Canadian Dollar Advances As Oil Prices Rise

01 March 2021 - 7:52PM

RTTF2

The Canadian dollar climbed against its major counterparts in

the European session on Monday, as progress in U.S. stimulus

package and the approval of Johnson & Johnson's single shot

Covid-19 vaccine lifted oil prices.

The U.S. House passed the $1.9 trillion coronavirus relief

package on Saturday. The bill now moves to the Senate, where a vote

could happen as early as next week.

The U.S. FDA on Saturday authorized Johnson & Johnson's

single-shot Covid-19 vaccine for emergency use, beginning the

rollout of millions of doses of a third effective vaccine that

could reach Americans by early next week.

Traders await the OPEC+ meeting due this week, which is likely

to raise production amid falling inventories.

Analysts expect the coalition to increase output by 500,000

barrels a day next month.

The loonie edged up to 84.25 against the yen, from a low of

83.60 seen at 5:00 pm ET. The loonie may find resistance around the

86.00 level.

The latest survey from Jibun Bank showed that the manufacturing

sector in Japan climbed into expansion territory in February, with

a 22-month high manufacturing PMI score of 51.4.

That's up from 49.8 in January and it moves above the

boom-or-bust line of 50 that separates expansion from

contraction.

The loonie recovered to 1.2671 against the greenback and 0.9802

against the aussie, from its early lows of 1.2737 and 0.9863,

respectively. The loonie is likely to face resistance around 1.25

against the greenback and 0.96 against the aussie.

The loonie was up against the euro, at a 4-day high of 1.5262.

On the upside, resistance is likely seen near the 1.50 level.

Looking ahead, U.S. ISM manufacturing PMI for February and

construction spending for January are set for release in the New

York session.

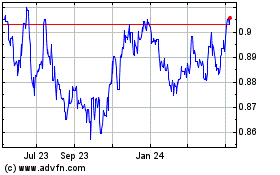

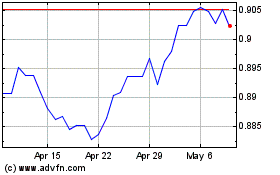

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Apr 2023 to Apr 2024