Filed pursuant to General Instruction

II.L. of Form F-10

File No. 333-283907

No securities regulatory authority has expressed

an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement (this “Prospectus

Supplement”), together with the accompanying short form base shelf prospectus dated January 10, 2025 (the “Prospectus”)

to which it relates, as amended or supplemented, and each document deemed to be incorporated by reference into this Prospectus Supplement

and the Prospectus, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for

sale and therein only by persons permitted to sell such securities.

This short form prospectus constitutes a public

offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted

to sell such securities. TRX Gold Corporation has filed a registration statement on Form F-10 with the United States Securities and Exchange

Commission under the United States Securities Act of 1933, as amended, with respect to these securities. See “Plan of Distribution”.

Information has been incorporated by reference

in this prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents

incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of TRX Gold Corporation at 277

Lakeshore Road East, Suite 403, Oakville, Ontario, L6J 1H9, telephone 1.647.515.3310, and are also available electronically at www.sedarplus.ca.

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF

PROSPECTUS DATED JANUARY 10, 2025

| New Issue |

February 7, 2025 |

TRX Gold Corporation

Up to US$25,000,000

Common Shares

This prospectus supplement (this “Prospectus

Supplement”) of TRX Gold Corporation (the “Company”), together with the accompanying short form base prospectus

dated January 10, 2025 to which this Prospectus Supplement relates (the “Prospectus”), qualifies the distribution (the

“Offering”) of common shares of the Company (the “Common Shares”) having an aggregate sales amount

of up to US$25,000,000 (the “Offered Shares”). The Offering is being made in the United States under the terms of a

registration statement on Form F-10, as amended (SEC File No. 333-283907) (the “Registration Statement”) filed with

and declared effective by the United States Securities and Exchange Commission (the “SEC”), of which this Prospectus

Supplement and the accompanying Prospectus form a part. See “Plan of Distribution” and “Description of the Offered Shares”.

The Company entered into an At-The-Market Offering

Agreement (the “ATM Sales Agreement”) with H.C. Wainwright & Co., LLC (“Lead Agent”) and Roth

Capital Partners, LLC (together with the Lead Agent, the “Agents”) relating to our Common Shares offered by this Prospectus

Supplement. In accordance with the terms of the ATM Sales Agreement, the Company may, from time to time, offer and sell Common Shares

pursuant to this Prospectus Supplement having an aggregate sales amount of up to US$25,000,000 through the Lead Agent. Unless otherwise

indicated, reference to dollars in this Prospectus Supplement shall mean United States dollars. The Offered Shares will only be offered

in the United States, including, without limitation, on the NYSE American or on any other trading market for the Offered Shares in the

United States. No Offered Shares will be sold under the ATM Sales Agreement in Canada or on the TSX or any other trading market in Canada.

Sales of Offered Shares, if any, under this Prospectus

Supplement and the Prospectus will only be made in transactions that are deemed to be “at-the-market distributions” as defined

in National Instrument 44-102 — Shelf Distributions (“NI 44- 102”), including, without limitation, sales

made directly on the NYSE American or on any other trading market for the Offered Shares in the United States. The Lead Agent is not required

to sell any specific number or dollar amount of Common Shares but will use its commercially reasonable efforts, consistent with its normal

sales and trading practices, to sell the Offered Shares under the terms and conditions of the ATM Sales Agreement. The Offered Shares

will be distributed at market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers of the Offered

Shares and during the period of distribution. There is no minimum amount of funds that must be raised under the Offering. This means

that the Offering may terminate after only raising a small portion of the offering amount set out above, or none at all. The Agents will

only sell Offered Shares on marketplaces in the United States. See “Plan of Distribution”.

The Company is permitted, under a multi-jurisdictional

disclosure system (“MJDS”) adopted in the United States and Canada, to prepare this Prospectus Supplement and the Prospectus

in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those

of the United States. The Company prepares its financial statements in accordance with International Financial Reporting Standards as

issued by the International Accounting Standards Board (“IFRS”). Thus, the Company’s financial statements may not be

comparable to the financial statements of United States companies.

Prospective investors should be aware that the acquisition,

ownership and disposition of the securities described herein may have tax consequences in the United States. Such tax consequences for

investors who are residents in, or citizens of, the United States may not be fully described herein. Investors should read the tax discussion

in this Prospectus Supplement and consult their own tax advisors with respect to their particular circumstances. See “Certain Income

Tax Considerations”.

The enforcement by investors of civil liabilities

under United States federal securities laws may be affected adversely by the following facts: that the Company is incorporated under the

laws of the Province of Alberta, Canada; that most of its officers and directors are residents of Canada; that some of the experts named

in this Prospectus Supplement and the Prospectus are residents of Canada; and that all or a substantial portion of the assets of the Company

and said persons are located outside of the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED

BY THE SEC NOR ANY STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON

THE ACCURACY OR ADEQUACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Investing in the Offered Shares is highly speculative

and involves significant risks that you should consider before purchasing such Offered Shares. The risks outlined in this Prospectus Supplement,

the Prospectus and in the documents incorporated by reference herein and therein should all be carefully reviewed and considered by prospective

investors in connection with an investment in the Offered Shares. See “Risk Factors”.

The Lead Agent will be entitled to compensation at

a fixed commission rate of 3.0% of the gross sales price per share sold. In connection with the sale of Offered Shares on our behalf,

each Agent will be deemed to be an “underwriter” within the meaning of the U.S. Securities Act and the compensation of the

Agents will be deemed to be underwriting commissions or discounts. The Company has also agreed to provide indemnification and contributions

to the Agents against certain civil liabilities, including liabilities under the U.S Securities Act. See “Plan of Distribution”.

Each Agent is not registered as a dealer in any Canadian jurisdiction and, accordingly, is not permitted to and will not, directly or

indirectly, advertise or solicit offers to purchase any of the Offered Shares in Canada.

In connection with the Offering, no Agent and no person

or company acting jointly or in concert with an Agent, may enter into any transaction that is intended to stabilize or maintain the market

price of the Offered Shares or securities of the same class as the Offered Shares, including selling an aggregate number or principal

amount of securities that would result in the Agent creating an over-allocation position in the Offered Shares. See “Plan of Distribution”.

The outstanding Common Shares are listed on the Toronto Stock Exchange (the “TSX”)

under the symbol “TRX” and on the NYSE American (the “NYSE American”) under the symbol “TRX”.

The closing price of the Common Shares on the TSX and on the NYSE American on February 6, 2025, the last trading day before the date

of this Prospectus Supplement, was C$0.475 and US$0.3262, respectively, per Common Share. The Company has submitted a notification of

listing to list the Offered Shares on the NYSE American and has sought approval for the Offering by the TSX. Listing on NYSE American

and approvals of the TSX will be subject to the Company fulfilling all of the requirements of NYSE American and the TSX, respectively.

An investment in the Offered Shares involves a high

degree of risk and must be considered speculative due to the nature of the Company’s business, the present stage of development

of its mineral projects and the fact that the Company does not yet have revenue-generating activities. Prospective investors should carefully

consider the risk factors described in and incorporated by reference into this Prospectus Supplement. See “Cautionary Statement

regarding Forward-Looking Information” and “Risk Factors” in this Prospectus Supplement.

