Pound Higher After Upbeat U.K. Retail Sales Data

26 March 2021 - 6:19PM

RTTF2

The pound gained ground against its major rivals in the European

session on Friday, as the nation's retail sales recovered in

February largely driven by non-food store sales and on improved

risk sentiment amid progress on vaccination rollouts and upbeat

economic data.

Data from the Office for National Statistics showed that retail

sales volume including auto fuel logged a monthly growth of 2.1

percent, in contrast to January's 8.2 percent decrease. The pace of

growth matched economists' expectations.

Excluding auto fuel, retail sales gained 2.4 percent on month,

in contrast to the 8.7 percent decrease seen in January and faster

than the forecast of +1.9 percent.

Non-food stores provided the largest positive contribution to

the monthly growth in February.

On a yearly basis, retail sales fell at a slower pace of 3.7

percent after decreasing 5.9 percent in January. This was the

second consecutive drop in sales and was better than the expected

drop of -3.5 percent.

Excluding auto fuel, retail sales were down 1.1 percent

annually, following a 3.7 percent drop seen in the prior month.

Economists had forecast an annual fall of 1.5 percent.

The U.S. recovery appeared to be on track after latest data

showed a bigger-than-forecast drop in weekly jobless claims and GDP

revising slightly upward to an annualized rate of 4.3 percent in

the fourth quarter.

In his first formal news conference, U.S. President Joe Biden

promised to deliver 200 million doses of Covid-19 vaccine within

his first 100 days in office.

The pound hit 1.2969 against the franc, its strongest level

since March 15. If the pound rises further, 1.31 is likely seen as

its next resistance level. The pound appreciated to a 3-day high of

1.3791 against the greenback, from yesterday's close of 1.3731. The

pound is likely to challenge resistance around the 1.40 level.

The pound spiked higher to a 1-week high of 151.00 against the

yen, compared to Thursday's closing value of 149.91. On the upside,

153.00 is possibly seen as its next resistance level.

Data from the Ministry of Internal Affairs and Communications

showed that Tokyo's consumer prices declined at a slower pace in

March.

The core consumer price index, excluding food, dropped 0.1

percent year-on-year in March. The annual rate was forecast to fall

0.2 percent after easing 0.3 percent in February. Core prices have

been falling since August 2020.

The pound jumped to 0.8548 against the euro, recording a 1-week

high. The pair had ended Thursday's deals at 0.8563. The next

likely resistance for the pound is seen around the 0.84 level.

Looking ahead, U.S. personal income and spending data for

February and University of Michigan's final consumer sentiment

index for March will be featured in the New York session.

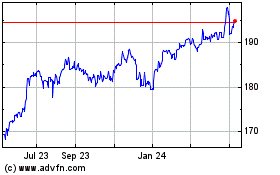

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

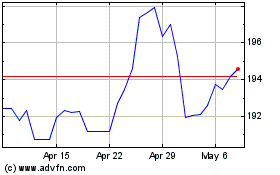

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024