NZ Dollar Falls Amid Risk Aversion

12 March 2021 - 7:01PM

RTTF2

The NZ dollar declined against its major counterparts in the

European session on Friday, as progress in vaccinations and the

approval of the stimulus package lifted U.S. bond yields, weighing

on European shares.

U.S. President Joe Biden signed the $1.9 trillion stimulus

package into law on Thursday, enabling Americans to receive direct

payments by this weekend.

In his televised address, Biden pledged aggressive action to

speed vaccinations and move the country closer to normality by July

4.

The 10-year Treasury yield hit 1.6 percent as investors assessed

the prospect of higher inflation.

The latest survey from BusinessNZ showed that New Zealand's

manufacturing sector continued to expand in February, albeit at a

slower pace, with a Performance of Manufacturing Index score of

53.4.

That's down from the upwardly revised 58.0 in January

(originally 57.5), although it remains above the boom-or-bust line

of 50 that separates expansion from contraction.

The International Monetary Fund cautioned that New Zealand

housing market is likely to undergo a pronounced correction.

Concluding the Article IV discussions, IMF staff said rising

speculative demand for housing, along with historically low

interest rates and structural housing supply shortages, is

amplifying the housing cycle and heightens financial stability and

affordability concerns.

The kiwi fell to more than a 2-week low of 1.0807 against the

aussie, from a high of 1.0765 set in the Asian session. On the

downside, 1.10 is possibly seen as the next support level for the

kiwi.

The kiwi declined to 2-day lows of 0.7160 against the greenback

and 1.6643 against the euro, off its early highs of 0.7233 and

1.6566, respectively. If the kiwi extends decline, 0.70 and 1.72

are possibly seen as its next support levels against the greenback

and the euro, respectively.

The NZ currency touched 78.03 against the yen, down from a high

of 78.61 seen at 8:30 pm ET. The kiwi is poised to target support

around the 76.00 mark.

Looking ahead, Canada jobs data and U.S. PPI for February and

University of Michigan's preliminary U.S. consumer sentiment index

for March will be featured in the New York session.

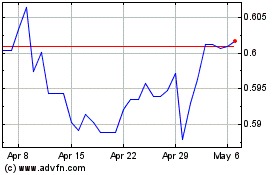

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

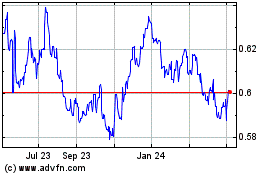

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024