The Company’s registered address is 400 3rd Avenue

SW, Suite 3700, Calgary, AB T2P 4H2, and head office is located at 277 Lakeshore Road East, Suite 403, Oakville, Ontario, L6J 1H9.

Lead Agent

H.C. Wainwright & Co.

Co-Agent

Roth Capital Partners

TABLE OF CONTENTS

| ABOUT THIS PROSPECTUS SUPPLEMENT |

S-1 |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION |

S-1 |

| DOCUMENTS INCORPORATED BY REFERENCE |

S-2 |

| NOTICE TO INVESTORS REGARDING IFRS |

S-3 |

| RESOURCES AND RESERVE ESTIMATES |

S-3 |

| PROSPECTUS SUPPLEMENT SUMMARY |

S-4 |

| THE OFFERING |

S-4 |

| THE COMPANY |

S-5 |

| RECENT DEVELOPMENTS |

S-5 |

| CONSOLIDATED CAPITALIZATION |

S-5 |

| USE OF PROCEEDS |

S-5 |

| PLAN OF DISTRIBUTION |

S-6 |

| PRIOR SALES |

S-7 |

| DIVIDEND POLICY |

S-8 |

| DESCRIPTION OF COMMON SHARES |

S-8 |

| TRADING PRICE AND VOLUME |

S-8 |

| CERTAIN INCOME TAX CONSIDERATIONS |

S-9 |

| LEGAL MATTERS |

S-15 |

| INTERESTS OF EXPERTS |

S-15 |

| AUDITORS, TRANSFER AGENT AND REGISTRAR |

S-15 |

| RISK FACTORS |

S-15 |

| PURCHASERS’ STATUTORY RIGHTS OF RESCISSION AND WITHDRAWAL |

S-22 |

| ENFORCEMENT OF U.S. CIVIL LIABILITIES |

S-23 |

| CERTIFICATE OF THE COMPANY |

S-24 |

ABOUT THIS PROSPECTUS SUPPLEMENT

In this Prospectus Supplement, references to “TRX”, the “Company”,

“we”, “us” and “our” refers, collectively, to TRX Gold Corporation and its subsidiaries.

This document is in two parts. The first part is

this Prospectus Supplement, which describes the specific terms of the Offered Shares being offered and the method of distribution of those

securities and also supplements and updates information regarding the Company contained in the Prospectus. The second part, the Prospectus,

gives more general information, some of which may not apply to the Offered Shares being offered under this Prospectus Supplement. Both

documents contain important information you should consider when making your investment decision. This Prospectus Supplement may add,

update or change information contained in the Prospectus. Before investing, you should carefully read both this Prospectus Supplement

and the Prospectus together with the additional information about the Company to which the Company refers you in the sections of this

Prospectus Supplement entitled “Documents Incorporated by Reference”.

You should rely only on the information contained or

incorporated by reference in this Prospectus Supplement and the Prospectus. If the description of the Offered Shares or any other information

varies between this Prospectus Supplement and the Prospectus (including the documents incorporated by reference herein and therein), the

investor should rely on the information in this Prospectus Supplement. The Company has not, and the Agents have not, authorized anyone

to provide you with different or additional information. If anyone provides you with any different, additional, inconsistent or other

information, you should not rely on it. Neither the Company nor the Agents are making an offer to sell or seeking an offer to buy the

Offered Shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this

Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein is accurate as of any date other

than the date on the front of this Prospectus Supplement, the Prospectus or the respective dates of the documents incorporated by reference

herein and therein, regardless of the time of delivery or of any sale of the Offered Shares pursuant thereto. The Company’s business,

financial condition, results of operations and prospects may have changed since those dates. Information contained on the Company’s

website should not be deemed to be a part of this Prospectus Supplement, the Prospectus or incorporated by reference herein and should

not be relied upon by prospective investors for the purpose of determining whether to invest in the Offered Shares. This Prospectus Supplement

shall not be used by anyone for any purpose other than in connection with the Offering.

The Company has filed a Registration Statement on Form

F-10 with the SEC for the Offered Shares. This Prospectus Supplement does not contain all of the information contained in the Registration

Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. You should refer to the Registration

Statement and the exhibits to the Registration Statement for further information with respect to the Company and the Company’s securities.

The Company is subject to the information requirements of the United States Securities Exchange Act of 1934, as amended (the “U.S.

Exchange Act”) and applicable Canadian securities legislation, and, in accordance therewith, the Company files reports and other

information with the SEC and with the securities regulatory authorities in each of the provinces of Canada. Under a multijurisdictional

disclosure system adopted by the United States and Canada, the Company may generally prepare those reports and other information in accordance

with the Canadian disclosure requirements. Those requirements are different from those of the United States.

This Prospectus Supplement shall not be used by anyone

for any purpose other than in connection with an offering of Offered Shares as described in this Prospectus Supplement. The Company does

not undertake to update the information contained or incorporated by reference herein, including any Prospectus Supplement, except as

required by applicable securities laws. Information contained on, or otherwise accessed through, the website of the Company, www.trxgold.com,

shall not be deemed to be a part of this Prospectus Supplement and such information is not incorporated by reference herein.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

Certain information in this Prospectus Supplement and

the documents incorporated by reference herein may constitute “forward-looking information”, as such term is used in applicable

Canadian securities legislation, about the Company including its financial condition, results of operations, business strategies, operating

efficiencies, synergies, revenue enhancements, competitive positions, plans and objectives of management and growth opportunities of the

Company, various matters with respect to the markets for Common Shares and other matters. Forward-looking information generally can be

identified by the use of words such as “outlook”, “objective”, “may”, “might”, “will”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”,

“plans”, “continue” or similar expressions suggesting future outcomes or events.

Material factors or assumptions that were applied in

providing forward-looking information, include, but are not limited to the Company’s future growth potential, its results of operations,

future cash flows, the continued performance and business prospects and opportunities of the Company, the completion of certain transactions,

the Company’s ability to continue to develop and grow, the Company’s future levels of indebtedness, and the tax laws as currently

in effect remaining unchanged and the current general regulatory environment and economic conditions remaining unchanged. Many of these

factors or assumptions could affect the Company’s actual results and could cause the Company’s actual results to differ materially

from those expressed or implied in any forward-looking statement made by the Company or on its behalf.

Forward-looking information contained in this Prospectus

Supplement reflects management’s current expectations regarding future events and operating performance and speaks only as of the

date of this Prospectus Supplement. Such forward-looking information is based on currently available competitive, financial and economic

data and operating plans and is subject to known and unknown risks, uncertainties and other factors which may cause the actual results,

performance or achievements of the Company, or general industry results, to be materially different from any future results, performance

or achievements expressed or implied by such forward-looking information. Examples of such forward-looking information include, but are

not limited to, statements with respect to the following:

| · | the ability to achieve production, cost and capital guidance; |

| · | the ability to advance drill plans; |

| · | the success of mining, processing, exploration and development activities; |

| · | the Company’s ability to generate sufficient cash flow to service its debt obligations or implement

its business plan, including financing internal or external growth opportunities; |

| · | the estimation and realization of mineral reserves and mineral resources; |

| · | expectations regarding maintenance and capital expenditures; and |

| · | the impact of legislative, regulatory, competitive, technological and environmental changes. |

Forward-looking information involves significant risks

and uncertainties, should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication

of the times at or by which such performance or results will be achieved. In addition, a number of factors could cause actual results

to differ materially from the results discussed in the forward-looking information, including, but not limited to, the other risk factors

under the heading “Risk Factors” in this Prospectus Supplement, and other risk factors relating to the Company and the mining

industry, as detailed from time to time in the Company’s filings with the SEC and the Canadian Securities Administrators, including,

without limitation, the Company’s most recent AIF. The impact of any one factor on a particular piece of forward-looking information

is not determinable with certainty as such factors are interdependent upon other factors, and management’s course of action would

depend upon its assessment of the future considering all information then available.

