BNP's Strong Investment Bank, Lower Provisions Fueled 1Q Beat -- Earnings Review

30 April 2021 - 9:39PM

Dow Jones News

By Pietro Lombardi

BNP Paribas SA released on Friday its first-quarter results.

Here is what you need to know.

NET PROFIT: The Paris-based lender, the country's biggest by

assets, posted a 38% increase in net profit to 1.77 billion euros

($2.15 billion), beating analysts' expectations of EUR1.24 billion,

according to a consensus forecast provided by FactSet.

REVENUE: The top line also came in above consensus. Revenue rose

8.6% to EUR11.83 billion, better than the EUR11.19 billion analysts

had forecast.

WHAT WE WATCHED:

--INVESTMENT BANK: Like for other large European peers, BNP's

investment-bank unit was boosted by strong client activity in

volatile markets. The corporate and investment bank division posted

a 24% increase in quarterly revenue, with global markets revenue up

41%. In the same period last year, the bank took a hit in its

equity-derivatives unit from companies that canceled their dividend

payments. However, analysts note that costs at the division were

higher than expected, contributing to an overall miss on costs, and

this is likely to be an important issue for investors, according to

Barclays. "The cost miss in CIB will also lead to debate as, unlike

peers, it was not offset by better revenues."

--PROVISIONS: Provisions for credit losses declined 37% to

EUR896 million. This was a key driver of the consensus-beating

performance in the quarter.

--CAPITAL: The bank's core tier 1 ratio was 12.8% at the end of

March. This is slightly above consensus and was driven by

stronger-than-expected earnings, Jefferies said.

Write to Pietro Lombardi at pietro.lombardi@wsj.com;

@pietrolombard10

(END) Dow Jones Newswires

April 30, 2021 07:24 ET (11:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

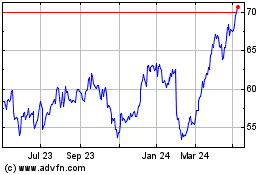

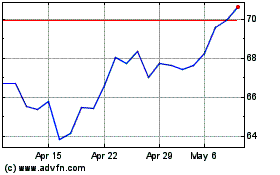

BNP Paribas (EU:BNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BNP Paribas (EU:BNP)

Historical Stock Chart

From Apr 2023 to Apr 2024