U.S. Dollar Rises As Treasury Yields Climb

30 March 2021 - 2:55PM

RTTF2

The U.S. dollar gained ground against its major counterparts in

the Asian session on Tuesday, as the faster vaccine rollout and the

prospect of more stimulus measures sent U.S. treasury yields

higher.

President Joe Biden is set to outline his infrastructure

spending plan on Wednesday in Pittsburgh.

The economic package worth about $3 billion will be split into

two parts, with the first one focused primarily on transportation

and other infrastructure.

U.S. bond yields jumped amid continued expectations for a swift

economic recovery in the wake of stimulus and vaccination

progress.

The U.S. jobs data due Friday is expected to signal that the

labour market recovery remains on track.

The greenback jumped to 110.21 against the yen, its biggest

level since March 2020. On the upside, 112.00 is likely seen as its

next resistance level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan retail sales fell 1.5 percent on year in February -

coming in at 11.628 trillion yen.

That beat forecasts for a decline of 2.8 percent following the

2.4 percent drop in the previous month.

The greenback appreciated to a 4-day high of 0.9415 against the

franc from Monday's close of 0.9390. If the greenback continues its

rise, 0.96 is possibly seen as its next resistance level.

The greenback rose to its highest level since November 2020

against the euro, at 1.1741. The greenback is seen finding

resistance around the 1.15 level.

The greenback edged up to 1.2603 against the loonie, after

falling to 1.2582 at 11:15 pm ET. Next key resistance for the

greenback is seen around the 1.27 level.

The greenback approached a 4-day high of 1.3742 against the

pound, rising from a low of 1.3783 seen at 1:00 am ET. The

greenback may possibly face resistance around the 1.34 level.

The U.S. currency recovered to 0.7006 against the kiwi and

0.7632 against the aussie, from its early 1-week lows of 0.7033 and

0.7664, respectively. The greenback is likely to find resistance

around 0.68 against the kiwi and 0.72 against the aussie.

Looking ahead, Eurozone economic confidence index for March will

be released in the European session.

At 8.00 am ET, Destatis is scheduled to issue Germany's flash

consumer prices for March.

Federal Housing finance agency's house price index and

S&P/Case-Shiller home price index for January and consumer

confidence index for March will be featured in the New York

session.

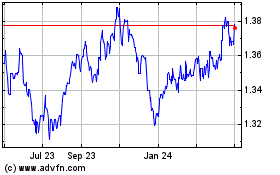

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

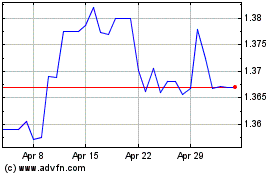

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024