The Company’s business is both highly competitive

and subject to various risks. Should any risk factor affect the Company in an unexpected manner, or should assumptions underlying the

forward-looking information prove incorrect, the actual results or events may differ materially from the results or events predicted.

Unless otherwise indicated, forward-looking information does not take into account the effect that transactions or non-recurring or other

special items announced or occurring after the date it is provided may have on the business of the Company. All of the forward-looking

information reflected in this Prospectus Supplement and the documents incorporated by reference herein are qualified by these cautionary

statements. There can be no assurance that the results or developments anticipated by the Company will be realized or, even if substantially

realized, that they will have the expected consequences for the Company. Forward-looking information is provided and forward-looking statements

are made as of the date of this Prospectus Supplement and except as may be required by applicable law, the Company disclaims any intention

and assumes no obligation to publicly update or revise such forward-looking information or forward-looking statements whether as a result

of new information, future events or otherwise.

DOCUMENTS INCORPORATED BY

REFERENCE

Information has been incorporated by reference in

this Prospectus Supplement from documents filed with the securities commissions or similar authorities in the provinces and territories

of Canada and with the SEC in the United States. Copies of the documents incorporated in this Prospectus Supplement by reference may be

obtained on request without charge from the Corporate Secretary of the Company 277 Lakeshore Road East, Suite 403, Oakville, Ontario,

L6J 1H9. In addition, copies of the documents incorporated by reference herein may be obtained from the securities commissions or similar

authorities in Canada through SEDAR+ at www.sedarplus.ca. Documents filed with, or furnished to, the SEC are available through the SEC’s

Electronic Data Gathering and Retrieval System (“EDGAR”), at www.sec.gov.

The following documents of the Company, filed with

the securities commissions or similar authorities in the provinces and territories of Canada and the SEC, are specifically incorporated

by reference into and form an integral part of this Prospectus Supplement:

| a. | the ATM Sales Agreement with H.C. Wainwright & Co., LLC and Roth Capital Partners, LLC dated

February 7, 2025, filed on February 7, 2025; |

| b. | a credit facility agreement with Stanbic Bank Tanzania Limited effective February 5, 2025, filed on

February 7, 2025; |

| c. | the unaudited consolidated financing statements of the Company for the three months ended November 30,

2024, and 2023 together with the notes thereto (the “Interim Financial Statements”), filed on January 14, 2025; |

| d. | the management’s discussion and analysis of the financial condition and results of operations of

the Company for the three months ended November 30, 2024, and 2023 (the “Interim MD&A”), filed on January 14, 2024; |

| e. | the material change report dated December 6, 2024 regarding the appointment of Richard Boffey as Chief

Operating Officer and the resignation of Andrew Cheatle as Chief Operating Officer and Director of the Company, filed on December 6, 2024; |

| f. | the audited consolidated financial statements of the Company for the years ended August 31, 2024 and 2023,

together with the notes thereto and the auditor’s report thereon (the “Annual Financial Statements”), filed on

November 29, 2024; |

| g. | the management’s discussion and analysis of the financial condition and results of operations of

the Company for the year ended August 31, 2024 (the “Annual MD&A”), filed on November 29, 2024; |

| h. | the Company’s annual information form for the fiscal year ended August 31, 2024 (the “AIF”),

filed on November 29, 2024; |

| i. | the notice of meeting and management information circular of the Company dated January 15, 2025, distributed

in connection with the annual and special meeting of shareholders held on February 27, 2025 (the “Circular”), filed

on January 28, 2025; and |

| j. | the Company’s National Instrument 43-101 (“NI 43-101”) Independent Technical

Report – Updated Mineral Resource Estimate for the Buckreef Gold Mine Project, Tanzania, East Africa, filed on June 23, 2020. |

Any documents of the type required by section 11.1

of Form 44-101F1 of National Instrument 44- 101 — Short Form Prospectus Distributions to be incorporated by reference

in a short form prospectus, if filed by the Company with the securities commissions or similar regulatory authorities in the provinces

and territories of Canada in which this Prospectus Supplement has been filed subsequent to the date of this Prospectus Supplement and

prior to the termination of the distribution, shall be deemed to be incorporated by reference in this Prospectus Supplement.

In addition, to the extent that any document or information

incorporated by reference into this Prospectus Supplement and the Prospectus is included in any report on Form 6-K or Form 40-F (or any

respective successor form) that is filed with or furnished to the SEC by the Company after the date of this Prospectus Supplement, such

document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this Prospectus

Supplement forms a part. In addition, the Company may incorporate by reference into this Prospectus Supplement, or the Registration Statement

of which it forms a part, other information from documents that the Company will file with or furnish to the SEC pursuant to Section 13(a)

or 15(d) of the Exchange Act, if and to the extent expressly provided therein.

Any statement contained in a document incorporated

or deemed to be incorporated by reference in this Prospectus Supplement shall be deemed to be modified or superseded for the purposes

of this Prospectus Supplement to the extent that a statement contained herein or in any other subsequently filed document which also is,

or is deemed to be, incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need

not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies

or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified

or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a

material fact that was required to be stated or that was necessary to make a statement not misleading in light of the circumstances in

which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part

of this Prospectus Supplement.

Upon a new annual information form and related annual

audited financial statements and the management’s discussion and analysis in respect thereof being filed by the Company with, and

where required, accepted by, the applicable securities regulatory authorities during the currency of this Prospectus Supplement, the previous

annual information form, the previous annual audited financial statements, all interim unaudited financial statements and the management’s

discussion and analysis in respect thereof, material change reports and business acquisition reports filed by the Company prior to the

commencement of the Company’s fiscal year in which the new annual information form was filed shall be deemed no longer to be incorporated

into this Prospectus Supplement for purposes of future offers and sales of Securities hereunder. Upon an interim unaudited financial statements

and the management’s discussion and analysis in respect thereof being filed by the Company with the applicable securities regulatory

authorities during the currency of this Prospectus Supplement, all interim unaudited financial statements and the management’s discussion

and analysis in respect thereof filed prior to the new interim unaudited financial statements shall be deemed no longer to be incorporated

into this Prospectus Supplement for purposes of future offers and sales of Securities hereunder. Upon a new management information circular

relating to an annual meeting of shareholders of the Company being filed by the Company with the applicable securities regulatory authorities

during the currency of this Prospectus Supplement, the management information circular for the preceding annual meeting of shareholders

shall be deemed no longer to be incorporated by reference into this Prospectus Supplement for purposes of future offers and sales of Securities

hereunder.

NOTICE TO INVESTORS REGARDING

IFRS

The Company prepares its financial statements in accordance

with IFRS. The Annual Financial Statements and the corresponding Annual MD&A, incorporated by reference in this Prospectus Supplement,

have been prepared in accordance with IFRS.

