U.S. Dollar Weakens Amid Declining Bond Yields

24 May 2021 - 2:10PM

RTTF2

The U.S. dollar depreciated against its most major counterparts

in the Asian session on Monday, in tandem with falling treasury

yields, as investors pinned hopes on the Fed maintaining its easy

monetary policy in the coming months.

Inflation expectations eased as investors digested the Fed's

commitment to its dovish policy.

U.S. treasury yields fell, with the benchmark yield on 10-year

note touching 1.62 percent. Yields move inversely to bond

prices.

Investors await reports on U.S. new home sales, consumer

confidence, durable goods orders and personal income and spending

due this week for more direction.

The White House lowered its infrastructure bill to $1.7 trillion

from $2.25 trillion by reducing spending on broadband, roads,

bridges and major infrastructure projects.

Still, Senate Republicans did not consider the new proposal as a

significant improvement from the original package.

The greenback eased off from an early 4-day high of 1.4137

against the pound, dropping to 1.4167. The greenback is seen

finding support around the 1.45 region.

The greenback fell to 1.2198 against the euro and 108.70 against

the yen, off its prior highs of 1.2172 and 109.00, respectively. On

the downside, 1.24 and 107.00 are possibly seen as its next support

levels against the euro and the yen, respectively.

The greenback was trading at 1.2055 against the loonie, 0.7187

against the kiwi and 0.7744 against the aussie, down from its early

highs of 1.2078 and 0.7160 and a 5-day high of 0.7714,

respectively. The currency is likely to target support around 1.18

against the loonie, 0.74 against the kiwi and 0.80 against the

aussie.

On the flip side, the greenback remained higher against the

franc, at 0.8976. The greenback may test resistance around the 0.92

level, if it rises again.

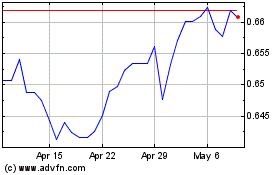

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024