Japanese Yen Climbs Ahead Of Fed Outcome

16 June 2021 - 5:31PM

RTTF2

The Japanese yen advanced against its major rivals in the

European session on Wednesday, as investors turned cautious ahead

of the outcome of policy meeting by the U.S. Federal Reserve due

later in the day.

The central bank is not expected to take any immediate action,

but investors will be parsing the statement to see whether the

policy makers consider starting discussions about scaling back $120

billion bond purchase program.

The Fed will also publish economic and interest rate

projections, and expectations are that the so-called dot plot could

point to a rate hike in 2023.

Official data showed that China's industrial production and

retail sales grew less than expected in May.

Industrial production grew 8.8 percent on a yearly basis in May,

weaker than the economists' forecast of 9 percent.

Retail sales expanded 12.4 percent annually, which was slower

than the expected increase of 13.6 percent.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade deficit of 187.1 billion yen in May.

That missed expectations for a shortfall of 91.2 billion

following the downwardly revised 253.1 billion yen surplus in

April.

Data from the Cabinet Office showed that Japan core machine

orders rose a seasonally adjusted 0.6 percent on month in April -

coming in at 802.9 billion yen.

That missed expectations for an increase of 2.7 percent and was

down from 3.7 percent in March.

The yen rose to 2-day highs of 109.90 versus the greenback,

133.23 versus the euro and 90.19 versus the loonie, after falling

to 110.14, 133.59 and 90.43, respectively in early deals. The

currency is likely to find resistance around 108.00 versus the

greenback, 130.00 versus the euro and 88.00 versus the loonie.

The yen recovered to 155.00 against the pound and 78.44 against

the kiwi, from its prior lows of 155.38 and 78.68, respectively. On

the upside, 150.00 and 76.00 are likely seen as its next resistance

levels against the pound and the kiwi, respectively.

In contrast, the yen weakened to 84.76 against the aussie from

Tuesday's close of 84.56. If the yen falls further, it may

challenge support around the 86.00 level.

Looking ahead, Canada CPI, U.S. housing starts and building

permits and import and export prices, all for May, are due out in

the New York session.

At 2:00 pm ET, the Fed announces its decision on interest rate.

Economists widely expect the federal funds rate to be kept at

0-0.25 percent.

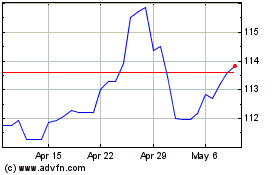

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

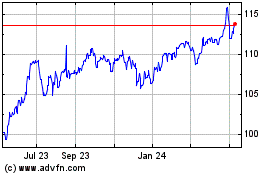

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024