TIDMHCFT

RNS Number : 6065K

Highcroft Investments PLC

03 September 2021

Highcroft Investments PLC

Interim Report for the six months ended 30 June 2021

Key Highlights:

*Gross rental income decreased 2% to GBP2,977,000 (2020

GBP3,044,000)

*Net rental income decreased 2% to GBP2,735,000 (2020

GBP2,777,000)

*89% occupancy in the property portfolio (2020 99%)

*90% of Q1 rent, 96% of Q2 rent and 95% of Q3 rent, due to date,

collected

*Adjusted earnings per share reduced 21% to 28.3p (2020

35.9p)

*Total earnings per share 118.8p (2020 51.4p loss)

*Property valuation increased by 5.7% to GBP86,745,000 (December

2020 GBP82,060,000)

*Net assets per share increased 7.3% to 1185p (June 2020 1095p,

December 2020 1104p)

*Loan to value 31.4% (June 2020 31.9%, December 2020 33.1%)

Dear Shareholder

I am writing to report our half year 2021 results. Whilst the

effects of COVID-19 have continued to impact on our everyday life

it would appear we are starting to see the situation improve

slightly off the back of a hugely appreciated effort by the NHS to

vaccinate as many of us as possible.

When considering the recent challenging circumstances, I am very

pleased with our performance for the first half of 2021 with 93% of

rent collected for the period and just a 2% fall in gross and net

rental income. A very strong 5.7% increase in property valuation

which in turn has led to an 7.3% increase in net assets per share

to 1185p that takes the net asset value back above the pre-pandemic

level (December 2019, 1175p per share). This 5.7% increase is made

up of a 4.3% negative movement in our high street retail properties

which now only account for 6.1% of our portfolio but a strong

upward movement of 10% in our industrial portfolio. This overall

movement compares favourably with the MSCI All property index of

2.9% for the same period and is underpinned by new leases at our St

Austell property and one of our Wisbech units, one positive rent

review. At the period end three of our properties were void,

representing 11% of our rental income. We are negotiating a new

lease on one of these units representing 4% of our rental income,

and we are actively engaged in seeking new tenants for the

others.

We continue to take a conservative view on debt and remain

comfortable with our 31.4% LTV position at the period end.

During the period we exchanged contracts, with a conditional

completion arrangement, for the sale of long-leasehold retail

warehouse property in Andover let to Jewsons. I am pleased to

report that the conditions were met last week, and we completed the

transaction, after the period end, on 23 August 2021 generating

gross sales proceeds of GBP3.55m, a premium of 9.2% over the

valuation at 31 December 2020.

Dividend

I am pleased to report an interim property income distribution

of 22p (2020 21p) per share, payable on 15 October 2021 to

shareholders on the register at 17 September 2021 (with an

ex-dividend date of 16 September 2021).

Outlook

Whilst there appears to be growing evidence that the COVID-19

pandemic is abating we, as a board, will continue to take a prudent

view and monitor the situation closely. We will continue to work

closely with our tenants and support them where we can whilst at

the same time keeping our gearing low and a healthy cash balance to

ensure we are well positioned as we start to return to some degree

of normality again.

Charles Butler

Chairman

2 September 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018.

For further information, contact:

Highcroft Investments PLC

Charles Butler/Roberta Miles +44 (0)1869 352766

Singer Capital Markets Advisory LLP

Peter Steel / Amanda Gray - Corporate Finance

Tom Salvesen - Corporate Broking

+44 (0)20 7496 3000

Independent review report to Highcroft Investments PLC

We have been engaged by Highcroft Investments PLC ("the

Company") to review the financial information for the six months

ended 30 June 2021 which comprises the condensed consolidated

interim statement of comprehensive income, the condensed

consolidated interim statement of financial position, the condensed

consolidated interim statement of changes in equity, the condensed

consolidated interim statement of cash flows and related notes 1 to

13. We have read the other information contained in the interim

report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial

information.

