Dollar Muted After ADP Private Payrolls Data

31 March 2021 - 8:56PM

RTTF2

The U.S. dollar showed muted trading against its major

counterparts in the European trading session on Wednesday, after

the release of ADP data showing strong private sector job growth in

the month of March.

Data from payroll processor ADP showed that private sector

employment surged up by 517,000 jobs in March after climbing by an

upwardly revised 176,000 jobs in February.

Economists had expected employment to jump by 550,000 jobs

compared to the addition of 117,000 jobs originally reported for

the previous month.

On Friday, the Labor Department is scheduled to release its more

closely watched monthly jobs report, which includes both public and

private sector jobs.

Investors awaited President Joe Biden's infrastructure plan

worth around $2.25 trillion set to be unveiled later in the

day.

The plan will fund road and bridge projects and boost

investments in climate infrastructure and research and

development.

The plan will be funded by tax hikes, including an increase of

the corporate tax rate to 28 percent from 21 percent.

The greenback was higher in the Asian session on the back of

rising U.S. treasury yields.

The greenback recovered to 1.1721 against the euro, from a low

of 1.1748 hit at 4:30 am ET. The greenback is on course to pierce a

multi-month high of 1.1704 seen in the Asian session. If the

greenback rises further, 1.14 is likely seen as its next resistance

level.

Flash data from Eurostat showed that Eurozone consumer prices

increased at a faster pace in March.

Inflation advanced to 1.3 percent in March, in line with

expectations, from 0.9 percent in February. This was the third

consecutive rise in prices.

The greenback rose back to 0.9443 against the franc, not far

from the Asian session's peak of 0.9447, which was its biggest

level since July 2020. At yesterday's trading close, the pair was

quoted at 0.9420. On the upside, 0.96 is possibly seen as its next

resistance level.

The greenback remained higher against the yen, with the pair

worth 110.80. This may be compared to more than a 1-year high of

110.96 set at 11:00 pm ET. The pair had closed Tuesday's deals at

110.35. The next likely resistance for the greenback is seen around

the 112.00 region.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan housing starts continued to decline in

February.

Housing starts decreased 3.7 percent year-on-year in February,

bigger than the 3.1 percent fall in January and 4.8 percent decline

expected by economists.

The U.S. currency staged a modest recovery to 1.3754 against the

pound, following a 2-day low of 1.3794 logged at 5:30 am ET. The

pound-greenback pair had ended yesterday's trading session at

1.3740. The greenback is likely to test resistance around the 1.34

region.

Data from the Office for National Statistics showed that the UK

economy grew more than previously estimated in the fourth quarter

but the overall contraction for the whole year of 2020 was the

biggest on record.

Gross domestic product grew 1.3 percent sequentially in the

fourth quarter instead of +1 percent estimated initially. The

economy had expanded sharply by 16.9 percent in the third quarter.

U.S. pending home sales for February are due out at 10:00 am

ET.

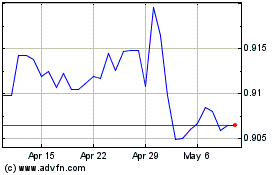

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024