MetLife Investment Management Originates $15.7 Billion in Private Placement Debt and Private Structured Credit In 2020

12 March 2021 - 8:23AM

Business Wire

2020 business activity includes $3.6 billion of

investments originated on behalf of third party institutional asset

management clients

MetLife Investment Management (MIM), the institutional asset

management business of MetLife, Inc. (NYSE: MET), today announced

it originated $15.7 billion in private placement debt and private

structured credit across 215 transactions in 2020. This included

$3.6 billion of investments originated on behalf of third party

institutional clients. This origination activity, which added 85

new credits, helped grow MIM’s total private placement debt and

private structured credit portfolio to $102.1 billion1 as of

December 31, 2020.

“During a year in which companies all over the world were

impacted by the pandemic, we continued to provide timely, bespoke

financing solutions for issuers that provided liquidity and

financial certainty during difficult times,” said Nancy Mueller

Handal, head of Private Fixed Income & Alternatives at MIM.

MIM’s private placement origination for 2020 included $9.0

billion, $3.7 billion, and $3.0 billion in corporate,

infrastructure and structured credit transactions, respectively.

Notably, nearly $4.0 billion of this origination was completed in

March and April last year.

John Wills, global head of Private Placements at MIM, noted:

“Our strong corporate relationships and ability to source

attractive financing and investment opportunities for our clients

around the world were key factors in a strong year for MIM. During

the worst of the pandemic-driven dislocation, MIM continued to work

closely with new and existing issuers to provide solutions that

helped companies and equity sponsors pay down debt, boost liquidity

and operational cash, and ultimately, create a financial buffer

against the uncertainty caused by the pandemic.”

Scott Waterstredt, head of Private Structured Credit at MIM,

added: “Macro-economic uncertainty due to the pandemic effectively

closed the broadly-syndicated, asset-backed market for a period

during the year. The private structured credit team worked with a

number of asset owners to provide financing and liquidity solutions

that were attractive for both the asset owner and our clients.”

Corporate origination was well-diversified by industry sector,

led by investment in the Professional Services and Healthcare &

Life Sciences sectors, which, together, accounted for roughly

one-quarter of the $9.0 billion in origination. Infrastructure

origination was led by Renewable Power transactions, which

accounted for approximately one-third of the $3.7 billion in

origination, supporting sustainability objectives. Private

structured credit investments focused on residential mortgage and

alternative asset financing transactions.

Mueller Handal concluded: “Looking ahead, we will continue to

support issuers and investors with solutions that ensure they

manage through the later stages of the pandemic, and we look

forward to providing expansion capital for new opportunities as

global economic growth resumes post-pandemic.”

About MetLife Investment

Management

MetLife Investment Management, the institutional asset

management business of MetLife, Inc. (NYSE: MET), is a global

public fixed income, private capital and real estate investment

manager providing tailored investment solutions to institutional

investors worldwide. MetLife Investment Management provides public

and private pension plans, insurance companies, endowments, funds

and other institutional clients with a range of bespoke investment

and financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and as of December 31, 2020 had $659.6 billion2 in total assets

under management.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (MetLife), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help its individual and

institutional customers navigate their changing world. Founded in

1868, MetLife has operations in more than 40 markets globally and

holds leading positions in the United States, Japan, Latin America,

Asia, Europe and the Middle East. For more information, visit

www.metlife.com.

Forward-Looking Statements

The forward-looking statements in this news release, such as

“continue,” “ensure,” look forward,” “looking ahead,” “resumes,”

“seek,” and “will,” are based on assumptions and expectations that

involve risks and uncertainties, including the “Risk Factors”

MetLife, Inc. describes in its U.S. Securities and Exchange

Commission filings. MetLife’s future results could differ, and it

has no obligation to correct or update any of these statements.

Endnotes

1 At estimated fair value. Includes all corporate and

infrastructure private placement debt and private structured credit

investments managed by MIM.

2 Total assets under management is comprised of all MetLife

general account and separate account assets and unaffiliated/third

party assets, at estimated fair value, managed by MIM.

L0321011883[exp0921]

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210311006018/en/

For Media: James Murphy +1 917-225-6303

james.p.murphy@metlife.com

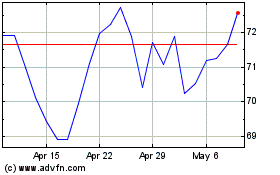

MetLife (NYSE:MET)

Historical Stock Chart

From Mar 2024 to Apr 2024

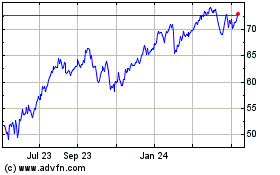

MetLife (NYSE:MET)

Historical Stock Chart

From Apr 2023 to Apr 2024