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

issued by the Financial Reporting Council and our Engagement Letter

dated 07 July 2021. Our work has been undertaken so that we might

state to the Company those matters we are required to state to them

in an independent review report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company, for our review

work, for this report, or for the conclusions we have formed.

Respective responsibilities of directors and auditor

The interim report, including the financial information

contained therein, is the responsibility of, and has been approved

by, the Directors. The Directors are responsible for preparing the

interim report in accordance with International Accounting Standard

34, 'Interim Financial Reporting', as adopted by the United Kingdom

and the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority, which requires that the

interim report must be prepared and presented in a form consistent

with that which will be adopted in the Company's annual accounts

having regard to the accounting standards applicable to such annual

accounts.

Our responsibility is to express to the Company a conclusion on

the condensed consolidated financial information in the interim

report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Financial Reporting Council for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed consolidated financial

information in the interim report does not give a true and fair

view of the financial position of the parent and subsidiary

entities as at 30 June 2021 and of its financial performance and

its cash flows for the six months then ended, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the United Kingdom and the Disclosure

Guidance and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

Stephen Eames (Senior Statutory Auditor) for and on behalf of

Mazars LLP

Chartered Accountants and Statutory Auditor

The Pinnacle

160 Midsummer Boulevard

Milton Keynes

MK9 1FF

2 September 2021

Notes:

(a) The maintenance and integrity of the Highcroft Investments

PLC's web site is the responsibility of the Directors; the work

carried out by us does not involve consideration of these matters

and, accordingly, we accept no responsibility for any changes that

may have occurred to the interim report since it was initially

presented on the web site.

(b) Legislation in the United Kingdom governing the preparation

and dissemination of financial information may differ from

legislation in other jurisdictions.

Condensed consolidated interim statement of comprehensive income

(unaudited)

for the six months ended 30 June 2021

Unaudited Unaudited

First half 2021 First half 2020

---- ---------------------------- ----------------------------

Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---- -------- -------- -------- -------- -------- --------

Continuing operations

---- -------- -------- -------- -------- -------- --------

Gross rental income 2,977 - 2,977 3,044 - 3,044

---- -------- -------- -------- -------- -------- --------

Bad debt provision (127) - (127) (195) - (195)

---- -------- -------- -------- -------- -------- --------

Property operating

expenses (115) - (115) (72) - (72)

---- -------- -------- -------- -------- -------- --------

Net rental income 2,735 - 2,735 2,777 - 2,777

---- -------- -------- -------- -------- -------- --------

Valuation gains on

investment property - 5,275 5,275 - 600 600

---- -------- -------- -------- -------- -------- --------

Valuation losses on

investment property - (590) (590) - (5,115) (5,115)

---- -------- -------- -------- -------- -------- --------

Net valuation gains/(losses)

on investment property 7 - 4,685 4,685 - (4,515) (4,515)

---- -------- -------- -------- -------- -------- --------

Administrative expenses (539) - (539) (471) - (471)

---- -------- -------- -------- -------- -------- --------

Operating profit before

net financing costs 2,196 4,685 6,881 2,306 (4,515) (2,209)

---- -------- -------- -------- -------- -------- --------

Finance income 1 - 1 2 - 2

---- -------- -------- -------- -------- -------- --------

Finance expenses (425) - (425) (458) - (458)

---- -------- -------- -------- -------- -------- --------

Net finance costs (424) - (424) (456) - (456)

---- -------- -------- -------- -------- -------- --------

Profit/(loss) before

tax 1,772 4,685 6,457 1,850 (4,515) (2,665)

---- -------- -------- -------- -------- -------- --------

Income tax (charge)/credit 4 (304) - (304) 8 - 8

---- -------- -------- -------- -------- -------- --------

Total profit/(loss)

and comprehensive

income for the financial

period 1,468 4,685 6,153 1,858 (4,515) (2,657)

---- -------- -------- -------- -------- -------- --------

Basic and diluted

earnings

per share 6 118.8p (51.4p)

