Australian Dollar Falls After China's Suspension Of Economic Dialogue With Canberra

06 May 2021 - 12:27PM

RTTF2

The announcement by China's top economic planner that it was

suspending activities under the China-Australia Strategic Economic

Dialogue triggered a sell-off in the Australian dollar in the Asian

session on Thursday.

In a statement, the National Development and Reform Commission

said that it had "indefinitely suspended" its high-level economic

dialogue with Australia.

Beijing said that the move was based "on the current attitude of

the Australian Commonwealth Government toward China-Australia

cooperation".

China is Australia's largest trading partner and disruptions

between the two nations could have economic impact on

Australia.

Last month, Australia revoked Victoria state's participation in

China's Belt and Road Initiative amid escalating tensions between

both nations.

Relations between China and Australia have deteriorated since

Canberra's push to seek a probe into the origins of the coronavirus

pandemic.

The aussie eased off to 84.24 against the yen, after rising to a

6-day high of 84.82 at 9:15 pm ET. The aussie is poised to find

support around the 80.00 mark.

Minutes from the Bank of Japan's meeting on March 18 and 19

showed that members of the monetary policy board said that the

country's economy is showing signs of inconsistent improvement but

continues to be threatened by COVID-19.

The pandemic and its different variants continue to shroud the

global economic recovery in uncertainty, the minutes said. The

members said they will monitor the situation and will take

additional easing measures if they're needed.

The aussie pulled back to 0.7701 against the greenback and

1.5576 against the euro, from its early 2-day high of 0.7758 and a

9-day high of 1.5479, respectively. The next possible support for

the aussie is seen around 0.75 against the greenback and 1.57

against the euro.

The aussie weakened to 1.0718 against the kiwi, setting a 6-day

low. On the downside, 1.06 is seen as its next likely support

level.

Data from Statistics New Zealand showed that New Zealand

building permits spiked a seasonally adjusted 17.9 percent on month

in March - coming in at 4,218.

That follows the 19.3 percent monthly contraction in

February.

The Australian currency reversed from an early 2-day high of

0.9512 against the loonie, falling to a 6-day low of 0.9462. The

aussie is seen finding support around the 0.93 mark.

Looking ahead, U.K. final services PMI for April and Eurozone

retail sales for March are due in the European session.

The Bank of England's monetary policy announcement will be out

at 7:00 am ET. The Monetary Policy Committee is widely expected to

hold the key rate at a record low of 0.10 percent and the

quantitative easing programme at GBP 875 billion.

The U.S. weekly jobless claims for the week ended May 1 are

scheduled for release in the New York session.

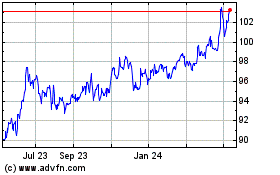

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

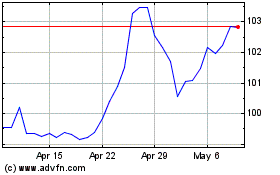

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024