Canadian Dollar Declines On Falling Oil Prices

07 April 2021 - 9:05PM

RTTF2

The Canadian dollar drifted lower against its major counterparts

in the European session on Wednesday, as oil prices dropped after

Iran nuclear talks opened the possibility of an easing of sanctions

on its oil exports.

Crude for June delivery fell $0.26 to $62.48 per barrel.

Iran said talks in Vienna on Tuesday aimed at restoring its 2015

nuclear deal with world powers had been "constructive" and they

will continue to discuss ways to revive the Joint Comprehensive

Plan of Action (JCPOA) that former U.S. President Donald Trump

unilaterally abandoned in May 2018.

"The talks in Vienna were constructive … our next meeting will

be on Friday," Abbas Araghchi, who is leading the Iranian

delegation in Vienna, told Press TV.

Data from Statistics Canada showed that Canada's merchandise

trade surplus fell in February.

The trade surplus dropped to C$1.04 billion in February from a

revised C$1.21 billion in the previous month.

The loonie slipped to an 8-day low of 1.2634 against the

greenback, 9-day low of 86.85 against the yen and near a 4-week low

of 1.5034 against the euro, off its early highs of 1.2562, 87.38

and 1.4914, respectively. The loonie is seen finding support around

1.29 against the greenback, 84.00 against the yen and 1.52 against

the euro.

The loonie fell back to 0.9640 against the aussie, not far from

the Asian session's fresh 2-week low of 0.9651. If the loonie

slides further, 0.98 is likely seen as its next support level.

Looking ahead, the U.S. consumer credit for February will be

released in the New York session.

The Fed minutes from the March 16-17 meeting are set for release

at 2:00 pm ET.

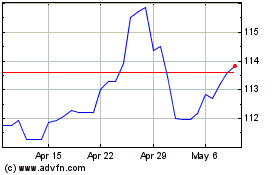

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

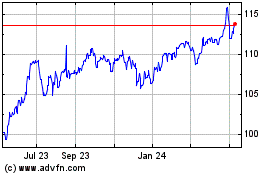

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024