China Manufacturing Sector Growth Improves In May

01 June 2021 - 10:15AM

RTTF2

China's manufacturing sector expanded at a faster pace in May on

robust new orders and production, data published by IHS Markit

showed on Tuesday.

The Caixin manufacturing Purchasing Managers' Index rose to 52.0

in May from 51.9 in April. The reading was expected to remain

unchanged at 51.9.

Although mild, the upturn was the strongest recorded in the year

to date. A score above 50 indicates expansion in the sector.

Total sales grew the most in five months, supported by greater

demand both at home and overseas. New export order growth improved

to a six-month high in May.

Production increased in May but the pace of growth softened due

to the material shortage and higher purchasing costs.

Employment was broadly unchanged in May. While some firms added

to their payrolls in order to expand capacity, other companies

expressed a more cautious approach to hiring.

Average cost burdens rose rapidly in the latest survey period,

with the rate of inflation the quickest since December 2016. Firms

generally passed on greater input costs to clients by raising their

output prices which increased at the fastest rate since February

2011.

Manufacturing firms remained confident that output would

increase over the year ahead amid forecasts of rising customer

demand and new product releases. However, the level positive

sentiment dipped to a four-month low amid rising costs and

pandemic-related uncertainty.

To sum up, manufacturing expanded in May as the post-epidemic

economic recovery kept its momentum, Wang Zhe, a senior economist

at Caixin Insight Group said.

Inflationary pressure would limit the room for monetary policy

maneuvers, Wang noted. The price transmission effect emerged as

manufacturing output prices surged last month. Rapidly rising

commodity prices began to disrupt the economy as some enterprises

began to hoard goods, while some others suffered raw material

shortages.

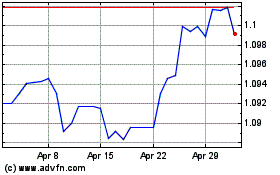

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

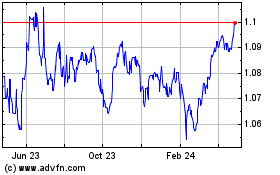

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024