Zoom Fills its War Chest as Pandemic's End Nears

13 January 2021 - 9:38AM

Dow Jones News

By Dan Gallagher

Zoom Video Communications didn't exactly call its own peak, but

the videoconferencing superstar still has good reasons to cash in

on investor enthusiasm.

Zoom filed papers Tuesday to sell $1.5 billion worth of common

stock, its first offering since going public in April 2019. The

shares will be sold by the company, and Zoom included the typical

boiler plate explanation in its filing that the proceeds would be

used for "working capital and general corporate purposes," with the

possibility that the money also could help fund acquisitions though

no current deals are in the works.

Zoom's videoconferencing business is still booming, in large

part because of Covid-19, but investors are already grappling with

what post-pandemic life could mean for the company. The

once-highflying stock is now 40% off its mid-October peak. And

while still richly valued at around 30 times forward sales, it is

no longer the most premium play among cloud stocks. At least a

dozen now carry higher multiples relative to projected sales.

But Zoom is still valued at close to $100 billion, a level that

software companies don't typically reach until they have

established multiple lines of business. So the company still faces

some pressure to show it is no one trick pony.

The company disclosed Tuesday that it has now sold 1 million

seats for its Zoom Phone service, which replaces office telephone

systems. That is a potentially huge market, but also one with very

well-entrenched competitors along with newer challengers such as

Microsoft, Google and RingCentral.

Zoom might also have to look for deals that can expand its

business. According to FactSet, the company has only done one since

going public -- last year's pickup of a small encryption company

called Keybase for an estimated $43 million. Many speculated that

Zoom was competing with Salesforce for the purchase of Slack, but

that deal turned out to have no other bidders. It would have been a

stretch for Zoom anyway. With less than $2 billion in gross cash on

its current balance sheet, Zoom has less on hand than any other

software company valued at more than $100 billion, according to

data from S&P Global Market Intelligence.

Being valued like a player may soon force Zoom to start playing

like one.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

January 12, 2021 17:23 ET (22:23 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

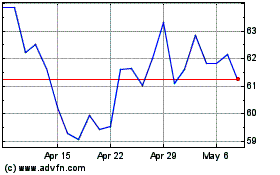

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

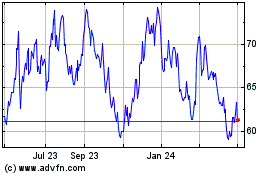

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Apr 2023 to Apr 2024