Life360, Inc. to Participate at 33rd Annual ROTH Conference on March 15-17, 2021

11 March 2021 - 1:00AM

via InvestorWire -- Life360, Inc. (ASX:360), the leading safety and

coordination service for families worldwide, today announced that

its CEO Chris Hulls and CFO Russell Burke will participate in the

33rd Annual ROTH Conference on March 15-17, 2021.

The annual gathering of institutional investors, private equity

investors, VCs, company executives and services providers has

become a must-attend event for anyone working in the small and

mid-cap space. Investors will have the opportunity to hear from and

meet with executive management from approximately 400 private and

public companies in a variety of growth sectors.

Life360 management will participate in one-on-one meetings with

investors and analysts to discuss 2020 results, which saw revenue

increase 39 percent year-on-year underpinned by the successful

launch of the new membership model. To schedule a virtual meeting

with Life360 executives during the conference, please contact your

ROTH representative. Investors who are not yet registered should

submit a new investor registration request here.

The company’s 2020 year-end earnings presentation can be viewed

by investors here. In addition to these results, management is

available during the virtual meetings to discuss Life360's

favorable unit economics, growth plans, and strategic initiatives

to improve shareholder value.

###

About Life360 Life360 operates a platform for

today’s busy families, bringing them closer together by helping

them better know, communicate with and protect the people they care

about most. The company’s core offering, the Life360 mobile app, is

a market leading app for families, with features that range from

communications to driving safety and location sharing. Life360 is

based in San Francisco and has more than 26 million MAU as at

December 2020, located in 195 countries.

Life360’s CDIs are issued in reliance on the exemption from

registration contained in Regulation S of the US Securities Act of

1933 (Securities Act) for offers of securities which are made

outside the US. Accordingly, the CDIs, have not been, and will not

be, registered under the Securities Act or the laws of any state or

other jurisdiction in the US. As a result of relying on the

Regulation S exemption, the CDIs are ‘restricted securities’ under

Rule 144 of the Securities Act. This means that you are unable to

sell the CDIs into the US or to a US person who is not a QIB for

the foreseeable future except in very limited circumstances until

after the end of the restricted period, unless the re-sale of the

CDIs is registered under the Securities Act or an exemption is

available. To enforce the above transfer restrictions, all CDIs

issued bear a FOR Financial Product designation on the ASX. This

designation restricts any CDIs from being sold on ASX to US persons

excluding QIBs. However, you are still able to freely transfer your

CDIs on ASX to any person other than a US person who is not a QIB.

In addition, hedging transactions with regard to the CDIs may only

be conducted in accordance with the Securities Act.

Investor Relations Contact:Jolanta

Masojadajmasojada@life360.com

Media Contact:Kira

CooperLife360@thekeypr.com

Wire Service Contact InvestorWire (IW) Los

Angeles, California www.InvestorWire.com 212.418.1217 Office

Editor@InvestorWire.com

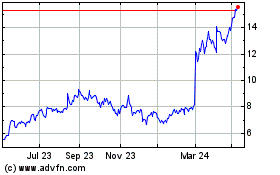

Life360 (ASX:360)

Historical Stock Chart

From Mar 2024 to Apr 2024

Life360 (ASX:360)

Historical Stock Chart

From Apr 2023 to Apr 2024