U.S. Dollar Advances On Rising Treasury Yields

03 March 2021 - 8:57PM

RTTF2

The U.S. dollar was higher against its major counterparts in the

European session on Wednesday, as Treasury yields ticked up on

hopes that U.S. fiscal stimulus and vaccine rollouts will boost the

global economic recovery and spur inflation.

U.S. President Joe Biden said Tuesday that the U.S. expects to

take delivery of enough coronavirus vaccines for all adults by the

end of May, two months earlier than anticipated, after Merck &

Co agreed to produce rival Johnson & Johnson's newly approved

shot.

Biden also announced he would be using the powers of the federal

government to direct all states to prioritize vaccinating teachers,

and said the federal government would provide the doses directly

through its pharmacy program.

Investors cheered progress in the $1.9 trillion relief package,

which will be taken up by the Senate later in the day.

Democrats are racing to get it approved before March 14, when

some aid expire.

Data from payroll processor ADP showed that U.S. private sector

employment increased much less than expected in February.

ADP said private sector employment rose by 117,000 jobs in

February after climbing by an upwardly revised 195,000 jobs in

January.

Economists had expected employment to increase by 177,000 jobs

compared to the addition of 174,000 jobs originally reported for

the previous month.

The Labor Department is scheduled to release its more closely

watched monthly employment report on Friday, which includes both

public and private sector jobs.

The dollar gained in the Asian session as accelerated vaccine

rollouts and coronavirus aid package boosted hopes of the economic

recovery.

The greenback appreciated to 0.9189 against the franc and 1.2043

against the euro, after falling to 0.9140 and a 5-day low of

1.2113, respectively in early deals. The greenback is seen finding

resistance around 0.94 against the franc and 1.18 against the

euro.

The greenback reversed from an early 5-day low of 1.4007 against

the pound, with the pair trading at 1.3942. On the upside, 1.37 is

possibly seen as its next resistance level.

Survey results from IHS Markit and Chartered Institute of

Procurement & Supply showed that the UK service sector output

declined only moderately in February after a sharp downturn at the

start of 2021, as the third national lockdown has caused limited

damage to the economy.

The final services Purchasing Managers' Index rose to 49.5 in

February from an eight-month low of 39.5 in January. The flash

score was 49.7.

The greenback edged up to 0.7245 against the kiwi, 0.7771

against the aussie and 1.2658 against the loonie, up from its prior

low of 0.7305, 5-day lows of 0.7838 and 1.2593, respectively. If

the greenback rises further, 0.70, 0.75 and 1.20 are possibly seen

as its next resistance levels against the kiwi, the aussie and the

loonie, respectively

The greenback touched 107.08 against the yen, its highest level

since July, 2020. The currency is poised to find resistance around

the 109 level.

The latest survey from Jibun Bank showed that Japan services

sector continued to contract in February, albeit at a slower pace,

with a services PMI score of 46.3.

That's up from 46.1 in January, although it remains beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

U.S. ISM non-manufacturing PMI for February will be published at

10:00 am ET.

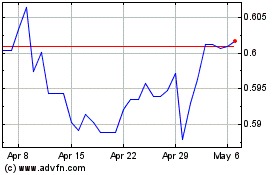

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

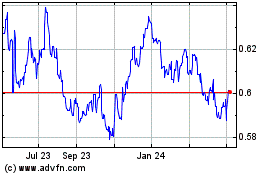

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024