Statement re Placing and Conversion of Debt

17 May 2023 - 9:10PM

Statement re Placing and Conversion of Debt

DXS INTERNATIONAL PLC

(AQSE: DXSP)

Placing and Conversion of

debt

DXS International plc ("DXS", the "Company"), the digital

clinical decision support company, is pleased to announce that it

has raised GBP 500,000 (before expenses) (the "Placing"), through a

placing of 12,500,000 new ordinary shares (the "Placing Shares") of

0.33 pence each in the capital of the Company ("Ordinary Shares")

at a placing price of 4p per share (the "Placing Price") to current

shareholders and new institutional investors through the Placing by

Hybridan LLP “Hybridan” as sole broker to the Company. In addition

to the Placing, the Company announces a debt to equity swap (the

"Stakeholder Issue”) through which £130,628.33 of debt has been

converted to new Ordinary Shares at the Placing Price per share

through the issue of 3,265,708 new Ordinary Shares (the

"Stakeholder Shares"). The new Ordinary Shares to be issued

pursuant to the Placing and Stakeholder Issue (together, the

"Fundraising") represent a total dilution of 32.67 per cent of the

existing issued share capital of the Company.

Application has been made for admission of the Placing Shares

and the Stakeholder Shares (together, the "New Ordinary Shares"),

to trading on the Access segment of the AQUIS Stock Exchange

("AQUIS") and trading is expected to commence on or around 24 May

2023 ("Admission"). The Placing and Stakeholder Issue are both

conditional, inter alia, on Admission .

Participants in the Stakeholder Issue comprise a combination of

the Company's Directors, key management and consultants who have,

during the past 14 months, postponed payment of a total of £130,628

in unpaid salaries and fees, and have agreed to convert this to

equity at the Placing Price. These stakeholders of the Company have

agreed to continue to postpone receipt of further payments of

salaries and fees as they fall due until the Company is cashflow

positive.

The net proceeds of the Fundraising will be used by the Company

to invest in the Group's operations to provide working capital to

take the Company’s newly developed healthcare solutions to market.

The Company's strategy is to leverage its existing customer base

which provides a recurring revenue combination from the NHS and the

pharmaceutical industry as supplemented by new revenue streams from

the new SMART solutions. The Company has been investing, piloting

and gaining accreditations for its new SMART solutions during the

past three years.

After Admission the issued share capital of the Company will be

64,022,124 Ordinary Shares. This figure may be used by shareholders

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or

change to their interest in, the Company under the FCA's Disclosure

Guidance and Transparency Rules.

David Immelman, Chief Executive Officer, commented:

"I am delighted with the continued support we have received from

our shareholders, and to welcome new institutions including funds

managed by Downing LLP in this latest fundraising. We are pleased

to see sentiment changing within the NHS and to hear the positive

feedback we have received on the various trials in clinics with our

new products. Building blocks are in place to potentially rapidly

scale our annual revenue to £4.7m by April 2024.”

Pursuant to the terms of the Placing, Hybridan has been granted

warrants in respect of 750,000 new Ordinary Shares (the "New

Warrants"). The New Warrants are exercisable by Hybridan at any

time between the date of this announcement and 16 May 2028 at a

strike price equal to the Placing Price. In addition the Company

has agreed to vary the strike price for the existing warrants in

respect of 748,500 Ordinary Shares that were issued to Hybridan on

18 February 2020, expiring on 17 February 2025, such that these

warrants are also now exercisable at the Placing Price.

The Directors of DXS International plc accept responsibility for

this announcement

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Enquiries:

| David

Immelman (Chief

Executive)DXS International plc |

01252 719800david@dxs-systems.com |

|

https://www.dxs-systems.co.uk |

|

| Corporate

Advisor |

|

| City &

Merchant David Papworth |

020 7101 7676 |

| Corporate

Broker |

|

| Hybridan

LLPClaire Louise Noyce |

020 3764 2341 |

Note to Editors:

About DXS

DXS International presents up to date treatment

guidelines and recommendations, from Clinical Commissioning Groups

and other trusted NHS sources, to doctors, nurses, and pharmacists

in their workflow and during the patient consultation. This

effective clinical decision support ultimately translates to

improved healthcare outcomes delivered more cost effectively which

should significantly contribute towards the NHS achieving its

projected efficiency savings.

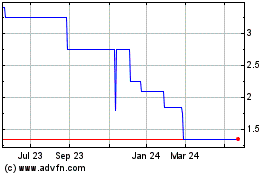

DXS (AQSE:DXSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

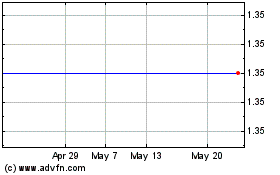

DXS (AQSE:DXSP)

Historical Stock Chart

From Nov 2023 to Nov 2024