---- -------- -------- -------- -------- -------- --------

Condensed consolidated interim statement of financial position

(unaudited)

as at 30 June 2021

Unaudited Audited

30 June 31 December

2021 2020

Note GBP'000 GBP'000

Assets

---- --------- ------------

Investment property 7 83,195 78,810

---- --------- ------------

Total non-current assets 83,195 78,810

---- --------- ------------

Current assets

---- --------- ------------

Trade and other receivables 1,616 1,692

---- --------- ------------

Cash at bank and in hand 2,772 3,295

---- --------- ------------

4,388 4,987

---- --------- ------------

Assets classified as held for sale 7 3,550 3,250

---- --------- ------------

Total current assets 7,938 8,237

---- --------- ------------

Total assets 91,133 87,047

---- --------- ------------

Liabilities

---- --------- ------------

Current liabilities

---- --------- ------------

Interest bearing loan 8 (7,500) -

---- --------- ------------

Trade and other payables (2,510) (2,726)

---- --------- ------------

Total current liabilities (10,010) (2,726)

---- --------- ------------

Non-current liabilities

---- --------- ------------

Interest-bearing loans and borrowings 8 (19,700) (27,200)

---- --------- ------------

Total non-current liabilities (19,700) (27,200)

---- --------- ------------

Total liabilities (29,710) (29,926)

---- --------- ------------

Net assets 61,423 57,121

---- --------- ------------

Equity

---- --------- ------------

Issued share capital 1,296 1,294

---- --------- ------------

Share premium 117 51

---- --------- ------------

Share based payment reserve 58 43

---- --------- ------------

Other equity reserve (121) (53)

---- --------- ------------

Revaluation reserve - property 16,803 12,814

---- --------- ------------

Revaluation reserve - other - -

---- --------- ------------

Capital redemption reserve 95 95

---- --------- ------------

Realised capital reserve 28,995 28,995

---- --------- ------------

Retained earnings 14,180 13,882

---- --------- ------------

Total equity 61,423 57,121

---- --------- ------------

Condensed consolidated interim statement of changes in

equity

for the six months ended 30 June 2021

Issued Share Share Other Capital Realised Retained Total

share premium based equity redemption Capital earnings

capital payment reserve Revaluation

(note reserve

10) property

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

At 1 January 2021 1,294 51 43 (53) 12,814 95 28,995 13,882 57,121

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Transactions with

owners:

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Dividends - - - - - - (1,866) (1,866)

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Issue of shares 2 66 - (68) - - - - -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

2 66 - (68) - - - (1,866) (1,866)

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Reserve transfers:

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Non-distributable

items recognised

in income statement:

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Revaluation losses - - - - (590) - - 590 -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Revaluation gains - - - - 5,275 - - (5,275) -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Excess of cost over

revalued amount

taken to retained

earnings - - - - (696) - - 696 -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

- - - - 3,989 - - (3,989) -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Share award expensed - - 15 - - - - - 15

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Total profit and

comprehensive income

for the period - - - - - - - 6,153 6,153

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

At 30 June 2021 1,296 117 58 (121) 16,803 95 28,995 14,180 61,423

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Issued Share Share Other Capital Realised Retained Total

share premium based equity redemption Capital earnings

capital payment reserve Revaluation

First half 2020 (note reserve reserve

Unaudited 10) property

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

At 1 January 2020 1,292 - 12 - 12,931 95 28,995 17,396 60,721

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Transactions with

owners:

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Dividends - - - - - - - (1,397) (1,397)

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Issue of shares 2 51 - (53) - - - - -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

2 51 - (53) - - - (1,397) (1,397)

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Reserve transfers:

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Non-distributable

items recognised

in income statement:

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Revaluation losses - - - - (5,115) - - 5,115 -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Revaluation gains - - - - 600 - - (600) -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Excess of cost over

revalued amount

taken to retained

earnings - - - - 1,098 - - (1,098) -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

- - - - (3,417) - - 3,417 -

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Share award expensed - - 7 - - - - - 7

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Loss and total

comprehensive

income for the

period - - - - - - - (2,657) (2,657)

