U.S. Dollar Higher On Rate Hike Hopes

13 May 2021 - 5:25PM

RTTF2

The U.S. dollar spiked higher against its most major

counterparts in the European session on Thursday, as

higher-than-expected U.S. inflation in April fueled speculations

that the Fed might resort to tightening of monetary policy sooner

than expected.

Overnight data showed that the U.S. annual inflation rate jumped

to the highest in 13 years and well above forecasts, while the

monthly gauge rose the most since 2009.

Expectations for a Fed rate hike have been pushed forward, with

investors pricing in an 80 percent chance of an increase as early

as December next year.

Although the Fed has played down the risk of inflation,

investors fear that persistent inflationary pressures could force

it to tighten policy sooner than thought.

Fed vice chair Richard Clarida said on Wednesday that the recent

rise in prices could be temporary and it has not changed the

central bank's stance of keeping monetary policy loose.

Investors await the producer price index and initial jobless

claims data due later in the day for more direction.

The greenback rebounded to 0.9092 against the franc, from a low

of 0.9066 seen at 3:15 am ET. Should the greenback strengthens

further, it is likely to test resistance around the 0.92

region.

The greenback appreciated to a 3-day high of 1.4006 against the

pound and a 1-week high of 1.2051 against the euro, after declining

to 1.4078 and 1.2106, respectively in early deals. Next key

resistance for the greenback is likely seen around 1.37 against the

pound and 1.18 against the euro.

The greenback rose to a 6-day high of 1.2157 against the loonie

and 9-day highs of 0.7688 against the aussie and 0.7135 against the

kiwi, up from its prior lows of 1.2104, 0.7748 and 0.7179,

respectively. The greenback is seen finding resistance around 1.25

against the loonie, 0.75 against the aussie and 0.70 against the

kiwi.

On the other hand, the greenback reversed from an early near a

5-week high of 109.79 against the yen, with the pair trading at

109.62. If the greenback falls further, it is likely to test

support around the 108.00 region.

Data from the Ministry of Finance showed that Japan posted a

current account surplus of 2,650.1 billion yen in March- up 37.3

percent on year.

That missed expectations for a surplus of 2,796.2 billion yen

and was down from 2,916.9 billion yen in February.

The U.S. weekly jobless claims for the week ended May 8 and PPI

for April will be featured in the New York session.

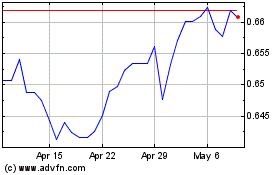

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024