RESOURCES

AND RESERVE ESTIMATES

This Prospectus Supplement and the documents incorporated

by reference herein have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve

estimates, which differ from the current standards of the United States securities laws. In particular, and without limiting the generality

of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”,

“inferred mineral resources,”, “indicated mineral resources,” “measured mineral resources” and “mineral

resources” used or referenced in this Prospectus Supplement and the documents incorporated by reference herein are Canadian mineral

disclosure terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition

Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”).

For United States reporting purposes, the SEC has adopted

amendments to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements

for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934, as amended (“U.S.

Exchange Act”). The SEC Modernization Rules more closely align the SEC’s disclosure requirements and policies for mining properties

with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure

requirements for mining registrants that were included in Industry Guide 7 under the U.S. Securities Act. As a foreign private issuer

that is eligible to file reports with the SEC pursuant to the MJDS, the Company is not required to provide disclosure on its mineral properties

under the SEC Modernization Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve

and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed

by United States companies. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured

mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC

has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially

similar” to the corresponding definitions under the CIM Standards, as required under NI 43-101.

United States investors are cautioned that while the

above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions

under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources

that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral

resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the

same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

All references to “US$” in this Prospectus Supplement are to United States dollars, all

references to “C$” are to Canadian dollars. On February 6, 2025, the Bank of Canada daily rates of exchange were US$1.00 =

C$1.4322 or C$1.00 = US$0.6982.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights certain information about the Company, this

Offering and selected information contained elsewhere in or incorporated by reference into this Prospectus Supplement or the Prospectus.

This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in

the Offered Shares. For a more complete understanding of the Company and this Offering, the Company encourages you to read and consider

carefully the more detailed information in this Prospectus Supplement and the Prospectus, including the information incorporated by reference

in this Prospectus Supplement and the Prospectus, and in particular, the information under the heading “Risk Factors” in this

Prospectus Supplement. All capitalized terms used in this summary refer to definitions contained elsewhere in this Prospectus Supplement

or the Prospectus, as applicable.

|

THE

OFFERING

|

| Offered Shares |

Offered Shares having an aggregate sales amount of up to US$25,000,000. |

| Common Shares Outstanding Immediately Before Offering |

281,873,229 Common Shares |

| Plan of Distribution |

Sales of Offered Shares, if any, under this Prospectus Supplement and the Prospectus may be made in transactions that are deemed to be “at-the-market distributions” as defined in NI 44-102, including, without limitation, sales made directly on the NYSE American or other existing trading market for the Common Shares in the United States. The Offered Shares will be distributed at market prices prevailing at the time of sale of such Offered Shares. No Offered Shares will be offered or sold in Canada on the TSX or other trading markets in Canada. See “Plan of Distribution”. |

| Use of Proceeds |

The principal business objectives that the Company expects to accomplish using the net proceeds, if any, from the Offering, together with the Company’s current cash resources, are to advance the exploration and development of the drilling, exploration and technical work for the development of the sulphide mineralized material at our Buckreef Gold Project, and for working capital and other general corporate purposes. See “Use of Proceeds”. |

| Risk Factors |

See “Risk FactorsSS” in this Prospectus Supplement and the Prospectus and the risk factors discussed or referred to in the AIF, Annual MD&A, and Interim MD&A which are incorporated by reference into this Prospectus Supplement as those terms are defined in the Prospectus, for a discussion of factors that should be read and considered before investing in the Offered Shares. |

| Tax Considerations |

For investors purchasing Offered Shares, there may be tax consequences. This Prospectus Supplement and the Prospectus may not describe these consequences fully for all investors. Investors should read the tax discussion in this Prospectus Supplement and the Prospectus and consult with their tax advisor. See “Certain Income Tax Considerations” in this Prospectus Supplement. |

| Listing Symbol |

The Common Shares are listed for trading on the TSX and NYSE American under the symbol “TRX”. |

THE COMPANY

TRX Gold Corporation was originally incorporated under

the name “424547 Alberta Ltd.” in the Province of Alberta on July 5, 1990, under the Business Corporations Act (Alberta).

The name was changed to “Tan Range Exploration Corporation” on August 13, 1991. The name of the Company was again changed

to “Tanzanian Royalty Exploration Corporation” on February 28, 2006. Subsequently, at the 2019 Annual Meeting, the shareholders

approved a change of name to Tanzanian Gold Corporation. The name changed to Tanzanian Gold Corporation became effective in the Province

of Alberta, Canada on April 17, 2019. The Articles of the Company were further amended on May 24, 2022, to change the name of the Company

to its present name of “TRX Gold Corporation”. The Articles of the Company were further amended on February 23, 2023, to allow

for meetings of shareholders to be held in any location or manner as determined by the board. The Company is also registered in the Province

of British Columbia as an extra-provincial company under the Business Corporations Act (British Columbia).

The principal executive office of the Company is

located at 277 Lakeshore Road East, Suite 403, Oakville, Ontario, L6J 1H9, and its telephone number is 1.647.515.3310. The Company maintains

a website at www.trxgold.com. Information contained on, or that can be accessed through, our website is not part of this Prospectus Supplement.

The Company’s main area of interest has been

in the exploration and development of gold properties, with a primary focus on exploring for and developing gold properties in the United

Republic of Tanzania (“Tanzania”). Tanzania remains the focus of the Company’s exploration and development activities.

The Company’s primary asset is its interest in the Buckreef Gold Project, a joint venture that is 55% owned by one of the Company’s

subsidiaries (TRX Gold Tanzania Limited) and 45% is owned by the State Mining Corporation (“STAMICO”), a Governmental agency

of Tanzania.

The Company continues to advance the Buckreef Gold

Project. Anchored by a Mineral Resource published in May 2020, the project currently hosts an NI 43-101 Measured and Indicated Mineral

Resource (“M&I Resource”) of 35.88 million tonnes (“MT”) at 1.77 grams per tonne (“g/t”) gold

containing 2,036,280 ounces (“oz”) of gold and an Inferred Mineral Resource of 17.8 MT at 1.11 g/t gold for 635,540 oz of

gold. The leadership team is focused on creating both near-term and long-term shareholder value by increasing gold production to generate

positive cash flow. The positive cash flow will be utilized for exploratory drilling with the goal of increasing the current mineral resource

base and advancing the larger project development which represents 90% of current mineral resources. The Company’s actions are guided

by the highest environmental, social and corporate governance (“ESG”) standards, evidenced by the relationships and programs

that the Company has developed during its nearly two decades of presence in the Geita Region, Tanzania. Please refer to the Company’s

NI 43-101.

RECENT

DEVELOPMENTS

The Company’s Buckreef Gold Project produced

19,389 ounces of gold in fiscal 2024, in line with revised full year production guidance, and sold approximately 19,075 ounces of gold

over the same period. This compares to production of approximately 20,759 ounces of gold and sales of 20,864 ounces of gold in fiscal

2023.

The Company expects an increase in

throughput and production in fiscal 2025, reflecting a full year of operations from the expanded 2,000 tonnes per day processing plant

that was fully commissioned at the end of the fourth quarter 2024. The Company is working on optimizing mill efficiency and is in the

process of developing finer grinding initiatives to achieve higher gold recoveries. Additionally, the Company expects to substantially

increase exploration drilling in fiscal 2025, with a focus on high-priority gold zones, such as Stamford Bridge, as well as Buckreef Main,

Buckreef West, Anfield and Eastern Porphyry. The newly discovered Stamford Bridge Zone is highly prospective and may become a bridge between

the Buckreef Main Zone, Eastern Porphyry and Anfield Zones.