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

At 30 June 2020 1,294 51 19 (53) 9,514 95 28,995 16,759 56,674

-------- -------- -------- -------- ----------- ----------- -------- --------- -------

Condensed consolidated interim statement of cashflows

for the six months ended 30 June 2021

Unaudited Unaudited

First First

half half

2021 2020

GBP'000 GBP'000

Operating activities

--------- ---------

Profit/(loss) before tax for the period 6,457 (2,665)

--------- ---------

Adjustments for:

--------- ---------

Net valuation (gains)/losses on investment

property (4,685) 4,515

--------- ---------

Share based payment expense 15 7

--------- ---------

Finance income received (1) (2)

--------- ---------

Finance expense paid 425 458

--------- ---------

Operating cash flow before changes in working

capital and provisions 2,211 2,313

--------- ---------

Decrease/(increase) in trade and other receivables 76 (393)

--------- ---------

(Decrease)/increase in trade and other payables (216) 131

--------- ---------

Cash generated from operations 2,071 2,051

--------- ---------

Finance income received 1 2

--------- ---------

Finance expense paid (425) (458)

--------- ---------

Income tax (paid)/received (304) 22

--------- ---------

Net cash flows from operating activities 1,343 1,617

--------- ---------

Investing activities

--------- ---------

Purchase of fixed assets - investment property - -

--------- ---------

Sale of fixed assets - equity investments - -

--------- ---------

Net cash flows from investing activities - -

--------- ---------

Financing activities

--------- ---------

Dividends paid (1,866) (1,397)

--------- ---------

Repayment of bank borrowings - -

--------- ---------

New bank borrowings - -

--------- ---------

Net cash flows from financing activities (1,866) (1,397)

--------- ---------

Net (decrease)/increase in cash and cash equivalents (523) 220

--------- ---------

Cash and cash equivalents at 1 January 3,295 1,559

--------- ---------

Cash and cash equivalents at period end 2,772 1,779

--------- ---------

Notes (Unaudited)

for the six months ended 30 June 2021

1. Nature of operations and general information

Highcroft Investments PLC ('Highcroft' or 'company') and its

subsidiaries' (together 'the group') principal activity is

investment in property. It is incorporated and domiciled in Great

Britain. The address of Highcroft's registered office, which is

also its principal place of business, is Park Farm Technology

Centre, Akeman Street, Kirtlington, OX5 3JQ. Highcroft's condensed

consolidated interim financial statements are presented in Pounds

Sterling (GBP), which is also the functional currency of the group.

These condensed consolidated interim financial statements have been

approved for issue by the directors on 2 September 2021. The

financial information for the period ended 30 June 2021 set out in

this interim report does not constitute statutory accounts as

defined in Section 404 of the Companies Act 2006. The group's

statutory financial statements for the year ended 31 December 2020

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Section 498(2) or Section 498(5) of the

Companies Act 2006.

2. Basis of preparation

These unaudited condensed consolidated interim financial

statements are for the six months ended 30 June 2021. They have

been prepared in accordance with IAS 34, Interim Financial

Reporting. They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the group for the

year ended 31 December 2020.

These unaudited condensed consolidated interim financial

statements have been prepared under the historical cost convention,

as modified by the revaluation of investment properties. These

unaudited condensed consolidated interim financial statements have

been prepared in accordance with the accounting policies adopted in

the last annual financial statements for the year to 31 December

2020.

The accounting policies have been applied consistently

throughout the group for the purposes of preparation of these

unaudited condensed consolidated interim financial statements.

The unaudited condensed consolidated interim financial

statements are drawn up on a going concern basis. The directors

have a reasonable expectation that the group has adequate resources

to continue in operational existence for the foreseeable future and

consider that there are no material uncertainties that lead to

significant doubt upon the group's ability to continue as a going

concern. Cash flow forecasts are prepared annually as part of the

planning and budgeting process and are monitored and reworked

regularly. The group has fixed-term non-amortising borrowing and

has additional headroom available. The loan that falls due for

repayment within one year can be refinanced under the existing

arrangements with Handelsbanken plc.

