Pound Climbs Following Strong U.K. Inflation Data

20 January 2021 - 5:05PM

RTTF2

The pound firmed against its major counterparts in the European

session on Wednesday, as the nation's consumer price inflation

improved in December, driven by rising transport costs and clothing

and recreation prices.

Data from the Office for National Statistics showed that

inflation accelerated to 0.6 percent from 0.3 percent in November.

The rate was above economists' forecast of 0.5 percent.

Month-on-month, consumer prices advanced 0.3 percent, reversing

a 0.1 percent drop in November and faster than the expected rate of

0.2 percent.

Excluding energy, food, alcoholic beverages and tobacco, core

inflation increased to 1.4 percent from 1.1 percent in November.

Core inflation was seen at 1.3 percent.

Further underpinning the currency was a weaker dollar following

Janet Yellen's backing of aggressive stimulus measures to boost the

economy.

Yellen urged Congress to "act big" on COVID- 19 relief, arguing

that the benefits of higher spending outweighed the implications of

a higher debt burden during her confirmation hearing before the

Senate Finance Committee on Tuesday.

In economic news, separate report from the ONS showed that U.K.

output prices dropped for the tenth consecutive month in December.

However, the pace of decrease was the slowest since March 2020.

Output prices fell 0.4 percent annually, following a 0.6 percent

drop logged a month ago. On a monthly basis, output price inflation

held steady at 0.3 percent.

Economists had forecast output prices to fall 0.6 percent on

year but to rise 0.2 percent on month in December.

At the same time, input price inflation turned positive for the

first time since August 2019. Input prices rose 0.2 percent from

last year, reversing a 0.3 percent fall in November. But the rate

was below economists' forecast of +1 percent.

On month, input prices moved up 0.8 percent, faster than the 0.4

percent increase in November and the expected 0.7 percent.

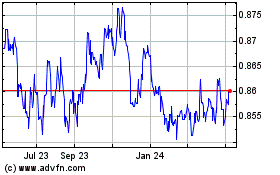

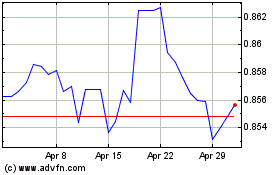

The pound jumped to 0.8847 against the euro, its highest level

since May 2020. Next key resistance for the pound is likely seen

around the 0.86 level.

Data from Destatis showed that Germany's producer prices rose

for the first time in eleven months in December, defying

expectations for further decline.

The producer price index rose 0.2 percent year-on-year in

December, after a 0.5 percent decrease in November. Economists had

forecast a 0.3 percent fall.

The pound appreciated to a 6-day high of 1.3700 against the

greenback from yesterday's close of 1.3622. The pound is likely to

face resistance around the 1.41 region, if it rallies again.

The U.K. currency was higher against the yen, at a 6-day high of

142.23. At yesterday's trading close, the pair was worth 141.57.

The pound is poised to challenge resistance around the 145.00

mark.

The pound touched its highest level since November 11 versus the

franc, at 1.2197. The pair had ended Tuesday's trading at 1.2107.

On the upside, the next resistance is seen near the 1.24 level.

Looking ahead, Canada CPI for December and U.S. NAHB housing

market index for January are due out in the New York session.

At 10:00 am ET, the Bank of Canada announces decision on

interest rates. Economists forecast the benchmark rate to hold at

0.25 percent.

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024