Central Fund Closes U.S. $375,705,000 Class a Share Issue

18 May 2010 - 10:42PM

Marketwired

Central Fund of Canada Limited ("Central Fund") (TSX: CEF.A)(TSX:

CEF.U)(NYSE Amex: CEF) of Calgary, Alberta is pleased to announce

that it has completed the sale of 25,300,000 Class A Shares of

Central Fund at a price of U.S.$14.85 per Class A Share to a

syndicate of underwriters (the "Underwriters") led by CIBC, raising

total gross proceeds of U.S.$375,705,000. The Class A Shares

offered were primarily sold to investors in Canada and in the

United States under the Multijurisdictional Disclosure System.

The underwritten price of U.S. $14.85 per Class A Share was

non-dilutive and accretive for the existing Shareholders of Central

Fund. Substantially all of the net proceeds of the offering have

been invested in gold and silver bullion in international banker

bar denominations, in keeping with the asset allocation

requirements in the constating documents of Central Fund and the

policies established by the Board of Directors of Central Fund,

with the balance of the net proceeds reserved for working capital

purposes. The additional capital raised by this underwriting is

expected to assist in reducing the annual expense ratio in favour

of the Shareholders of Central Fund.

The new total of issued and outstanding Class A Shares of

Central Fund is 238,282,713. The refined bullion and small bullion

certificate holdings of Central Fund are now represented by

approximately 1,504,234 fine ounces of gold and 75,209,103 ounces

of silver. Cash and short-term interest bearing certificates, less

accrued liabilities, now total a net amount of approximately U.S.

$86,000,000.

Central Fund has filed a second prospectus supplement to the

base shelf prospectus and registration statement dated September 8,

2009 with the Canadian securities regulatory authorities and the

United States Securities and Exchange Commission ("SEC") for the

offering to which this communication relates. You may obtain a copy

of the base shelf prospectus and prospectus supplement filed in the

United States from CIBC World Markets Corp., 425 Lexington Avenue,

5th Floor, New York, New York 10017, by fax at 212-667-6303 or by

e-mail at useprospectus@us.cibc.com. You may obtain a copy of the

base shelf prospectus and prospectus supplement filed in Canada

from CIBC, fax 416-594-7242 or request a copy by telephone at

416-594-7270.

Statements contained in this release that are not historical

facts are forward-looking statements that involve risks and

uncertainties. Central Fund's actual results could differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to, those risks detailed

in Central Fund's filings with the Canadian securities regulatory

authorities and the SEC.

Central Fund of Canada Limited (Est. 1961) is an

exchange-tradeable, refined gold and silver bullion holding

company. Class A Shares are qualified for inclusion in many North

American regulated accounts. Central Fund's bullion holdings are

stored unencumbered in allocated and segregated safekeeping in

Canada, in the treasury vaults of the Canadian Imperial Bank of

Commerce. The gold and silver bullion holdings are physically

inspected by Central Fund's Officers and Directors along with Ernst

& Young LLP representatives in the presence of bank officials.

Class A Shares are quoted on the NYSE Amex Equities, symbol CEF and

on the TSX, symbols CEF.A (Cdn.$) and CEF.U (U.S.$).

Contacts: Central Fund of Canada Limited J.C. Stefan Spicer

President and CEO 905-648-7878 Email: info@centralfund.com Website:

www.centralfund.com

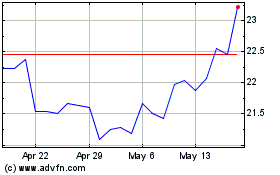

Sprott Physical Gold and... (AMEX:CEF)

Historical Stock Chart

From Oct 2024 to Nov 2024

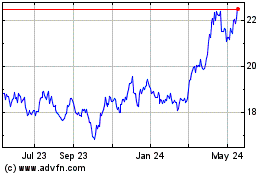

Sprott Physical Gold and... (AMEX:CEF)

Historical Stock Chart

From Nov 2023 to Nov 2024