By Caitlin McCabe, Gunjan Banerji and Mischa Frankl-Duval

A new army of social media-enabled day traders is helping push

stocks to records and turning companies into market sensations.

As trading by individual investors boomed during the coronavirus

pandemic, so has the popularity of online communities where they

gather. Platforms including TikTok, Twitter, YouTube, Reddit,

Instagram, Facebook and messaging platform Discord have become the

new Wall Street trading desks. Individual investors gather to talk

about hot stocks like Tesla Inc., boast of gains and commiserate

about losses.

These investors do more than just talk, though. They piggyback

on each others' ideas and trades, helping fuel the momentum that

has propelled some companies to triple-digit or bigger gains in

2020.

"People fall in love with [some stocks] and they get in these

echo chambers, where they are all shouting, like, 'We're going to

buy Tesla forever!'" said Blake Bassett, a 31-year-old delivery

driver who began trading several years ago. "People post all day

like it's a football game."

And while online discussions among investors aren't necessarily

new -- in the late 1990s internet chat rooms dedicated to stocks

helped sustain the tech-stock bubble -- social media is more

widespread than ever before. That, meanwhile, has coincided with an

industrywide move to commission-free trading, while most brokerages

have made it easier to dabble in risky instruments like

options.

Shares of Chinese electric-vehicle maker NIO Inc. are an

example. The stock has received some of the most enduring interest

from individual investors, joining the ranks of dozens of others,

including fuel-cell company Plug Power Inc. and Tesla.

Though hardly a household name, NIO is among the most searched

stocks on Google. Video snippets under the tag #nio have

accumulated more than 35 million views on the social-media platform

TikTok, with many young investors encouraging others to buy shares

of the company or questioning if it is the next Tesla. And the buzz

is alive on Twitter, where it was mentioned nearly 6,800 times on a

single day in November, up from about 100 mentions a day at the

start of 2020.

The excitement online has coincided with a rush of trading

activity. NIO has been the second-most actively traded stock in the

U.S. market over the past year, with about 111 million shares

changing hands on average each day, according to Dow Jones Market

Data as of Thursday. That only trailed trading in Apple Inc., which

has a market valuation more than 20 times that of NIO.

NIO has been a more popular trade than even the SPDR S&P 500

Exchange-Traded Fund Trust, one of the biggest ETFs tracking the

broad stock-market index. Options volume tied to NIO has surged,

with more than one-tenth of all activity recently stemming from

individual investors, according to Trade Alert data.

Fetching under $4 at the beginning of 2020, NIO's U.S.-traded

American depositary receipts closed at $62.70 Monday, a record. Its

market value of about $98 billion is well above that of General

Motors Co.

The chatter has persisted into the new year. NIO was the

second-most-traded stock Monday on the retail-trading platform

operated by Fidelity Investments Inc., trailing only Tesla. And the

trend was mirrored on Webull Financial LLC's platform last week.

Part of the excitement stemmed from the unexpected Democratic

Senate wins in Georgia, which some investors believe will give

President-elect Joe Biden a greater shot at achieving his

clean-energy initiatives.

The company's annual "NIO Day" on Saturday, during which the

electric-vehicle maker unveiled its fourth production model, had

also prompted enthusiasm among individual investors leading up to

the event.

The online buzz has enticed traders to pile in. Gavin Mayo, a

19-year-old student at the University of North Carolina at Chapel

Hill, says he typically spends anywhere from one to five hours a

day scrolling TikTok, YouTube and other platforms for ideas on what

to trade while churning out video snippets to more than 60,000 of

his TikTok followers.

"If there's some really good stocks out there -- usually people

are talking about it," said Mr. Mayo, adding that he recently sold

100 shares of NIO for about a $1,600 profit after they rallied more

quickly than he expected. Now, he's staying away from shares of

electric-vehicle makers because he thinks they have run up too far.

