U.S. Dollar Climbs Amid Economic Optimism

29 March 2021 - 2:38PM

RTTF2

The U.S. dollar was higher against its most major opponents in

the Asian session on Monday, as faster vaccinations and hopes of

stimulus boosted optimism about a faster economic recovery.

President Joe Biden is set to outline his infrastructure

spending plan on Wednesday in Pittsburgh.

The economic package worth about $3 billion covers

infastructure, education, healthcare and environmental

programs.

The administration plans to split the package into two parts to

avail support from congressional Republicans.

Investors will also be watching U.S. jobless claims data and and

the payrolls report due later in the week.

The greenback appreciated to 1.1773 against the euro and 1.3757

against the pound, reversing from its early lows of 1.1794 and

1.3797, respectively. The next likely resistance for the greenback

is seen around 1.16 against the euro and 1.34 against the

pound.

The greenback recovered to 0.9403 against the franc, from a

4-day low of 0.9381, and held steady thereafter. If the greenback

rises further, 0.96 is likely seen as its next resistance

level.

The greenback hit a 4-day high of 1.2627 against the loonie,

compared to last week's close of 1.2571. On the upside, 1.29 is

likely seen as its next resistance level.

The greenback rebounded to 0.6972 against the kiwi and 0.7615

against the aussie, from its early low of 0.6996 and a 6-day low of

0.7645, respectively. The greenback is likely to challenge

resistance around 0.74 against the kiwi and 0.66 against the

aussie.

In contrast, the greenback edged down to 109.37 against the yen,

from a high of 109.80 seen earlier in the session. The greenback

may challenge support around the 107.5 mark.

Looking ahead, U.K. mortgage approvals for February are due in

the European session.

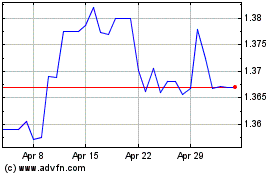

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

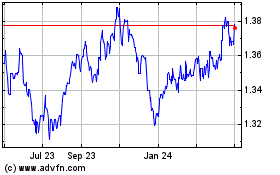

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024