Investor Sues Chinese E-Cigarette Maker RLX for Allegedly Misrepresenting Risks

11 June 2021 - 8:23AM

Dow Jones News

By Mark Maurer

An investor filed a lawsuit against RLX Technology Inc.,

claiming the Chinese vaping company overstated its financials and

misrepresented potential regulatory risks when it filed the

paperwork for its initial public offering in the U.S.

The lawsuit, submitted Wednesday by shareholder Alex Garnett in

the U.S. District Court for the Southern District of New York,

alleges RLX's registration statement from last October omitted the

impact of ongoing efforts by Chinese regulators to tighten sales of

electronic cigarettes.

Companies under rules established by the U.S. Securities and

Exchange Commission have to disclose any known events or

uncertainties that at the time of an IPO caused or were likely to

not represent future earnings.

Mr. Garnett's suit, which he filed on behalf of other RLX

investors, comes amid increased scrutiny of Chinese companies

trading on U.S. stock exchanges because of concerns about the

accuracy of their financial statements. Among those was

coffee-chain Luckin Coffee Inc., which last year delisted from the

Nasdaq Stock Market after disclosing that some employees fabricated

hundreds of millions of dollars in sales.

RLX didn't immediately respond to a request for comment.

Beijing-based RLX, which was founded in 2018, went public on the

New York Stock Exchange in January. The offering raised $1.39

billion, and was one of the largest global IPOs in the first

quarter, according to data provider Dealogic Ltd. Its stock price

has fallen sharply since then, in part as a result of potential

regulatory changes in China. RLX's shares traded at $9.15 on

Thursday, down about 69% since its debut.

Chinese regulators in 2019 called on companies and marketplaces

to stop selling e-cigarettes online, in an effort to curb underage

vaping. Regulators then in March 2021 proposed rules that would

designate these cigarettes as tobacco products, raising scrutiny on

the businesses that sell them.

Although RLX sells vaping products in China, privately held RELX

International distributes them abroad.

The lawsuit alleges investors purchased RLX shares at

artificially inflated prices, in part because the company omitted

and misrepresented information in the registration statement. As

the stock price dropped, RLX investors lost hundreds of millions of

dollars, the lawsuit said. Mr. Garnett bought 300 shares at a price

of $27.87, according to a filing. Mr. Garnett didn't immediately

respond to a request for comment.

At least two other law firms, Labaton Sucharow LLP and Schall

Law Firm, in recent weeks said they are investigating on behalf of

investors to determine whether RLX failed to disclose relevant

information to investors. Rosen Law Firm PA and Bronstein, Gewirtz

& Grossman LLC, among others, said Thursday they are seeking

RLX investors who want to join a class-action suit.

RLX on June 2 reported revenue of 2.4 billion Chinese yuan,

equivalent to $366.1 million, for the quarter ended March 31, up

from 368.6 million yuan the prior-year period. The company booked a

net loss of 267 million yuan, or $40.8 million, compared with a

profit of 12.1 million yuan during the prior-year quarter.

The company's financial statements in recent months have raised

questions from accounting experts. Among the issues is RLX's

unusually high ratio of cash and securities to total assets,

according to Jacek Welc, assistant professor of corporate finance

and accounting at Poland's Wroclaw University of Economics and

Business. Cash and financial assets represented 86% of the

company's total assets for the nine-month period ended Sept. 30,

Mr. Welc said. That percentage is higher than those of five

international companies that were accused of cash-based accounting

fraud since 2008, according to Mr. Welc, including Germany's

Wirecard AG.

"The amount of cash on hand is kind of eye popping," said Erik

Gerding, a law professor at the University of Colorado, who

reviewed RLX's prospectus. "Even apart from financial fraud,

there's a question of where they're going to invest this cash and

why they wouldn't give it out to shareholders."

Write to Mark Maurer at mark.maurer@wsj.com

(END) Dow Jones Newswires

June 10, 2021 18:13 ET (22:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

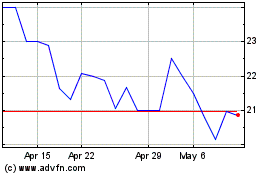

Luckin Coffee (PK) (USOTC:LKNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

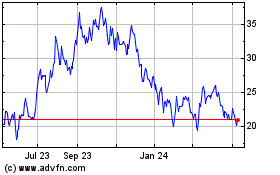

Luckin Coffee (PK) (USOTC:LKNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024