Canadian Dollar Declines On Falling Oil Prices

17 March 2021 - 8:25PM

RTTF2

The Canadian dollar drifted lower against its most major

counterparts in the European session on Wednesday, as oil prices

fell on demand worries after the suspension of vaccinations in some

major European countries using the AstraZeneca vaccine.

Several EU nations, including Germany, France, and Italy halted

vaccinations amid fears about potential side effects.

Slower vaccinations could delay the economic recovery, as some

major economies are suffering from a third wave of COVID-19

infections.

"Oil demand will likely never catch up with its pre-pandemic

trajectory," the Paris-based IEA said Wednesday in its annual

medium-term outlook.

There may be no return to "normal" for the oil market in the

post-Covid era, the agency said.

European shares dropped ahead of the Federal Reserve's monetary

policy decision due later in the day.

The Fed is widely expected to leave interest rates unchanged,

but traders will be paying close attention to any changes in the

accompanying statement.

The loonie weakened to 1.2478 against the greenback, after

touching more than a 3-year high of 1.2434 in the Asian session.

The loonie is poised to challenge support around the 1.28 mark.

The loonie edged down to 1.4856 against the euro, from more than

a 1-year high of 1.4796 seen at 5:00 pm ET. The loonie is likely to

challenge support around the 1.50 region, if it drops again.

Final data from Eurostat showed that Eurozone consumer prices

increased for the second straight month in February.

The consumer price index rose 0.9 percent year-on-year, the same

rate as in January. A year earlier, the rate was 1.2 percent.

The loonie retreated to 87.43 versus the yen, after approaching

87.68, which was its biggest level since October 2018. The loonie

is seen finding support around the 85.5 mark.

Data from the Ministry of Finance showed that Japan recorded a

merchandise trade surplus of 217.381 billion yen in February - down

80.5 percent on year.

That was shy of expectations for a surplus of 420 billion yen

following the downwardly revised 325.4 billion yen deficit in

January (originally -323.9 billion yen).

In contrast, the loonie appreciated to a fresh 3-month high of

0.9617 against the aussie, following a low of 0.9645 set at 6:15 am

ET. Next immediate resistance for the loonie is eyed around the

0.94 level.

Looking ahead, at 2:00 pm ET, the Fed announces its decision on

interest rate. Economists widely expect the federal funds rate to

be kept at 0 - 0.25 percent.

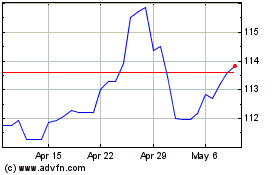

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

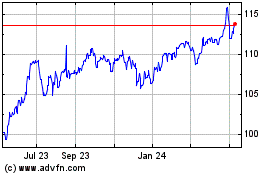

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024