CONSOLIDATED CAPITALIZATION

There have been no material changes in the share and

loan capital of the Company, on a consolidated basis, since August 31, 2024 (the period end of the most recently filed consolidated annual

financial statements of the Company incorporated by reference in this Prospectus Supplement). As of the date of this Prospectus Supplement,

there were 281,873,229 Common Shares issued and outstanding, as well as 36,190,770 Warrants, 17,008,732 stock options, and 3,812,153

Restricted Stock Units of the Company which, if exercised or settled, would result in the issuance of an additional 338,884,884 Common

Shares.

USE OF PROCEEDS

The net proceeds of the Offering, if any, are not determinable

in light of the nature of the distribution. Sales of Offered Shares, if any, will be made in transactions that are deemed to be “at-the-market

distributions” as defined in NI 44-102, including, without limitation, sales made directly on the NYSE American in the United States.

The net proceeds to the Company of any given distribution of Offered Shares through the Agents in an “at-the-market distribution”

under the ATM Sales Agreement will represent the gross proceeds of the Offering, after deducting the applicable commission and the expenses

of the Offering. The gross proceeds of the Offering will be up to US$25,000,000. There is no minimum amount of funds that must be raised

under the Offering. This means that the Offering may terminate after raising only a portion of the Offering amount set out above, or none

at all.

The net proceeds from the Offering will be used primarily

for the Company’s drilling, exploration and technical work for the development of the sulphide mineralized material at our Buckreef

Gold Project, and for working capital and other general corporate purposes.

PLAN OF DISTRIBUTION

The Company entered into the

ATM Sales Agreement with the Agents on February 7, 2025. Under the terms of the ATM Sales Agreement, the Company may offer and sell

up to US$25,000,000 of our Common Shares from time to time through the Lead Agent pursuant to the Prospectus Supplement and the

Prospectus. Sales of shares of Common Shares, if any, under this Prospectus Supplement may be made in transactions that are deemed

to be “at the market offerings” as defined in NI 44-102, including, without limitation, sales made directly on the NYSE

American or other existing trading markets for the Common Shares in the United States. No Offered Shares will be sold under the ATM

Sales Agreement in Canada or on the TSX or any other trading market in Canada.

Upon delivery of a placement notice and subject to

the terms and conditions of the ATM Sales Agreement, the Lead Agent may sell Common Shares of the Company by any method permitted by law

deemed to be an “at-the-market offering” as defined in as defined in NI 44-102. The sales, if any, of Offered Shares made

under the ATM Sales Agreement will be made by means of ordinary brokers’ transactions on NYSE American or another existing trading

market in the United States at market prices, or as otherwise agreed upon by the Company and the Lead Agent. The Company will designate

the maximum amount of Offered Shares to be sold pursuant to any placement notice to the Lead Agent. The Company may instruct the Lead

Agent not to sell Offered Shares if the sales cannot be effected at or above the price designated by the Company in a particular placement

notice. The Lead Agent is not required to sell any specific number or dollar amount of Common Shares but will use its commercially reasonable

efforts, consistent with its normal sales and trading practices, to sell the Offered Shares under the terms and conditions of the ATM

Sales Agreement. The Lead Agent shall provide to the Company written confirmation following the close of trading on the NYSE American

on each day in which Offered Shares are sold under the Sales Agreement. Each confirmation will include the number of Offered Shares sold

on that day, the gross sales proceeds and the net proceeds to the Company. The Company or the Lead Agent may suspend the Offering of the

Offered Shares at any time and from time to time by notifying the other party. The Company and the Lead Agent each have the right, by

giving written notice as specified in the ATM Sales Agreement, to terminate the ATM Sales Agreement in each party’s sole discretion

at any time.

The Company will pay the Lead Agent a commission, in

cash, at a fixed commission rate of 3.0% of the gross sales price per share sold. Because there is no minimum offering amount required

as a condition of this Offering, the actual aggregate offering amount, commissions and proceeds to us, if any, are not determinable at

this time. The Company has also agreed to reimburse the Agents for certain specified expenses, including the fees and disbursements of

Lead Agent’s legal counsel in an amount not to exceed US$50,000 in addition to up to US$2,500 per quarterly due diligence update

session for the Lead Agent’s counsel’s fees.

Settlement for sales of Common Shares will occur on

the first business day (or such shorter settlement cycle as may be in effect under Exchange Act Rule 15c6-1 from time to time) following

the date on which any sales are made, or on some other date that is agreed upon by the Company and Lead Agent in connection with a particular

transaction, in return for payment of the net proceeds to the Company. Sales of Common Shares as contemplated in the Prospectus Supplement

will be settled through the facilities of The Depository Trust Company or by such other means as the Company and Lead Agent may agree

upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale of Common Shares on our

behalf, each Agent will be deemed to be an “underwriter” within the meaning of the U.S Securities Act and the compensation

of each Agent will be deemed to be underwriting commissions or discounts. The Company agreed to provide indemnification and contribution

to each Agent against certain civil liabilities, including liabilities under the U.S Securities Act.

The Offering of Offered Shares pursuant to the ATM

Sales Agreement and this Prospectus Supplement will terminate upon the earliest of (i) the sale of all Offered Shares subject to the ATM

Sales Agreement and this Prospectus Supplement; and (ii) the termination of the ATM Sales Agreement as provided therein.

To the extent required by Regulation M, an Agent will

not engage in any market making activities involving our Common Shares while the Offering is ongoing under this Prospectus Supplement.

No underwriter or agent of the at-the-market distribution, and no person or company acting jointly or in concert with an underwriter or

agent, may, in connection with the distribution, enter into any transaction that is intended to stabilize or maintain the market price

of the securities or securities of the same class as the securities distributed under the Prospectus Supplement, including selling an

aggregate number or principal amount of securities that would result in the underwriter or agent creating an over-allocation position

in the securities.

Each Agent is not registered as a dealer in any Canadian

jurisdiction and, accordingly, is not permitted to and will not, directly or indirectly, advertise or solicit offers to purchase any of

the Offered Shares in Canada.

Each Agent and its affiliates may in the future provide

various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in

the future receive customary fees. This summary of the material provisions of the ATM Sales Agreement does not purport to be a complete

statement of its terms and conditions. A copy of the ATM Sales Agreement is filed as an exhibit to the Company’s Form 6-K and is

incorporated by reference in this Prospectus Supplement.

The Prospectus Supplement and Prospectus in electronic

format may be made available on a website maintained by the Lead Agent and the Lead Agent may distribute the Prospectus Supplement and

Prospectus electronically.

Selling Restrictions Outside of the United States

Other than in the United States, no action has been

taken by the Company that would permit a public offering of the Offered Shares in any jurisdiction outside the United States where action

for that purpose is required. The Offered Shares may not be offered or sold, directly or indirectly, nor may this Prospectus Supplement

or any other offering material or advertisements in connection with the offer and sale of any such Offered Shares be distributed or published

in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction.

Persons into whose possession this Prospectus Supplement comes are advised to inform themselves about and to observe any restrictions

relating to the Offering and the distribution of this Prospectus Supplement. This Prospectus Supplement does not constitute an offer to

sell or a solicitation of an offer to buy any Offered Shares in any jurisdiction in which such an offer or a solicitation is unlawful.

