Siemens 2Q Net Profit Jumps, Boosted by Flender Sale and Industrial Businesses -- Update

07 May 2021 - 5:32PM

Dow Jones News

--Siemens's net profit surpasses company-provided consensus

--China made a significant contribution to revenue growth

--The German engineering conglomerate raises guidance for its

fiscal year

By Mauro Orru

Siemens AG said Friday that net profit for the second quarter of

fiscal 2021 rose thanks to the performance of its industrial

businesses and the sale of its mechanical-drives business Flender.

China made a significant contribution to revenue growth.

The German engineering conglomerate said net profit for the

quarter ended March 31 climbed to 2.27 billion euros ($2.74

billion) from EUR652 million a year earlier.

Siemens closed the sale of its Flender business to investment

company Carlyle Group Inc. in March, booking a gain of EUR900

million.

Adjusted earnings before interest, taxes and amortization for

its industrial businesses--a metric closely-watched by

analysts--rose to EUR2.09 billion from EUR1.59 billion, with a

corresponding margin of 15.1%.

Chief Financial Officer Ralf P. Thomas said during the company's

earnings call that the automotive industry and machine

building--two key customer markets--continued to recover at a fast

pace, with orders up across all automation businesses.

Revenue for the group increased to EUR14.67 billion from

EUR13.78 billion. Orders rose to EUR15.88 billion from EUR14.66

billion.

Analysts had expected net profit of EUR1.56 billion, revenue of

EUR14.13 billion and orders of EUR15.07 billion, according to

consensus provided by the company.

"Growth momentum came, in particular, from the automotive

industry, machine building, our software business and--from a

geographic perspective--from China. Besides the gratifying margin

developments at our industrial businesses, our successful portfolio

management also paid off," Mr. Thomas said.

Chief Executive Roland Busch echoed the message on China where

he said industrial output is above pre-pandemic levels, while the

recovery in Europe and the U.S. is gaining momentum as vaccinations

accelerate.

Mr. Busch said during the earnings call that there should be an

uptick in spending in areas such as travel and trade-show expenses

as economies reopen, adding that Siemens would make selective

investments in digital apps and other areas based on demand.

"We'll also continue to optimize our sales channels. After all,

we want to grasp the emerging opportunities," Mr. Busch said.

Given higher visibility for the coming months and the

expectation Siemens will deliver a strong performance in the second

half of the fiscal year ending Sept. 30, the company raised its

guidance.

Siemens now expects net income between EUR5.7 billion and EUR6.2

billion instead of between EUR5 billion and EUR5.5 billion as

previously indicated.

Revenue growth should be between 9% and 11% on a comparable

basis. The company previously anticipated a range of mid- to

high-single-digit growth.

Like most companies of scale, Siemens has been affected by the

global chip shortage and price increases.

"So far, our teams have been doing a great job here. They're

working hard to further mitigate risks from electronics shortages

and price increases in certain categories," Mr. Busch said.

Management has noted supply tensions in areas such as steel,

plastics and freight capacities, saying there could be production

constraints and longer delivery lead times to customers in the

coming months.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

May 07, 2021 03:17 ET (07:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

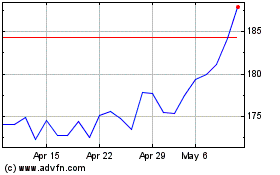

Siemens (TG:SIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Siemens (TG:SIE)

Historical Stock Chart

From Apr 2023 to Apr 2024