3. Segment reporting

The group has one main business segment, property investment

which is based in England and Wales.

In the first six months of 2021 the largest tenant represented

12% (2020 11%) and the second largest tenant represented 9% (2020

7%) of gross commercial property income for the period.

4. Income tax credit/(charge)

First First

half half

2021 2020

GBP'000 GBP'000

Current tax:

-------- --------

On revenue profits - prior year 304 8

current year - -

-------- --------

Total tax 304 8

-------- --------

The current year taxation charge has been based on the estimated

effective tax rate for the full year. As a Real Estate Investment

Trust the group does not pay corporation tax on its profits and

gains from its property activities. The tax charge arising in 2021

in respect of the prior year relates to the write-off of

GBP1.6million of the outstanding PID pool.

Notes (Unaudited) (continued)

for the six months ended 30 June 2020

5. Dividends

On 3 September 2021, the directors declared a property income

distribution of 22p per share (2020 21p per share) payable on 15

October 2021 to shareholders registered at 17 September 2021.

The following property income distributions have been paid by

the company:

First First

half half

2021 2020

GBP'000 GBP'000

2020: final 27p and 2020 special 6p per ordinary

share (2019 final 27p) 1,866 1,397

-------- --------

6. Earnings per share

The calculation of earnings per share is based on the profit for

the period of GBP6,153,000 (2020 loss GBP2,657,000) and on

5,178,943 shares which is the weighted average number of shares in

issue during the period ended 30 June 2021 (2020 5,169,695).

In order to draw attention to the impact of valuation gains and

losses which are included in the income statement but not available

for distribution under the company's articles of association, an

adjusted earnings per share based on the profit available for

distribution of GBP1,468,000 (2020 GBP1,858,000) has been

calculated.

First First

half half

2021 2020

GBP'000 GBP'000

Earnings:

-------- --------

Basic earnings 6,153 (2,657)

-------- --------

Adjustments for:

-------- --------

Net valuation (gains)/losses on investment

property (4,685) 4,515

-------- --------

Adjusted earnings 1,468 1,858

-------- --------

Per share amount:

-------- --------

Earnings per share (unadjusted) 118.8p (51.4p)

-------- --------

Adjustments for:

-------- --------

Net valuation (gains)/ losses on investment

property (90.5p) 87.3p

-------- --------

Adjusted earnings per share 28.3p 35.9p

-------- --------

Notes (Unaudited) (continued)

for the six months ended 30 June 2021

7. Investment property

First

half Full year

2021 2020

GBP'000 GBP'000

Valuation at 1 January 82,060 86,710

-------- ---------

Gain/(loss) on revaluation 4,685 (4,650)

-------- ---------

Valuation at period end 86,745 82,060

-------- ---------

Less property held for sale categorised as

current asset (3,550) (3,250)

-------- ---------

Property categorised as fixed asset 83,195 78,810

-------- ---------

The directors have used an external independent valuation of

properties at 30 June 2021 which has been carried out consistently

with the annual valuation.

8. Interest bearing loans

30 June 31 December

2021 2020

GBP'000 GBP'000

Short-term bank loans due within one year 7,500 -

-------- -----------

Medium-term loans 19,700 27,200

-------- -----------

The medium-term bank loans comprise amounts

falling due as follows:

-------- -----------

Between one and two years - 7,500

-------- -----------

Between two and five years - -

-------- -----------

Over five years 19,700 19,700

-------- -----------

The debt is secured on certain assets within the group's

property portfolio. The group has a facility in place with its

primary banker to enable it to re-finance the loan falling due in

May 2022 on similar terms to the existing loans.

9. Share capital

First

half Full year

2021 2020

Allotted, called up and fully paid ordinary

shares of 25p each

--------- ---------

At I January 5,175,175 5,167,240

--------- ---------

Issued in the year in connection with the

Highcroft incentive plan 8,524 7,935

--------- ---------

At period end 5,183,699 5,175,175

--------- ---------

Notes (Unaudited) (continued)

for the six months ended 30 June 2021

10. Related party transactions

Kingerlee Holdings Limited owns, through its wholly owned

subsidiaries, 27.2% (2020 27.2%) of the company's shares and D H

Kingerlee is a director of both the company and Kingerlee Holdings

Limited.