PRIOR SALES

The following table summarizes the

Common Shares that have been issued from treasury during the 12-month period before the date of this Prospectus Supplement.

| Date of issuance |

Type |

Number of securities |

Issue/ Exercise Price (US$) |

| January 29, 2024 |

Common Shares(1) |

32,000 |

$0.3400 |

| February 9, 2024 |

Common Shares(2) |

53,562 |

$0.3240 |

| March 6, 2024 |

Common Shares(1) |

150,000 |

$0.3480 |

| March 6, 2024 |

Common Shares(2) |

38,178 |

$0.3480 |

| April 2, 2024 |

Common Shares(2) |

22,854 |

$0.4100 |

| May 1, 2024 |

Common Shares(1) |

105,000 |

$0.4400 |

| May 1, 2024 |

Common Shares(2) |

21,772 |

$0.4400 |

| June 3, 2024 |

Common Shares(2) |

20,485 |

$0.4820 |

| July 3, 2024 |

Common Shares(2) |

23,778 |

$0.3874 |

| August 6, 2024 |

Common Shares(2) |

23,315 |

$0.3984 |

| August 19, 2024 |

Common Shares(1) |

228,153 |

$0.5000 |

| August 28, 2024 |

Common Shares(1) |

321,578 |

$0.4000 |

| September 5, 2024 |

Common Shares(2) |

24,015 |

$0.3820 |

| October 2, 2024 |

Common Shares(2) |

23,088 |

$0.4040 |

| October 3, 2024 |

Common Shares(3) |

333,333 |

$0.4040 |

| October 3, 2024 |

Common Shares(4) |

90,669 |

$0.4300 |

| October 3, 2024 |

Common Shares(4) |

23,786 |

$0.4000 |

| November 6, 2024 |

Common Shares(2) |

24,324 |

$0.3752 |

| December 5, 2024 |

Common Shares(2) |

24,876 |

$0.3636 |

| December 24, 2024 |

Common Shares(1) |

1,111,109 |

$0.3600 |

| January 6, 2025 |

Common Shares(2) |

27,293 |

$0.3203 |

| (1) | RSUs vesting for certain directors, officers and employees. |

| (2) | Compensation shares for service providers and consultants. |

| (3) | Compensation shares for certain directors and officers. |

The following table summarizes the Restricted Stock

Units (“RSUs”) that have been granted during the 12-month period before the date of this Prospectus Supplement.

| Date of Grant |

Type |

Number of securities |

Issue Price (US$) |

| December 24, 2024 |

RSUs(1) |

6,922,103 |

$0.36 |

| (1) | RSU grants to certain directors, officers and employees. |

The following table summarizes the stock options (“Options”)

that have been granted during the 12-month period before the date of this Prospectus Supplement.

| Date of Grant |

Type |

Number of securities |

Exercise Price (US$) |

| December 24, 2024 |

Options(1) |

2,600,000 |

$0.36 |

| (1) | Stock Options granted to certain officers. |

DIVIDEND POLICY

The Company has not declared or paid any dividends

on its Common Shares since the date of its incorporation. The Company intends to retain its earnings, if any, to finance the growth and

development of its business and does not expect to pay dividends or to make any other distributions in the near future. The Company's

board of directors will review this policy from time to time having regard to the Company’s financing requirements, financial condition,

and other factors considered to be relevant.

DESCRIPTION OF COMMON SHARES

The Company is authorized to issue an unlimited number

of Common Shares without par value. As of the date of this Prospectus Supplement, there were 281,873,229 Common Shares issued and outstanding

as fully paid and non-assessable Common Shares.

Each holder of Common Shares is entitled to one vote

for each share on all matters submitted to a vote of the shareholders, and each holder does not have cumulative voting rights. Accordingly,

the holders of a majority of the Common Shares entitled to vote in any election of directors can elect all of the directors standing for

election, if they so choose.

Subject to preferences that may be applicable to any

then outstanding preferred stock, holders of Common Shares are entitled to receive ratably those dividends, if any, as may be declared

from time to time by the board of directors out of legally available funds. In the event of our liquidation, dissolution or winding up,

holders of Common Shares will be entitled to share ratably in the net assets legally available for distribution to shareholders after

the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any

outstanding preferred shares.

Holders of Common Shares have no pre-emptive or conversion

rights or other subscription rights and there are no redemption or sinking fund provisions applicable to the Common Shares. All outstanding

Common Shares are, and the Common Shares offered by us in this Offering, when issued and paid for, will be fully paid and non-assessable.

The rights, preferences and privileges of the Common Shares are subject to, and may be adversely affected by, the rights of the holders

of shares of any series of preferred share which the Company may designate in the future.

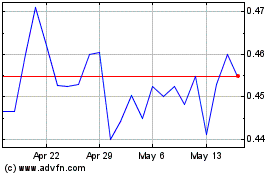

TRADING PRICE AND VOLUME

The outstanding Common Shares are listed and posted for trading on the TSX and on the NYSE American

under the symbol “TRX”. On February 6, 2025, the last trading day prior to the date of this Prospectus Supplement, the closing

price of the outstanding Common Shares on the TSX and on the NYSE American was C$0.475 and US$0.3262, respectively.

The following table provides the high and low prices, and total volume

for the Common Shares traded on the TSX for the periods indicated (stated in Canadian Dollars):

| Period |

High |

Low |

Volume |

| February 2024 |

0.5100 |

0.3750 |

395,612 |

| March 2024 |

0.6000 |

0.4600 |

215,326 |

| April 2024 |

0.6700 |

0.5300 |

665,272 |

| May 2024 |

0.6800 |

0.6000 |

234,897 |

| June 2024 |

0.6500 |

0.5200 |

225,598 |

| July 2024 |

0.6100 |

0.5100 |

186,115 |

| August 2024 |

0.5900 |

0.4950 |

217,435 |

| September 2024 |

0.5900 |

0.5000 |

104,417 |

| October 2024 |

0.5300 |

0.5100 |

312,266 |

| November 2024 |

0.5600 |

0.4600 |

238,012 |

| December 2024 |

0.5100 |

0.4010 |

347,243 |

| January 2025 |

0.5000 |

0.4200 |

446,241 |

| February 1 – 6, 2025 |

0.4950 |

0.4550 |

70,711 |

The following table provides the high and low prices,

and total volume for the Common Shares traded on the NYSE America for the periods indicated (stated in U.S. Dollars):

| Period |

High |

Low |

Volume |

| February 2024 |

0.3700 |

0.3149 |

4,767,621 |

| March 2024 |

0.4000 |

0.3330 |

5,083,697 |

| April 2024 |

0.4900 |

0.3920 |

11,917,249 |

| May 2024 |

0.4900 |

0.4400 |

6,605,627 |

| June 2024 |

0.4824 |

0.3880 |

5,964,622 |

| July 2024 |

0.4501 |

0.4501 |

6,428,375 |

| August 2024 |

0.4252 |

0.3701 |

5,549,704 |

| September 2024 |

0.4273 |

0.3702 |

7,290,797 |

| October 2024 |

0.4210 |

0.3774 |

9,955,356 |

| November 2024 |

0.4062 |

0.3487 |

7,675,530 |

| December 2024 |

0.3733 |

0.2850 |

12,714,583 |

| January 2025 |

0.3520 |

0.3000 |

8,806,303 |

| February 1 – 6,

2025 |

0.3429 |

0.3200 |

2,024,133 |

CERTAIN INCOME TAX CONSIDERATIONS

The Offered Shares under this Prospectus Supplement

will only be offered in the United States including, without limitation, on the NYSE American or on any other trading market for the Offered

Shares in the United States.

