

biggest buyout in history. Mr. Musk at the time wrote on Twitter:

"Am considering taking Tesla private at $420. Funding secured." The

deal didn't happen, and the tweet spurred a Securities and Exchange

Commission probe and legal battles with the regulator.

As Mr. Musk tried to make a deal work to take Tesla private, his

advisers sought funding from several places, including Volkswagen.

He eventually scuttled his effort.

By the third quarter of 2019, Tesla had turned the corner and

kicked off a string of quarterly profits, exciting investors who

have sent the company's shares soaring and made the company the

most valuable auto maker in the world with a value of more than

$600 billion. It was added to the S&P 500 index, a key

benchmark, on Monday.

Excitement around the company has allowed Tesla to raise

billions of dollars for what Mr. Musk has described as his war

chest.

Mr. Musk didn't respond to questions about his latest tweet.

The Model 3 wasn't Tesla's first troubled car introduction --

all vehicles up to that point had been painful. The company's first

vehicle, the Roadster sports car, almost led to the company's

collapse in 2008 and the Model S large sedan in 2012 was also

troublesome. During that period, Mr. Musk turned to Google about a

potential deal, people familiar with the situation have said.

When sales of the Model S kicked in during the first quarter of

2013, Mr. Musk was able to post the company's first quarterly

profit and he quickly raised more money amid the excitement about

the company's future.

Mr. Musk's success with Tesla has spurred investor enthusiasm in

electric cars and other advanced driving technologies. It is also

leading to more competition for Tesla. Traditional car-making

rivals are ramping up their electric vehicle efforts. And rivals

working on self-driving car technology, such as Waymo LLC, a unit

of Google's parent Alphabet Inc., also are securing funds to ramp

up their activities. Amazon.com Inc. in June said it was buying

autonomous car-developer Zoox.

Talk of an Apple-Tesla tie-up has often circulated around

Silicon Valley. During a 2015 shareholder meeting, Mr. Cook

sidestepped shareholders pushing for a deal. "Quite frankly, I'd

like to see you guys buy Tesla," one investor told Mr. Cook during

the meeting -- a sentiment met with laughter and applause.

Apple typically has eschewed big acquisitions. It bought Beats

Electronics LLC for $3 billion in 2014, though has never done a

transaction near the scale of what Tesla would have cost.

Since his earliest days as CEO, Mr. Musk has turned to Apple for

key hires and inspiration, from store designs to a large,

flat-screen, touch panel in the Model S.

As Apple became more interested in cars, a war for talent

ensued. Mr. Musk complained to Bloomberg Businessweek in a 2015

article that Apple was trying to poach his engineers with offers of

$250,000 signing bonuses and 60% salary increases. He later

lamented to German newspaper Handelsblatt that Apple hired those

who couldn't handle working at Tesla. "We always jokingly call

Apple the 'Tesla Graveyard,' " he was quoted saying in 2015.

Still, it has been clear that Apple has been in Mr. Musk's

sights. That year, he also told investors that he saw a path for

Tesla by 2025 to be as valuable as Apple was at the time, which

then was $700 billion.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

December 22, 2020 18:34 ET (23:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

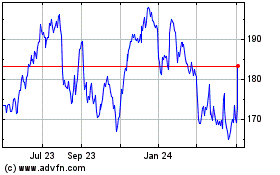

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

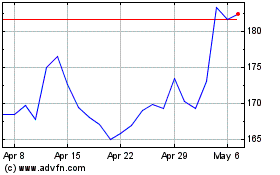

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024