HSBC Scraps Executive Floor in Canary Wharf as Part of Flexible Working Push -- Financial News

19 April 2021 - 6:41PM

Dow Jones News

By James Booth

Of Financial News

HSBC Holdings PLC boss Noel Quinn has scrapped the executive

floor of its Canary Wharf headquarters as it seeks to slash real

estate needs in its post-pandemic working policy.

Mr. Quinn said the 42nd-floor private offices formerly used by

the bank's top executives have now been turned into client meeting

rooms.

The bank's senior executives now hot-desk on an open-plan floor

two storeys below.

"Our offices were empty half the time because we were traveling

around the world. That was a waste of real estate," Mr. Quinn told

the Financial Times. "If I'm asking our colleagues to change the

way that they're working, then it's only right that we change the

way we're working."

"We don't have a designated desk. You turn up and grab one in

the morning," he added. "I won't be in the office five days a week.

I think it's unnecessary...It's the new reality of life."

The move is part of a wider strategic shift to cut 40% from its

global head office costs, Mr. Quinn said.

To achieve that goal HSBC doesn't plan to renew many of its

city-centre leases over the next three to five years. It is also

introducing a policy of about two employees per desk, excluding

branches.

"We will have a very different working style going forward that

will be much more hybrid, where colleagues can part work in the

office, part at home," Mr. Quinn said.

HSBC was contacted for comment.

The bank is also undertaking a wider restructuring exercise as

part of a plan to pivot the bank towards its markets in Asia.

The lender aims to strip out 35,000 jobs as part of the plans to

cut jobs and move its focus to core markets.

Greg Guyett, co-CEO of global banking and markets at HSBC, Nuno

Matos, chief executive of wealth and personal banking and Barry

O'Byrne, chief executive of global commercial banking, are all set

to move to Hong Kong as part of the shake-up.

"This decision reflects the importance of the Asia-Pacific

region to the strategies of CMB, GBM and WPB. Being based in Hong

Kong will enable Barry, Greg and Nuno to be closer to the execution

of their plans and to customer needs in the region," wrote Mr.

Quinn this month in a memo seen by Financial News.

Website: www.fnlondon.com

(END) Dow Jones Newswires

April 19, 2021 04:26 ET (08:26 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

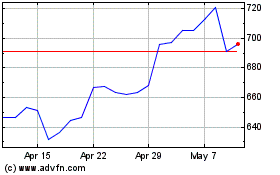

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

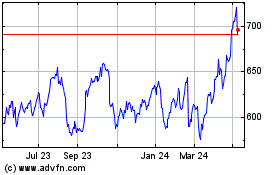

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024