The following is a general summary of certain material

U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) arising from the acquisition of Common Shares pursuant

to the Offering and the ownership and disposition of the Common Shares. This summary applies only to U.S. Holders who hold Common Shares

as capital assets (generally, property held for investment) and who acquire Common Shares at their original issuance pursuant to the Offering,

and does not apply to any subsequent U.S. Holder of a Common Share.

This summary is for general information purposes

only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations that may apply

to a U.S. Holder as a result of the ownership and disposition of Common Shares. In addition, this summary does not take into account the

individual facts and circumstances of any particular U.S. Holder that may affect the U.S. federal income tax consequences to such U.S.

Holder, including specific tax consequences to a U.S. Holder under an applicable tax treaty. Accordingly, this summary is not intended

to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any particular U.S. Holder. In addition,

this summary does not address the U.S. federal alternative minimum, U.S. federal estate and gift, U.S. Medicare contribution, U.S. state

and local, or non-U.S. tax consequences of the acquisition, ownership or disposition of Common Shares. Except as specifically set forth

below, this summary does not discuss applicable tax reporting requirements. Each U.S. Holder should consult its own tax advisor regarding

all U.S. federal, U.S. state and local and non-U.S. tax consequences of the acquisition, ownership, or disposition of Common Shares.

No opinion from U.S. legal counsel or ruling from

the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding the U.S. federal income tax consequences

of the acquisition, ownership or disposition of Common Shares. This summary is not binding on the IRS, and the IRS is not precluded from

taking a position that is different from, and contrary to, any position taken in this summary. In addition, because the authorities upon

which this summary is based are subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the

positions taken in this summary.

Scope of This Disclosure

Authorities. This summary is based

on the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed),

published rulings of the IRS, published administrative positions of the IRS, the Convention Between Canada and the United States of America

with Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended (the “Canada-U.S. Tax Convention”),

and U.S. court decisions that are applicable and, in each case, as in effect and available, as of the date hereof. Any of the authorities

on which this summary is based could be changed in a material and adverse manner at any time, and any such change could be applied on

a retroactive or prospective basis which could affect the U.S. federal income tax considerations described in this summary. This summary

does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation that, if enacted, could be applied

on a retroactive or prospective basis.

U.S. Holders. For purposes of this

summary, the term “U.S. Holder” means a beneficial owner of Common Shares that is for U.S. federal income tax purposes:

| · | An individual who is a citizen or resident of the U.S.; |

| · | A corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created

or organized in or under the laws of the U.S., any state thereof or the District of Columbia; |

| · | An estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| · | A trust that (a) is subject to the primary supervision of a court within the U.S. and the control of one

or more U.S. persons for all substantial decisions or (b) has a valid election in effect under applicable Treasury Regulations to be treated

as a U.S. person. |

Non-U.S. Holders. For purposes

of this summary, a “non-U.S. Holder” is a beneficial owner of Common Shares that is not a partnership (or other “pass-through”

entity) for U.S. federal income tax purposes and is not a U.S. Holder. This summary does not address the U.S. federal income tax considerations

applicable to non-U.S. Holders arising from the acquisition, ownership or disposition of Common Shares.

Accordingly, a non-U.S. Holder should consult its own

tax advisor regarding all U.S. federal, U.S. state and local, and non-U.S. tax consequences (including the potential application of and

operation of any income tax treaties) relating to the purchase of the Common Shares pursuant to the Offering and the acquisition, ownership

or disposition of Common Shares.

Transactions Not Addressed. This

summary does not address the tax consequences of transactions effected prior or subsequent to, or concurrently with, any purchase of the

securities (whether or not any such transactions are undertaken in connection with the purchase of the securities), other than the U.S.

federal income tax considerations to U.S. Holders of the acquisition of Common Shares and the ownership and disposition of such Common

Shares.

U.S. Holders Subject to Special U.S. Federal Income Tax Rules Not

Addressed

This summary does not address the U.S. federal income

tax considerations of the acquisition, ownership, or disposition of Common Shares by U.S. Holders that are subject to special provisions

under the Code, including, but not limited to, the following: (a) tax-exempt organizations, qualified retirement plans, individual retirement

accounts, or other tax-deferred accounts; (b) financial institutions, underwriters, insurance companies, real estate investment trusts,

or regulated investment companies; (c) broker-dealers, dealers, or traders in securities or currencies that elect to apply a “mark-to-

market” accounting method; (d) U.S. Holders that have a “functional currency” other than the U.S. dollar; (e) U.S. Holders

that own Common Shares as part of a straddle, hedging transaction, conversion transaction, constructive sale, or other arrangement involving

more than one position; (f) U.S. Holders that acquire Common Shares in connection with the exercise of employee stock options or otherwise

as compensation for services; (g) U.S. Holders that hold Common Shares other than as a capital asset within the meaning of Section 1221

of the Code (generally, property held for investment purposes); (h) U.S. Holders that own directly, indirectly, or by attribution, 10%

or more, by voting power or value, of the outstanding stock of the Company; and (i) U.S. Holders subject to Section 451(b) of the Code.

This summary also does not address the U.S. federal income tax considerations applicable to U.S. Holders who are: (a) U.S. expatriates

or former long-term residents of the U.S.; (b) persons that have been, are, or will be a resident or deemed to be a resident in Canada

for purposes of the Tax Act; (c) persons that use or hold, will use or hold, or that are or will be deemed to use or hold Common Shares

in connection with carrying on a business in Canada; (d) persons whose Common Shares constitute “taxable Canadian property”

under the Tax Act; or (e) persons that have a permanent establishment in Canada for purposes of the Canada-U.S. Tax Convention. U.S. Holders

that are subject to special provisions under the Code, including U.S. Holders described immediately above, should consult their own tax

advisors regarding all U.S. federal, U.S. state and local, and non-U.S. tax consequences (including the potential application and operation

of any income tax treaties) relating to the acquisition, ownership, or disposition of Common Shares.

If an entity or arrangement that is classified as a

partnership (or other “pass-through” entity) for U.S. federal income tax purposes holds Common Shares, the U.S. federal income

tax consequences to such partnership and the partners (or other owners) of such partnership of the acquisition, ownership, or disposition

of the Common Shares generally will depend on the activities of the partnership and the status of such partners (or other owners). This

summary does not address the U.S. federal income tax consequences for any such partner or partnership (or other “pass-through”

entity or its owners). Owners of entities and arrangements that are classified as partnerships (or other “pass-through” entities)

for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences of the acquisition,

ownership, or disposition of Common Shares.

Tax Consequences Other than U.S. Federal Income Tax Consequences

Not Addressed

This summary does not address the U.S. state and local

tax, U.S. estate, gift, and generation-skipping tax, U.S. federal net investment income, U.S. federal alternative minimum tax, or foreign

tax consequences to U.S. Holders relating to the acquisition, ownership, and disposition of Offered Shares. In addition, except as specifically

set forth below, this summary does not discuss applicable tax reporting requirements. Each U.S. Holder should consult its own tax advisor

regarding the U.S. state and local tax, U.S. estate, gift, and generation- skipping tax, U.S. federal net investment income, U.S. federal

alternative minimum tax and foreign tax consequences relating to the acquisition, ownership, and disposition of Offered Shares.