He recently sold his position in Tesla, too. That stock has surged

748% in the past 12 months, a rally that has intensified over the

past week, making the company worth more than Facebook Inc.

Social media is what drew Mr. Mayo to stocks in the first place

at around age 13, when he says he saw millionaire penny-stock

trader Timothy Sykes's account while browsing Instagram. Mr. Sykes

has boasted of making a full-time job out of trading stocks and

posted about the $35,000 gold Rolex watch he had bought.

Not everyone is swept up by the hype, even if they, too, are

part of the social-media stock-market debate.

Mr. Bassett has become skeptical of NIO's recent share-price

moves. In early December, he turned to a popular stock-trading

group on Facebook: "Do people even look into stocks anymore?" he

asked the group's more than 150,000 members. "NIO is outright

overvalued."

Dozens of comments flooded in. One trader said he had taken his

profits and run. Another member of the Facebook group suggested NIO

will "take over" the electric-car industry. A third offered a much

simpler explanation: Never mind technicals, the member said, "We're

in a bull run until we're not."

Determining the degree to which online chatter drives

share-price movement can be difficult to quantify. But some

researchers have found individual investors typically make the

biggest impact on smaller, more speculative stocks. Based on an

analysis that he conducted in August of Robinhood Markets Inc.

customers, Nick Maggiulli, chief operating officer for Ritholtz

Wealth Management, said users appeared to largely be chasing NIO's

stock gains -- rather than driving them -- as it was climbing last

summer.

Though few expect this year to see as much market volatility as

2020, online interest in investing has only grown. As of January,

posts tied to #stockmarket had garnered over 800 million views on

TikTok, more than triple the figure in June. Reddit's infamous

WallStreetBets forum has more than doubled in subscribers since the

start of 2020. StockTwits, a social network focused on investing

and trading, has seen its user numbers more than triple over the

past year. Recently, Tesla and NIO have generated some of the most

chatter.

Some new investors are drawn by the camaraderie that the

platforms offer. Georgina Allen, who is 26, waded into stock and

options trading after two of her friends convinced her to join a

Discord server dedicated to trading. While she was furloughed from

her job during the pandemic, the federal government worker turned

her attention to markets.

She often followed a routine: She would wake up at 6 a.m.,

assess premarket stock moves and look over her option positions.

When markets opened, she would jump on a Zoom call with other

members of her Discord group.

"We actually would join like a Zoom call, and we would

live-trade together. And that was pretty much my life," said Ms.

Allen, who is now back at work.

Members of the channel would discuss articles or the

conversation among CNBC pundits and delve into company balance

sheets. Like many other young investors, Ms. Allen bought shares of

NIO after reading about the company online. Impressed by its

financials -- and keen not to miss out on gains she saw others reap

-- she bought the shares at about $14 apiece, she said. They are

now 348% higher.

"Just seeing other people's success, normal people like me, and

not like institutional traders, was really motivating," Ms. Allen

said.

Some industry veterans warn social-media posts can inadvertently

send too rosy a message about beginner trading. That can draw other

newbies in.

"Everybody only posts the wins," said Anthony Denier, chief

executive of Webull, a brokerage that is popular with younger

investors. "Nobody sends a selfie on Instagram when they just woke

up after a bender. It's when they're having their first cocktail

for the night and they're all done up. It's the same for day

traders" posting their profits and losses.

--Caitlin Ostroff contributed to this article.

Write to Caitlin McCabe at caitlin.mccabe@wsj.com, Gunjan

Banerji at Gunjan.Banerji@wsj.com and Mischa Frankl-Duval at

Mischa.Frankl-Duval@wsj.com

(END) Dow Jones Newswires

January 11, 2021 17:26 ET (22:26 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

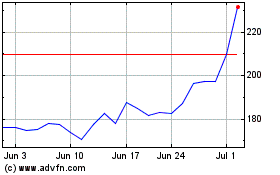

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024