U.S. Dollar Falls As Bond Yields Retreat

22 March 2021 - 7:19PM

RTTF2

The U.S. dollar slipped against its major counterparts during

European deals on Monday, as U.S. treasury yields dropped after a

surge last week.

The benchmark 10-year Treasury yield fell to 1.68 percent from

the highest levels in about 14 months.

In a Wall Street Journal article, Fed Chair Jerome Powell

reiterated that the central bank "will continue to provide the

economy with the support that it needs for as long as it

takes."

Powell said that although the U.S. economic outlook is

"brightening," the recovery is "far from complete".

Richmond Fed President Thomas Barkin said in a Bloomberg TV

interview Sunday that there is no sign yet of unwanted inflation

pressures.

Investors await speeches from a host of Fed officials, including

three appearances by Powell this week for more clues about the

magnitude and length of policy tightening.

This week's U.S. economic calendar includes reports on new and

existing home sales, durable goods orders, and personal income and

spending.

The greenback weakened to 0.9256 against the franc and 1.1928

against the euro, off its early high of 0.9310 and near a 2-week

high of 1.1871, respectively. The next possible support for the

greenback is seen around 0.90 against the franc and 1.21 against

the euro.

The greenback reached as low as 1.3875 against the pound, after

rising to a 6-day high of 1.3818 at 9:15 pm ET. The greenback may

locate support around the 1.41 level.

The greenback fell to 1.2478 against the loonie, 0.7744 against

the aussie and 0.7180 against the kiwi, following a high of 1.2534,

5-day high of 0.7704 and near a 2-week high of 0.7139,

respectively. The greenback is poised to challenge support around

1.21 against the loonie, 0.75 against the aussie and 0.73 against

the kiwi.

The greenback dropped back to 108.62 against the yen, not far

from a 10-day low of 108.58 set in the Asian session. On the

downside, 104.00 is possibly seen as its next support level.

Final data from the Cabinet Office showed that Japan's leading

index rose less than initially estimated in January.

The leading index, which measures the future economic activity,

rose to 98.5 in January, the highest since October 2018, from 97.7

in the previous month. However, the score was revised down from

99.1.

Federal Reserve Chair Jerome Powell is scheduled to speak in a

virtual panel discussion about central bank innovation at an online

event hosted by the Bank for International Settlements at 9 am

ET.

U.S. existing home sales for February will be published in the

New York session.

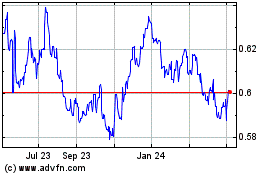

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

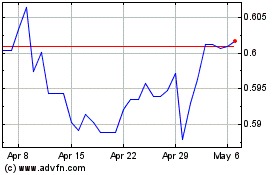

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024