GE Reports Surge in Year-End Cash Flow--Update

26 January 2021 - 11:56PM

Dow Jones News

By Thomas Gryta

General Electric Co. reported $4.4 billion in fourth-quarter

cash flow, beating its own projection and ending 2020 without

burning cash, a year ahead of schedule.

The Boston conglomerate said the surge of cash came from orders

in its power and renewables divisions, along with improved

financial efficiency. The company has been cutting corporate costs

and jobs in its aviation unit while streamlining its power

business.

The coronavirus pandemic continues to pressure GE's jet-engine

business, its largest division, but the overall results showed

progress in the yearslong turnaround of the company that also makes

health-care machines and power-generating equipment.

GE shares are up 60% in the last six months, closing Monday at

$10.99, as investors are encouraged by continued improvement in

cash flow, debt reduction and cost cutting. The S&P 500 index

is up about 20% in the same period. GE shares gained about 4% in

premarket trading Tuesday.

GE's cash flow is closely watched as a sign of the health of the

company's operations and ability to pay down debts. The company had

predicted fourth-quarter cash flow of at least $2.5 billion. The

company burned through $4.3 billion in cash in the first half of

the year.

For the full year, GE reported lower revenue after shedding

units, but positive cash flow of about $600 million from its

industrial operations. GE forecast $2.5 billion to $4.5 billion of

cash flow for 2021.

The GE aviation division's revenue fell nearly 35% to $5.8

billion in the fourth quarter, while orders fell by half. The drop

in aviation accounted for much of the decline in the company's

fourth-quarter revenue.

GE said Tuesday it expects the aviation market, which has been

sapped by the coronavirus pandemic, to begin recovering in the

second half. It expects 2021 revenue in the division flat or higher

from 2020.

A GE joint venture makes the engines for Boeing Co.'s MAX jet,

which was grounded in March 2019 after two deadly crashes but was

cleared to fly again in November. Boeing reports financial results

on Wednesday.

Cash flow was driven by the health-care division, which reported

$2.6 billion in cash flow for the year excluding its biopharma

operations, which it sold. The unit makes CT scanners, MRI machines

and other hospital equipment.

GE reported a jump in business in both its power unit, which

makes turbines for power plants, and its renewable-energy unit,

which mostly makes wind turbines. In the fourth quarter, orders at

power rose 26% and renewables jumped 34%. Slack demand in the power

unit had sapped GE's profits in prior years.

Overall, GE reported net income attributable to common

shareholders of $2.44 billion for the fourth quarter, compared with

a profit of $538 million a year before.

Excluding items, GE said its adjusted earnings were 8 cents a

share, compared with Wall Street's estimate of 9 cents a share.

Quarterly revenue fell 16% from a year before to $21.9 billion.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

January 26, 2021 07:41 ET (12:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

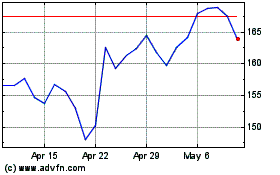

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

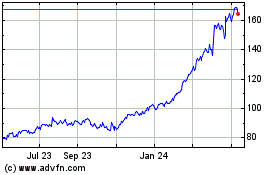

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024