During the period, the group made purchases from Kingerlee

Limited, a subsidiary of Kingerlee Holdings Limited, being a

service charge in relation to services at Thomas House, Kidlington,

the previous registered office of the company of GBP1,000 (2020

GBP7,000). The amount owed at 30 June 2021 was GBPnil (2020

GBPnil). In addition, the group recharged professional fees of

GBP12,000 to Kingerlee Holdings Limited in connection with

additional fees connected with the group reporting requirement for

the 2020 audit. The amount owed at 30 June 2021 was GBPnil (2020

GBPnil). All transactions were undertaken on an arm's length

basis.

During the period GBP507,000 (2020 GBP380,000) of dividend was

paid to the wholly owned subsidiaries of Kingerlee Holdings Limited

in respect of their shareholdings.

During the period ordinary shares of 25p each were issued under

the Highcroft incentive plan to the following directors of the

company: Simon Gill 4,534 (2020 4,309) and Roberta Miles 3,990

(2020 3,626).

During the period the following dividends were paid to directors

of the company in respect of their shareholdings:

First First

half half

2021 2020

GBP'000 GBP'000

Simon Gill 3 1

-------- --------

David Kingerlee 32 24

-------- --------

Roberta Miles 5 3

-------- --------

11. Net assets per share

First First

half half Full year

2021 2020 2020

Net assets GBP61,423,000 GBP56,674,000 GBP57,121,000

------------- ------------- -------------

Ordinary shares in issue 5,183,699 5,175,175 5,175,175

------------- ------------- -------------

Basic net assets per share 1185p 1095p 1104p

------------- ------------- -------------

12. Fair value of financial instruments

The fair values of loans and receivables and financial

liabilities held at amortised cost were not materially different

from book values.

13. Post balance sheet events

After the period end the group completed on the sale of its

long-leasehold investment property in Andover let to Jewsons, for

sales proceeds of GBP3,550,000, its valuation at 30 June 2021 and

9.2% above its valuation at 31 December 2020.

Statement of principal risks and uncertainties

The directors consider that there have been no material changes

to the group's principal risks as set out in detail on pages 30 and

31 of the annual report and accounts for the year ended 31 December

2020. These principal risk areas can be summarised as:

External risks Internal risks

Macro-economic outlook Business strategy

------------------

Political and regulatory outlook Key personnel

------------------

Occupier demand and tenant default

------------------

Commercial property investor demand

------------------

Availability and cost of finance

and debt covenant requirements

------------------

Statement of directors' responsibilities

The directors confirm that, to the best of their knowledge, this

condensed consolidated set of half-year financial statements has

been prepared in accordance with IAS 34. The half-year management

report includes a fair review of the information required by 4.2.7

and 4.2.8 of the Disclosure and Transparency Rules of the United

Kingdom's Financial Conduct Authority, namely:

-- an indication of the important events that have occurred

during the first six months of the financial year ending 31

December 2021 and their impact on the condensed consolidated set of

half-year financial statements, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- disclosure of material related party transactions in the

first six months of the financial year, and any material changes in

the related party transactions described in the last annual

report.

A list of current directors is maintained on the Highcroft

Investments PLC website: www.highcroftplc.com.

By order of the board.

Charles Butler

Chairman

2 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVRAFIFIIL

(END) Dow Jones Newswires

September 03, 2021 02:00 ET (06:00 GMT)

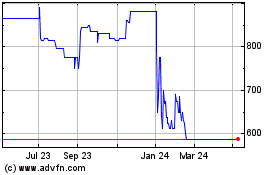

Highcroft Investments (LSE:HCFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Highcroft Investments (LSE:HCFT)

Historical Stock Chart

From Apr 2023 to Apr 2024