U.S. Dollar Recovers From Tuesday's Sell-off

23 June 2021 - 12:59PM

RTTF2

The U.S. dollar rebounded in the Asian session on Wednesday,

after falling overnight following comments from Fed Chair Jerome

Powell that an interest rate hike would not happen any time

soon.

The currency fell along with yields after Powell said that the

Fed would be patient in waiting to tighten monetary policy.

"We will not raise interest rates pre-emptively because we fear

the possible onset of inflation. We will wait for evidence of

actual inflation or other imbalances," Powell said in a hearing

before the House Select Subcommittee on Tuesday.

Powell's comments calmed markets after the Fed's shift in tone

kept traders on the edge last week.

Investors digested mixed comments from Fed policymakers

regarding scaling back of the stimulus measures.

San Francisco Fed President Mary Daly said on Tuesday that the

economy is likely to meet the conditions for tapering later this

year or early next year.

New York Fed President John Williams, however, argued that any

discussion about a liftoff is still far away.

The greenback rose to 1.1916 against the euro, from a 5-day low

of 1.1952 seen on Tuesday. The greenback is seen finding resistance

around the 1.16 level.

The greenback appreciated to 110.88 against the yen, its highest

level since March 31. The currency is likely to find resistance

around the 112.00 level.

The greenback edged up to 1.3924 against the pound, after a

5-day drop to 1.3964 on Tuesday. Should the greenback rises

further, 1.37 is likely seen as its next resistance level.

The greenback gained to 0.9200 against the franc, reversing from

a 4-day low of 0.9169 touched on Tuesday. On the upside, 0.94 is

likely seen as its next resistance level.

The greenback bounced off to 0.7538 against the aussie, 0.6995

against the kiwi and 1.2329 against the loonie, after having fallen

to 5-day lows of 0.7564, 0.7036 and 1.2302, respectively during

yesterday's trading session. Next key resistance for the greenback

is seen around 0.72 against the aussie, 0.68 against the kiwi and

1.25 against the loonie.

Looking ahead, PMI reports from major European economies are due

in the European session.

Canada retail sales for April and U.S. new home sales for May

will be featured in the New York session.

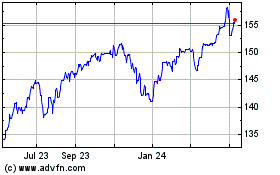

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

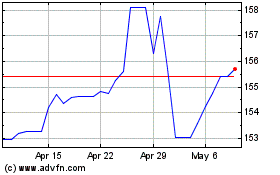

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024