Rio Tinto Sees Battery Metal Demand Supported by EV Sales Jump -- Commodity Comment

15 October 2021 - 10:35AM

Dow Jones News

By Rhiannon Hoyle

Rio Tinto PLC, the world's second largest mining company by

market value, on Friday cut its 2021 shipment and output guidance

for commodities including iron ore, citing setbacks including labor

shortages and plant disruptions. Here are some remarks from its

report.

On iron-ore supply:

"Aggregate shipments of the major seaborne suppliers are

trending flat year-on-year and are not expected to regain their

2018 levels for the third consecutive year. Higher-cost operations

which were incentivized by elevated prices have started to reassess

their viability."

On battery metals:

"Demand for battery materials has been well supported by

electric vehicle growth with global sales up 151% in the first

seven months of 2021. Electric vehicle adoption is being driven by

all major automotive markets and benefiting from improved model

variety together with the introduction of subsidies in many

markets."

On the aluminum market:

"Aluminum prices rallied to multi-year highs, driven by

extensive power-related smelting cuts in China, and concerns over

bauxite supply from Guinea. Physical markets remained very tight on

firm demand and logistical supply issues, resulting in regional

premia reaching new highs in both the U.S. and Europe."

On global trade:

"The global economy continues to recover, with vaccination rates

steadily increasing and global trade flows recovering. While

governments continue to provide active support, we remain watchful

of the risks that threaten to disrupt some of the progress already

achieved. Risks related to commodity supply and demand are

heightened due to supply chain bottlenecks as well as material and

energy shortages."

On its Australian iron-ore operations:

"Pilbara iron ore production of 83.3 million [metric] tons (100%

basis) was 4% lower than the third quarter of 2020 due to heritage

management, brownfield mine replacement tie-ins and project

completion delays. This also resulted in an increase of SP10

production in the third quarter that will continue into the fourth

quarter. We now expect Pilbara shipments to be 320 to 325 million

tons (previously at the low end of 325 to 340 million tons)

following modest delays to completion of the new greenfield mine at

Gudai-Darri and the Robe Valley brownfield mine replacement project

due to the tight labor market in Western Australia."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 14, 2021 19:20 ET (23:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

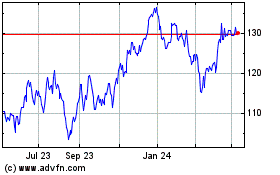

Rio Tinto (ASX:RIO)

Historical Stock Chart

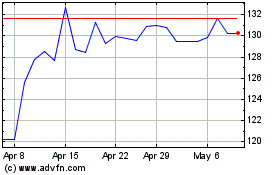

From Mar 2024 to Apr 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024