U.S. Federal Income Tax Consequences of the Acquisition, Ownership and

Disposition of Offered Shares

Classification as a Passive Foreign Investment Company (“PFIC”)

The Company does not believe that it was classified

as a PFIC for its taxable year ended August 31, 2024, but has not made a determination as to whether it will or will not be a PFIC in

the current tax year or in subsequent tax years. The determination of PFIC status is inherently factual, is subject to a number

of uncertainties, and can be determined only annually at the close of the tax year in question. Additionally, the analysis depends,

in part, on the application of complex U.S. federal income tax rules, which are subject to differing interpretations. There can

be no assurance that the Company will or will not be determined to be a PFIC for the current tax year or any prior or future tax year,

and no opinion of legal counsel or ruling from the IRS concerning the status of the Company as a PFIC has been obtained or will be requested.

U.S. Holders should consult their own U.S. tax advisors regarding the PFIC status of the Company. If the Company is classified as

a PFIC in any taxable year in which a U.S. Holder holds Offered Shares, the Company generally will be considered a PFIC with respect to

such Offered Shares in subsequent taxable years even if the Company is otherwise not a PFIC in such subsequent taxable years. If the Company

is considered to be a PFIC with respect to a U.S. Holder’s Offered Shares, such holder generally will be liable to pay income tax

at the highest ordinary income tax rate on any “excess distribution” from the Company and on the U.S. Holder’s gain

from the disposition of Offered Shares as if such excess distribution or gain had been recognized ratably over the U.S. Holder’s

holding period for the Offered Shares, plus interest on such amount as if it were treated as a series of underpayments of tax in such

prior years. Each U.S. Holder should consult its own tax advisor regarding the classification of the Company as a PFIC and the consequences

of such classification.

Distributions on Common Shares

Subject to the PFIC rules discussed below, a U.S. Holder

that receives a distribution, including a constructive distribution, with respect to an Offered Share will be required to include the

amount of such distribution in gross income as a dividend (without reduction for any Canadian income tax withheld from such distribution)

to the extent of the current or accumulated “earnings and profits” of the Company, as computed for U.S. federal income tax

purposes. To the extent that a distribution exceeds the current and accumulated “earnings and profits” of the Company, such

distribution will be treated first as a tax-free return of capital to the extent of a U.S. Holder’s tax basis in the Offered Shares

and thereafter as a gain from the sale or exchange of such Offered Shares (see “Sale or Other Taxable Disposition of Offered Shares”

below). However, the Company might not determine its current and accumulated earnings and profits in accordance with U.S. federal income

tax principles, and U.S. Holders should therefore assume that any distribution by the Company with respect to its Offered Shares will

constitute dividend income. Dividends received on Offered Shares will not be eligible for the “dividends received deduction”

allowed to corporations under the Code with respect to dividends received from domestic corporations.

Subject to applicable limitations and provided the

Company is eligible for the benefits of the Canada-U.S. Tax Convention or the Offered Shares are readily tradable on a United States securities

market, dividends paid by the Company to non-corporate U.S. Holders, including individuals, generally will be eligible for the preferential

tax rates applicable to long-term capital gains for dividends, provided certain holding period and other conditions are satisfied, including

that the Company is not classified as a PFIC in the tax year of distribution or in the preceding tax year. If the Company is not a PFIC,

dividends paid to a U.S. Holder that do not result in qualified dividend income generally will be taxed at ordinary income tax rates.

The dividend rules are complex, and each U.S. Holder should consult its own tax advisor regarding the application of such rules.

Sale or Other Taxable Disposition of Common Shares

Subject to the PFIC rules discussed below, upon the

sale or other taxable disposition of Offered Shares, a U.S. Holder generally will recognize a capital gain or loss in an amount equal

to the difference between (a) the amount of cash plus the fair market value of any property received and (b) such U.S. Holder’s

tax basis in the Offered Shares sold or otherwise disposed of. Such capital gain or loss will generally be a long-term capital gain or

loss if the Offered Shares have been held for more than one year, and will be a short term gain or loss if the holding period is equal

to or less than one year. Such gain generally will be treated as “U.S. source” for purposes of applying the U.S. foreign tax

credit rules unless the gain is subject to tax in Canada and is re-sourced as “foreign source” under the Canada U.S. Tax Convention

and such U.S. Holder elects to treat such gain or loss as “foreign source” (see a more detailed discussion at “Foreign

Tax Credit” below). Long term capital gains of certain non-corporate U.S. Holders. taxpayers are eligible for reduced rates of taxation.

Deductions for capital losses are subject to complex limitations.

PFIC Status of the Company

Because the Company is producing revenue from its mining

operations, the Company does not believe that it was classified as a PFIC for its taxable year ended August 31, 2024. If the Company is

or becomes a PFIC, the foregoing description of the U.S. federal income tax consequences to U.S. Holders of the ownership of Common Shares

will be different. The U.S. federal income tax consequences of owning and disposing of Common Shares if the Company is or becomes a PFIC

are described below under the heading “Tax Consequences if the Company is a PFIC.”

A non-U.S. corporation is a PFIC for each tax year

in which (i) 75% or more of its gross income is passive income (as defined for U.S. federal income tax purposes) (the “income test”)

or (ii) 50% or more (by value) of its assets (based on an average of the quarterly values of the assets during such tax year) either produce

or are held for the production of passive income (the “asset test”). For purposes of the PFIC provisions, “gross income”

generally includes sales revenues less cost of goods sold, plus income from investments and from incidental or other operations or sources,

and “passive income” generally includes dividends, interest, certain rents and royalties, certain gains from commodities or

securities transactions and the excess of gains over losses from the disposition of certain assets which product passive income. If a

non-U.S. corporation owns at least 25% (by value) of the stock of another corporation, the non-U.S. corporation is treated, for purposes

of the income test and asset test, as owning its proportionate share of the assets of the other corporation and as directly receiving

its proportionate share of the other corporation’s income.

Under certain attribution and indirect ownership rules,

if the Company is a PFIC, U.S. Holders will generally be deemed to own their proportionate share of the Company’s direct or indirect

equity interest in any company that is also a PFIC (a “Subsidiary PFIC”), and will be subject to U.S. federal income tax on

their proportionate share of (a) any “excess distributions,” as described below, on the stock of a Subsidiary PFIC and (b)

a disposition or deemed disposition of the stock of a Subsidiary PFIC by the Company or another Subsidiary PFIC, both as if such U.S.

Holders directly held the shares of such Subsidiary PFIC. In addition, U.S. Holders may be subject to U.S. federal income tax on any indirect

gain realized on the stock of a Subsidiary PFIC on the sale or disposition of Common Shares. Accordingly, U.S. Holders should be aware

that they could be subject to tax even if no distributions are received and no redemptions or other dispositions of the Company’s

Common Shares are made.

The Company has not conducted a formal analysis of

whether or not it will be deemed a PFIC for the tax year ended August 31, 2024, and does not plan to make such a determination for subsequent

years. The determination of whether the Company (or a subsidiary of the Company) was, or will be, a PFIC for a tax year depends, in part,

on the application of complex U.S. federal income tax rules, which are subject to differing interpretations. In addition, whether the